Warren Buffett Bolsters Holdings in Liberty SiriusXM Group

Introduction to the Transaction

Warren Buffett (Trades, Portfolio)'s investment firm, Berkshire Hathaway, has recently made a notable addition to its portfolio by acquiring shares in Liberty SiriusXM Group (NASDAQ:LSXMA). On March 28, 2024, the firm added 2,521,431 shares of Liberty SiriusXM Group, increasing its stake in the company significantly. This transaction has caught the attention of investors, as Buffett's moves are often seen as signals of strong value propositions.

Profile of Warren Buffett (Trades, Portfolio)

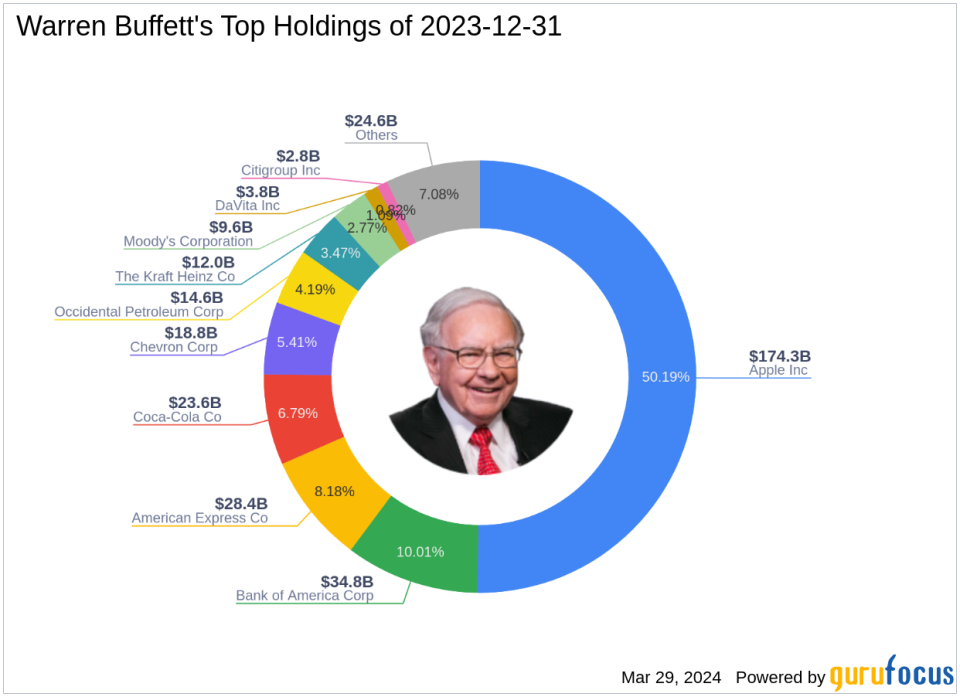

Warren Buffett (Trades, Portfolio), often referred to as "The Oracle of Omaha," is a legendary figure in the investment world. His firm, Berkshire Hathaway, is renowned for its impressive investment record and Buffett's value investing strategy. Buffett's approach, influenced by his mentor Benjamin Graham, focuses on acquiring undervalued companies with long-term potential and holding them over extended periods. Berkshire Hathaway's portfolio is a testament to this philosophy, with major holdings in companies like Apple Inc (NASDAQ:AAPL) and Bank of America Corp (NYSE:BAC).

Analysis of Liberty SiriusXM Group

Liberty SiriusXM Group operates a subscription-based satellite radio service, offering a wide array of music, sports, entertainment, and other programming across the United States and the United Kingdom. With a market capitalization of $9.69 billion and segments including Sirius XM Holdings, the company has established a significant presence in the media industry. Despite the competitive landscape, Liberty SiriusXM Group has maintained a steady performance in the market.

Transaction Details

The recent transaction by Buffett's firm involved a purchase price of $29.11 per share, with the total number of shares held by Berkshire Hathaway now standing at 32,755,624. This trade has a modest impact of 0.02% on the portfolio, reflecting a position of 0.27% in the firm's holdings and 10.03% of Liberty SiriusXM Group's shares. The current stock price of $29.70 suggests a slight gain since the transaction date.

Portfolio Context

Liberty SiriusXM Group now represents a more significant position within Buffett's portfolio, joining the ranks of top holdings in sectors such as Technology and Financial Services. The addition of LSXMA shares aligns with Berkshire Hathaway's strategy of investing in companies with favorable long-term prospects and solid business models.

Financial Health and Performance Metrics of Liberty SiriusXM Group

Liberty SiriusXM Group's financial health and performance metrics are a mixed bag. The company has a GF Score of 81/100, indicating good potential for outperformance. However, its Financial Strength is rated 4/10, and its Profitability Rank stands at 7/10. The company's Piotroski F-Score is 6, suggesting a reasonable financial situation, while the Altman Z-Score of 0.74 raises some concerns about financial stability. The company's Operating Margin has seen a decline, and its Growth Rank is 7/10, reflecting a solid growth trajectory.

Market Sentiment and Other Gurus' Positions

Since its IPO on April 18, 2016, Liberty SiriusXM Group's stock has appreciated by 44.38%, with a year-to-date change of 3.34%. Other notable investors, including Seth Klarman (Trades, Portfolio), Wallace Weitz (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio), also hold positions in the company, indicating a positive market sentiment among savvy investors.

Conclusion

Warren Buffett (Trades, Portfolio)'s latest trade in Liberty SiriusXM Group underscores the firm's confidence in the company's value proposition and long-term prospects. For value investors, Buffett's investment moves offer insights into potential opportunities in the market. As Berkshire Hathaway increases its stake in LSXMA, the investment community will be watching closely to see how this position evolves within the context of Buffett's legendary portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.