Warner Music Group (WMG): An In-Depth Look at Its Valuation

Warner Music Group Corp (NASDAQ:WMG)'s stock saw a daily gain of 2.28%, with a 3-month gain of 22.58%. The company's Earnings Per Share (EPS) (EPS) stands at 0.8. But is the stock modestly undervalued? This article aims to explore this question by conducting a comprehensive valuation analysis. So, let's delve into the details.

Company Overview

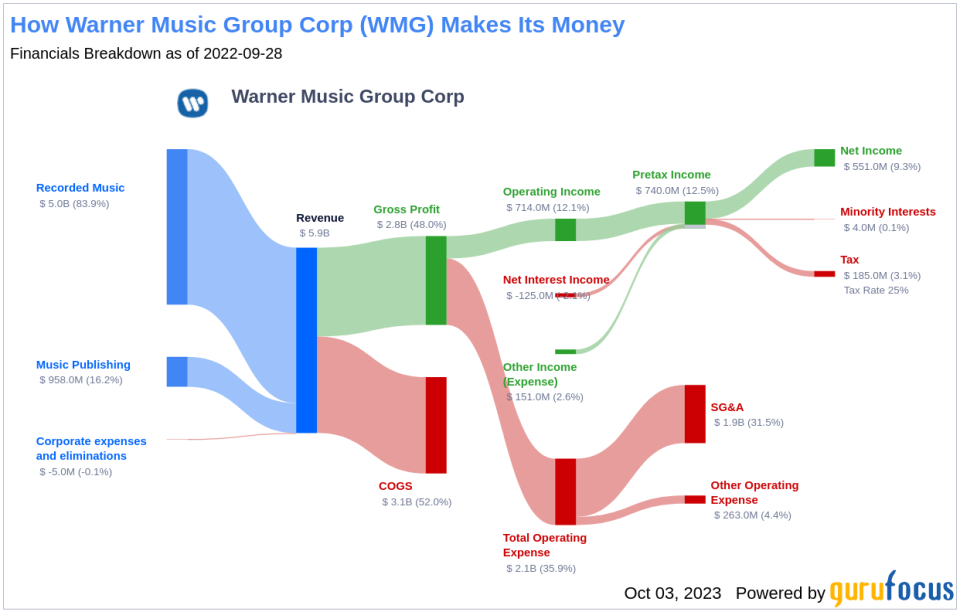

Warner Music Group is the third-largest global record label, trailing behind Universal Music and Sony Music. The company's larger segment, recorded music, includes iconic labels like Atlantic Records, Warner Records, and Parlophone Records. It boasts of popular artists such as Ed Sheeran, Cardi B, Dua Lipa, and Blake Shelton. Warner Chappell, the firm's publishing arm, represents over a million copyrights of more than 65,000 composers and songwriters. The company is controlled by Access Industries, which owns an 84% economic interest and 99% of voting rights.

Given its current stock price of $31.8 per share and a market cap of $16.40 billion, we will compare these figures with the company's GF Value, an estimation of its fair value, to determine whether the stock is undervalued.

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line denotes the stock's ideal fair trading value.

According to GuruFocus Value calculation, Warner Music Group (NASDAQ:WMG) appears to be modestly undervalued. The stock's current price is significantly below the GF Value Line, indicating that its future return is likely to be higher. Thus, the long-term return of Warner Music Group's stock is likely to exceed its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Evaluating Warner Music Group's Financial Strength

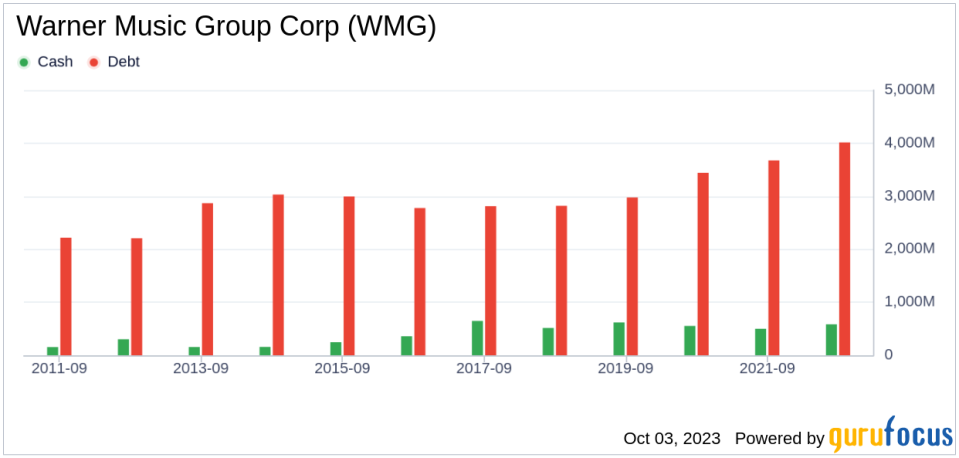

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Thus, it's crucial to review a company's financial strength before investing. Warner Music Group's cash-to-debt ratio of 0.14 is worse than 81.19% of 994 companies in the Media - Diversified industry. This indicates that Warner Music Group's overall financial strength is poor.

Assessing Profitability and Growth

Investing in profitable companies carries less risk. Warner Music Group has been profitable for 6 out of the past 10 years. Its operating margin of 12.46% is better than 78.83% of 1025 companies in the Media - Diversified industry. Furthermore, the company's growth is impressive. The 3-year average annual revenue growth rate of Warner Music Group is 8.9%, which ranks better than 73.73% of 944 companies in the Media - Diversified industry.

ROIC vs. WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is another way to evaluate its profitability. If the ROIC is higher than the WACC, it implies that the company is creating value for shareholders. Over the past 12 months, Warner Music Group's ROIC was 8.8, while its WACC came in at 12.48.

Conclusion

In conclusion, Warner Music Group's stock shows signs of being modestly undervalued. Despite its poor financial condition, the company's profitability is fair, and its growth ranks better than most companies in the Media - Diversified industry. To learn more about Warner Music Group stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.