Warner Music Group Corp Reports Strong Earnings with Significant Revenue and Net Income Growth

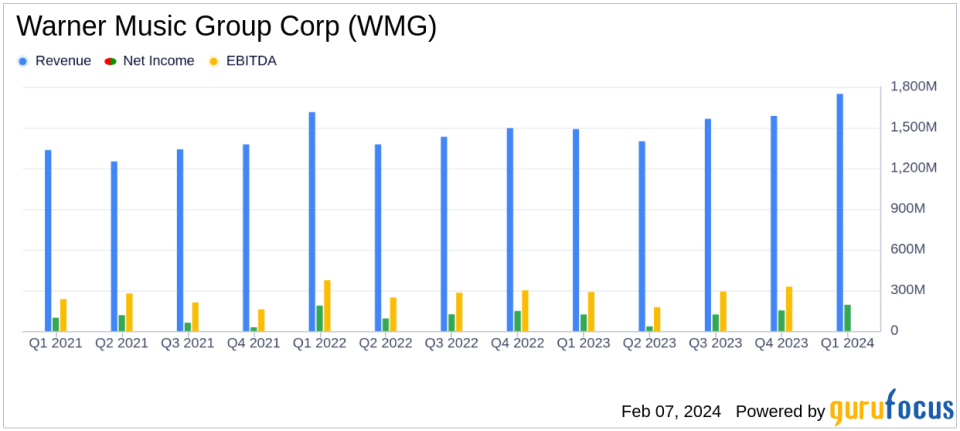

Revenue: Increased by 17% to $1.748 billion in Q1.

Net Income: Jumped by 56% to $193 million compared to the prior-year quarter.

Operating Income: Grew by 34% to $354 million.

Adjusted OIBDA: Rose by 35% to $451 million, reflecting operational efficiency.

Streaming Revenue: Recorded Music streaming revenue up by 13.7%, Music Publishing streaming revenue increased by 32.2%.

Free Cash Flow: Improved by 40% to $264 million.

On February 7, 2024, Warner Music Group Corp (NASDAQ:WMG) released its 8-K filing, announcing its fiscal first-quarter results for the period ended December 31, 2023. The company reported double-digit growth in revenue and adjusted OIBDA, with both its Recorded Music and Music Publishing segments delivering the highest quarterly revenue in the company's history.

Warner Music Group, a leading force in the global music industry, is the third-largest of the three major global record labels. Its Recorded Music segment includes iconic labels such as Atlantic Records and Warner Records, and its roster boasts popular artists like Ed Sheeran and Cardi B. Warner Chappell, the firm's publishing arm, represents over 65,000 composers and songwriters. Controlled by Access Industries, WMG continues to leverage its vast catalog and artist relationships to drive growth.

WMG's CEO, Robert Kyncl, highlighted the company's focus on execution and growth, while CFO Bryan Castellani emphasized the robust operating cash flow conversion, which stood at 65% of Adjusted OIBDA. The company's strategic plan aims to achieve $200 million in annual savings to reinvest into growth opportunities.

The company's financial achievements are particularly significant in the Media - Diversified industry, where content is king and the ability to monetize digital and streaming platforms is critical. WMG's robust streaming growth, both in Recorded Music and Music Publishing, underscores the company's successful adaptation to the evolving music landscape.

Key financial metrics from WMG's earnings report include:

"Total revenue increased 17%, or 16% in constant currency. Net income was $193 million versus $124 million in the prior-year quarter. Operating income increased 34% to $354 million versus $265 million in the prior-year quarter. Adjusted OIBDA increased 35% to $451 million versus $335 million in the prior-year quarter or 33% in constant currency."

WMG's balance sheet reflects a healthy cash balance of $754 million, with total debt at $4.004 billion and net debt at $3.250 billion. The company's capital expenditures increased by 38% to $29 million, primarily due to investments in technology, which is essential for maintaining competitive advantage in the digital era.

WMG's performance is a testament to its strategic focus on streaming and digital platforms, which are increasingly important revenue streams in the music industry. The company's ability to grow its top and bottom lines while navigating industry challenges, such as the evolving digital landscape and competitive pressures, speaks to the strength of its business model and management's execution.

For a detailed analysis of WMG's financial performance, investors and interested parties can refer to the company's current Quarterly Report on Form 10-Q, which will be filed with the Securities and Exchange Commission on February 8, 2024. Additionally, management will host a conference call to discuss the results on the same day.

Warner Music Group's legacy and its strategic focus on growth and efficiency position it well to capitalize on the opportunities within the dynamic music industry. The company's strong Q1 results are a clear indication of its ability to adapt and thrive in a rapidly changing market.

Explore the complete 8-K earnings release (here) from Warner Music Group Corp for further details.

This article first appeared on GuruFocus.