Warby Parker Inc CFO Steven Miller Sells 8,963 Shares

Steven Miller, the Chief Financial Officer of Warby Parker Inc (NYSE:WRBY), sold 8,963 shares of the company on March 5, 2024, according to a recent SEC Filing. The transaction was executed at an average price of $12.12 per share, resulting in a total value of $108,651.56.

Warby Parker Inc is a direct-to-consumer eyewear brand that offers designer eyewear at a revolutionary price while leading the way for socially conscious businesses. The company designs glasses in-house and sells directly to customers through its website and retail stores, which allows it to provide high-quality, beautifully designed eyewear at a fraction of the going price.

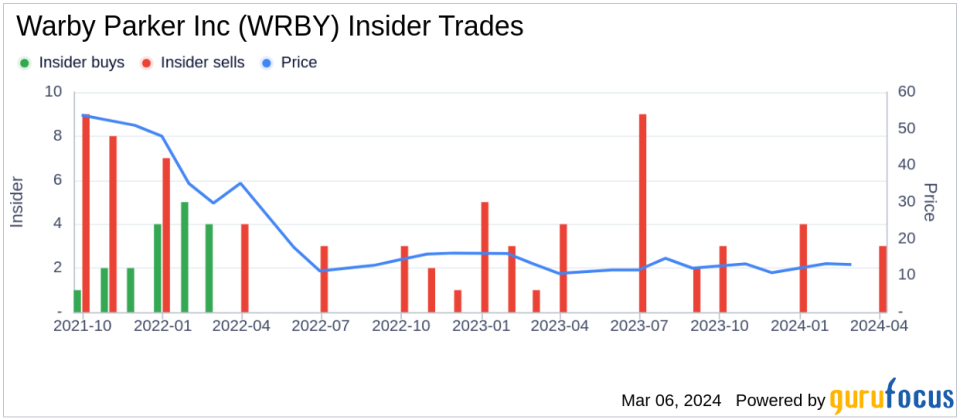

Over the past year, the insider has sold a total of 78,658 shares of Warby Parker Inc and has not made any purchases of the stock. The recent sale by the insider is part of a trend observed over the past year, where there have been no insider buys but 25 insider sells for the company.

On the day of the insider's recent sale, shares of Warby Parker Inc were trading at $12.12, giving the company a market capitalization of $1.445 billion.

The insider transaction history suggests a pattern of sales from insiders, which could be of interest to investors and analysts monitoring the company's stock performance and insider activities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.