Warby Parker Inc (WRBY) Posts 12% Revenue Growth in 2023 Amid Expansion Efforts

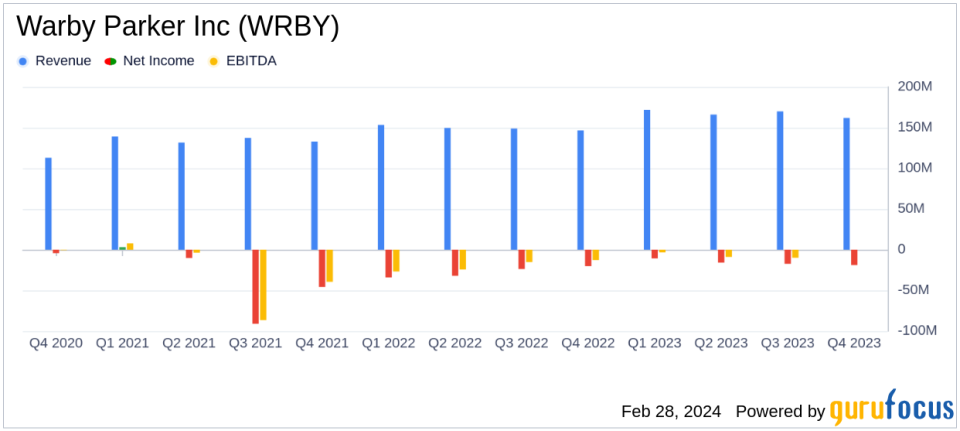

Net Revenue: Increased by 12.0% to $669.8 million in 2023.

Average Revenue per Customer: Rose by 9.3% to $287.

Adjusted EBITDA: Grew to $52.4 million with a margin of 7.8%.

Store Expansion: 40 new stores opened, totaling 237 stores.

Free Cash Flow: Reported at $7.3 million for the full year.

Strategic Partnerships: Expanded relationship with Versant Health, nearly doubling in-network access to over 34 million lives.

Social Impact: Distributed over 15 million pairs of glasses through the Buy a Pair, Give a Pair program.

On February 28, 2024, Warby Parker Inc (NYSE:WRBY) released its 8-K filing, detailing the company's financial performance for the fourth quarter and full year ended December 31, 2023. The lifestyle brand, known for its affordable designer eyewear and commitment to social enterprise, reported a 12.0% increase in net revenue, reaching $669.8 million for the year. This growth is attributed to a 9.3% rise in average revenue per customer and a 2.5% increase in active customers.

Despite the revenue growth, Warby Parker reported a full year GAAP net loss of $63.2 million, an improvement from the previous year's loss. The company's adjusted EBITDA stood at $52.4 million, with an adjusted EBITDA margin of 7.8%, indicating a strong underlying business performance. The expansion of its retail footprint with 40 new store openings and the strategic partnership with Versant Health are key highlights of the year, positioning the company for continued growth.

Financial Performance Analysis

Warby Parker's growth in net revenue and average revenue per customer underscores the brand's ability to attract and retain customers while increasing sales efficiency. The expansion of in-network access through Versant Health is expected to further drive customer growth and retention. However, the company's net loss and decrease in gross margin from 57.0% in 2022 to 54.5% in 2023 reflect the challenges of scaling operations, particularly in the context of expanding its store base and the lower-margin sales mix shift towards contact lenses.

The company's balance sheet remains robust with $216.9 million in cash and cash equivalents and a new $120 million revolving credit facility. The positive free cash flow of $7.3 million and the increase in net cash provided by operating activities from $10.4 million in 2022 to $61.0 million in 2023 demonstrate Warby Parker's ability to generate cash from its core operations.

Warby Parker's social impact initiative, the Buy a Pair, Give a Pair program, has distributed over 15 million pairs of glasses, reinforcing the company's commitment to social responsibility and enhancing its brand value.

Looking Ahead

For the full year 2024, Warby Parker anticipates net revenue between $748 to $758 million, representing approximately 12% to 13% growth over 2023. The company also expects an adjusted EBITDA of $67 million at the midpoint of the revenue range, equating to an adjusted EBITDA margin of 8.9%, and plans to open 40 new stores.

Warby Parker's co-founders and co-CEOs, Neil Blumenthal and Dave Gilboa, expressed confidence in the brand's strength and strategic vision, emphasizing a focus on delivering strong top-line and bottom-line results. CFO Steve Miller highlighted disciplined cost management as a key component of the company's strategy moving forward.

Investors and stakeholders can access a webcast and conference call discussing the fourth quarter and full year 2023 results, as well as the outlook for 2024, on the investors section of Warby Parker's website.

For detailed financial tables and a reconciliation of GAAP to Non-GAAP measures, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Warby Parker Inc for further details.

This article first appeared on GuruFocus.