Warren Buffett Bolsters Holdings in Liberty SiriusXM Group

Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway has made a notable addition to its investment portfolio by acquiring additional shares in Liberty SiriusXM Group (NASDAQ:LSXMA). On March 12, 2024, the firm increased its stake in the company, signaling a strategic move by the legendary investor. This transaction involved the purchase of 3,720,082 shares at a price of $29.95, bringing the total holdings to 28,951,624 shares. This addition has a modest impact of 0.03% on the portfolio, yet it reflects Buffett's confidence in the media conglomerate's value proposition.

Warren Buffett (Trades, Portfolio)'s Investment Acumen

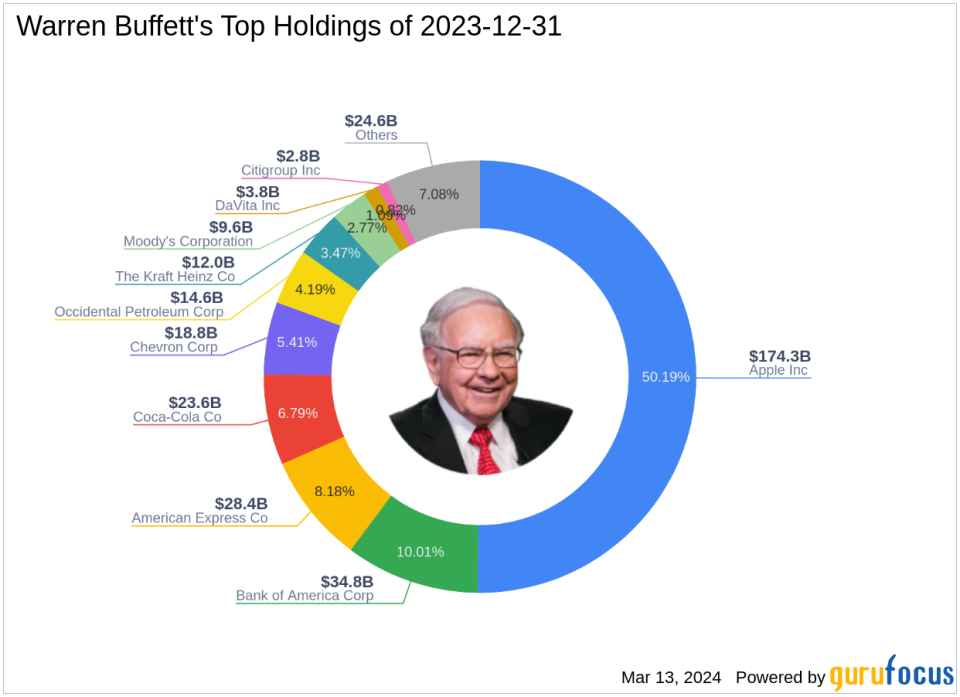

Warren Buffett (Trades, Portfolio), often referred to as "The Oracle of Omaha," is a paragon of investment success. As Chairman of Berkshire Hathaway, Buffett transformed a textile company into a colossal insurance and investment conglomerate. His investment philosophy, deeply influenced by Benjamin Graham, emphasizes understanding a business's intrinsic value and maintaining a margin of safety. Berkshire Hathaway's portfolio, which includes top holdings such as Apple Inc (NASDAQ:AAPL) and Bank of America Corp (NYSE:BAC), is a testament to Buffett's disciplined and patient approach to value investing.

