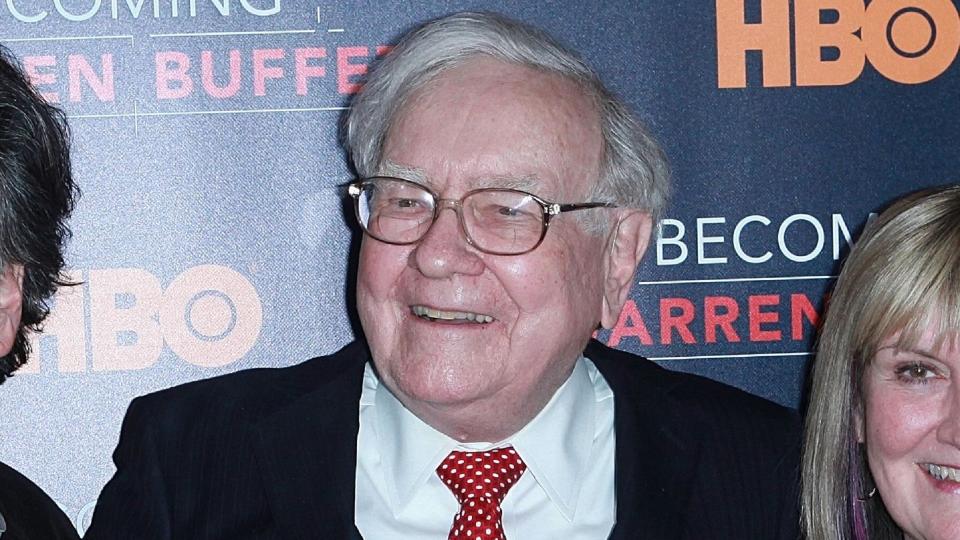

Warren Buffett Just Bought 10.5 Million More Shares in Major Oil Company — What It Means for Investors

Warren Buffett, known as The Oracle of Omaha, increased his stake in oil and gas company Occidental Petroleum on Dec. 11 and Dec. 12, buying an additional 10.5 million shares for $590 million, according to Securities and Exchange Commission (SEC) filings. Experts say the move signals his strong support for the company’s vision.

Warren Buffett’s Advice to Investors: ‘Incredible Period’ for America’s Economy is Ending

Find: 3 Things You Must Do When Your Savings Reach $50,000

Warren Buffett’s Berkshire Hathaway now owns 27% of the common stock. The move follows Occidental’s Dec. 11 acquisition of oil and gas producer CrownRock for $12 billion, according to a press release.

As David Kass, clinical professor of finance at University of Maryland, Robert H. Smith School of Business, noted that Buffett has expressed his admiration for OXY CEO Vicki Hollub, who has stressed her desire to have OXY earn rates of return that exceed its cost of capital, reduce the amount of debt on its balance sheet, buy back shares of its common stock and pay a cash dividend.

Indeed, during the company’s May annual shareholder meeting, Buffett said Hollub was “an extraordinary manager of Occidental,” according to a transcript.

“Buffett’s purchase of OXY shares earlier this week signals his approval of OXY’s purchase of CrownRock,” said Kass. “Over 80% of OXY’s petroleum reserves are located in the United States -thus minimizing geopolitical risk.”

Kass added that Buffett’s additional purchases of OXY stock earlier this week signals his confidence not only in the management of OXY, but the overall economy.

“Buffett is a long-term investor with large investments in both OXY and Chevron whose value is primarily determined by the price of oil,” he said. “This indicates that he is expecting oil currently trading at $70 per barrel to return to a 40-year average of $80 in the years ahead.”

What does it mean for Berkshire?

Cathy Seifert, vice president, CFRA Research, noted that Occidental represents a key investment for Berkshire, and that both the company and its management team are known entities to Berkshire.

“Against that backdrop, coupled with Berkshire’s significant cash hoard, and OXY’s — and the energy sector’s — underperformance versus the broader market year-to-date, it’s not surprising that Berkshire would allocate capital to this space.”

What does it mean for investors?

While this latest purchase of Occidental Petroleum shares reaffirms the position that Buffett and his colleagues find the company to be a compelling value in today’s market, some experts argue that investors should not infer anything about the broader market’s valuation from Buffett’s recent purchase.

“Berkshire Hathaway has amassed a huge cash hoard and he has referred to the massive cash pile as his “elephant gun,” meaning he’s always on the prowl for an opportunity to shoot large sums of money at a big acquisition or investment,” said Robert R. Johnson, PhD, CFA, CAIA, professor of finance, Heider College of Business, Creighton University. “He hasn’t shot that elephant gun in a long time and this purchase is certainly not an ‘elephant gun’ purchase, as it represents less than 1% of Berkshire’s cash position. Having said that, I believe that he would like to own as much Occidental Petroleum as he could.”

According to Johnson, who is a long-time Berkshire Hathaway shareholder and has attended nearly every annual meeting in the last 40 years, Occidental Petroleum “is a classic Buffett play,” in an out-of-favor industry with a below-market valuation on many standard metrics.

“Given the recent fervor — that I should note is waning — for ESG [environmental, social and governance] investments, OXY is a contrarian play and reaffirms that Buffett is willing to buck market trends,” he added.

Finally, he noted that while the recent purchase brings Berkshire Hathaway’s position to holding more than 25% of OXY, it still represents a small fraction of the Berkshire marketable securities portfolio.

“It is Berkshire’s sixth largest position at 3.7% of the marketable securities portfolio. It is dwarfed by the Apple position at 48% of the holdings. It should be noted that OXY isn’t even Berkshire’s largest oil holding, as Chevron represents 4.4% of the Berkshire portfolio,” he added.

More From GOBankingRates

The Average American Spends This Much on Rent -- See How You Stack Up

I'm a Self-Made Millionaire: Here Are 5 Stocks I'm Never Selling

This article originally appeared on GOBankingRates.com: Warren Buffett Just Bought 10.5 Million More Shares in Major Oil Company — What It Means for Investors