Liberty SiriusXM Group at a Glance

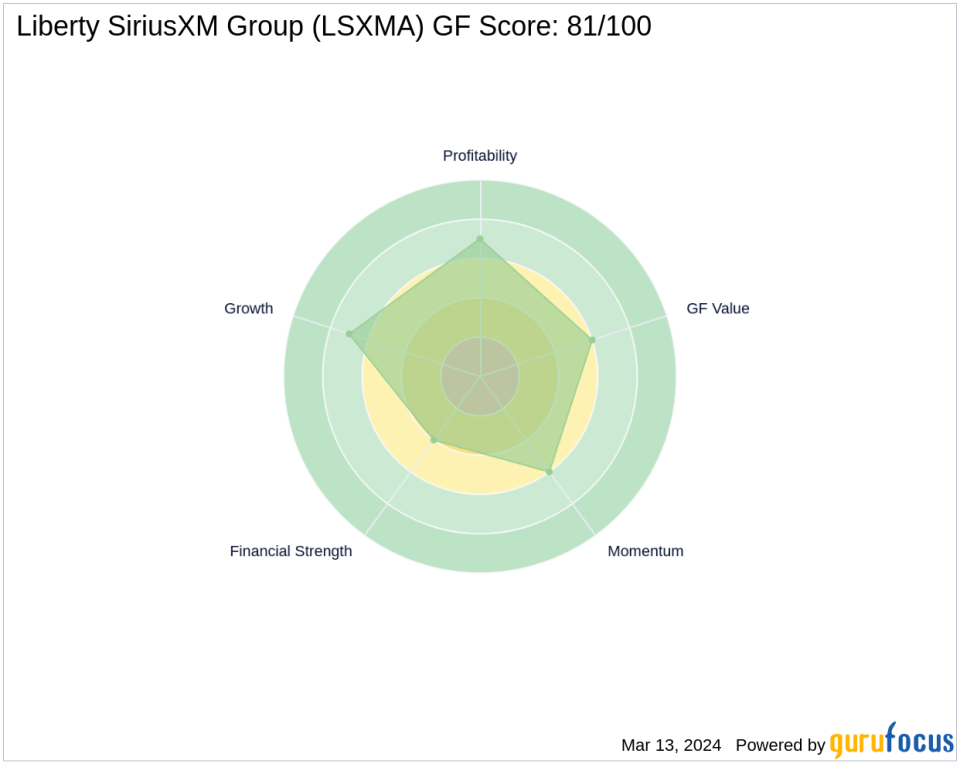

Liberty SiriusXM Group, through its subsidiary Sirius XM Holdings, offers a premium satellite radio service in the United States and the United Kingdom. The company, which went public on April 18, 2016, has carved a niche in the media-diversified industry by providing a wide array of music, sports, entertainment, and news channels. With a market capitalization of $9.79 billion and a stock price of $30.04, Liberty SiriusXM Group operates under a profitable business model, as indicated by its PE Ratio of 13.14 and a GF Score of 81/100, suggesting good potential for outperformance.

Impact of Buffett's Trade on His Portfolio

The recent acquisition of Liberty SiriusXM Group shares has increased Buffett's position in the company to 8.86%, representing 0.25% of the portfolio. This move not only diversifies Berkshire Hathaway's holdings but also aligns with Buffett's strategy of investing in companies with favorable long-term prospects and competent management. The trade's significance lies in its contribution to the portfolio's composition, reinforcing the firm's stake in the media sector.

Liberty SiriusXM's Market Valuation

Currently, Liberty SiriusXM Group is deemed Fairly Valued with a GF Value of $30.94 and a Price to GF Value ratio of 0.97. The stock has experienced a year-to-date increase of 2.84% and has grown 46.03% since its IPO. These metrics, along with a GF Score of 81, indicate a stable investment with potential for growth, aligning with Buffett's investment criteria.

Comparative Guru Holdings in LSXMA

Buffett is not the only prominent investor with an interest in Liberty SiriusXM Group. Other notable investors include Seth Klarman (Trades, Portfolio), Wallace Weitz (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio). However, Berkshire Hathaway remains the largest shareholder, with a significant lead over other investors, underscoring the firm's conviction in the stock's value.

Financial Health and Prospects of LSXMA

Liberty SiriusXM Group's financial health is reflected in its key ratios and ranks. The company has a Financial Strength rank of 4/10 and a Profitability Rank of 7/10. Its Piotroski F-Score of 6 indicates a stable financial situation, while the Altman Z-Score of 0.75 suggests some financial distress. However, with an interest coverage of 3.54 and consistent revenue growth, the company's prospects appear promising.

Concluding Thoughts on Buffett's LSXMA Trade

In conclusion, Warren Buffett (Trades, Portfolio)'s recent investment in Liberty SiriusXM Group is a strategic addition to Berkshire Hathaway's diverse portfolio. The transaction reflects Buffett's confidence in the company's long-term value and aligns with his investment philosophy. With solid financial metrics and a positive market outlook, Liberty SiriusXM Group stands as a potentially lucrative investment for value investors following Buffett's lead.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.