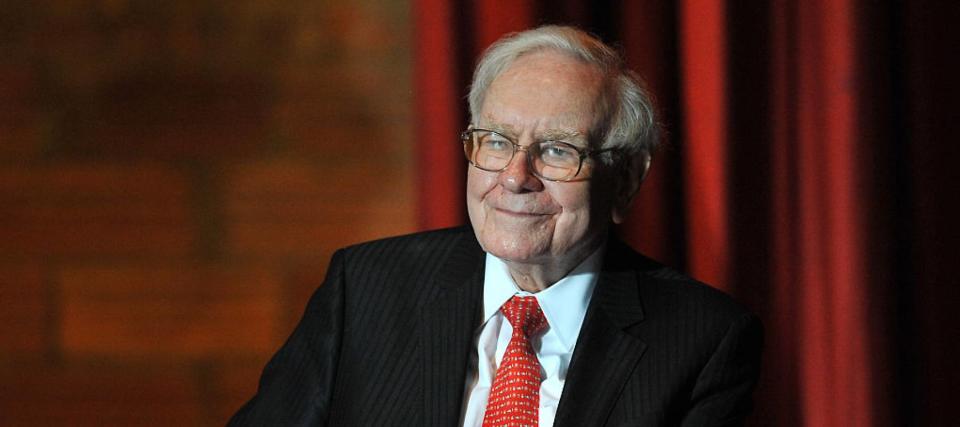

Warren Buffett once bet $1M that he could beat a group of fancy hedge funds over 10 years — and he crushed them with a technique requiring absolutely no investing skill. Here's what he did

Known for their complex investment strategies, hedge funds are typically seen as exclusive options for the ultra-rich. However, you don’t have to be among the elite to achieve comparable, or even superior, returns.

According to legendary investor Warren Buffett, there’s a very simple strategy that has the potential to outperform these complex hedge funds. Buffett was at one point so confident about this strategy that he was willing to wager a million dollars on its effectiveness.

Don’t miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Finish 2023 stronger than you started: 5 money moves you should make before the end of the year

The US dollar has lost 87% of its purchasing power since 1971 — invest in this stable asset before you lose your retirement fund

In 2007, Buffett bet a million dollars that over the course of a decade, a simple S&P 500 index fund would outperform a basket of hand-picked hedge funds. He picked the Vanguard 500 Index Fund Admiral Shares (VFIAX).

Hedge fund manager Ted Seides from Protégé Partners accepted the bet and picked five funds-of-funds. A fund-of-funds is a portfolio of funds that charges two layers of management fees.

The outcome? Buffett triumphed decisively.

Buffett shared the final scorecard of the bet in his 2017 shareholder letter. The S&P 500 index fund he selected delivered a total gain of 125.8% during the decade, while the five funds-of-funds reported respective gains of 21.7%, 42.3%, 87.7%, 2.8% and 27.0% during the same period.

Buffett gave all proceeds to charity — and Girls Inc. of Omaha turned out to be the biggest winner of the bet.

High returns, low fees

This decade-long bet challenged the notion that complex and expensive investment methods always yield the best results.

After all, anyone can replicate Buffett’ strategy at a very low cost. The Vanguard index fund he picked has an expense ratio of just 0.04%.

The hedge funds, Buffett pointed out, come at a much higher cost to investors.

“Even if the funds lost money for their investors during the decade, their managers could grow very rich,” he wrote in the shareholder letter. “That would occur because fixed fees averaging a staggering 2.5% of assets or so were paid every year by the fund-of-funds’ investors, with part of these fees going to the managers at the five funds-of-funds and the balance going to the 200-plus managers of the underlying hedge funds.”

In the investing world, fees should not be overlooked — they can eat into your returns. In an op-ed for Bloomberg titled “Why I Lost My Bet With Warren Buffett,” Seides agreed with Buffett on the subject of hedge funds’ management fees.

“He is correct that hedge-fund fees are high, and his reasoning is convincing. Fees matter in investing, no doubt about it,” he wrote.

Read more: 'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling inflation

These days, many ETFs enable investors to track benchmark indices at minimal costs. For instance, the Vanguard S&P 500 ETF (VOO), which follows the S&P 500, has a low expense ratio of 0.03%. Similarly, the SPDR S&P 500 ETF Trust (SPY) tracks the same index and carries an expense ratio of 0.0945%.

Does that mean every investor should abandon stock-picking and put all their money into index funds?

The answer varies based on the individual.

For someone like Buffett, making their own investment decisions could lead to significantly greater success. Consider this: from 1964 to 2022, Buffett’s Berkshire Hathaway delivered an astounding overall gain of 3,787,464%, substantially outperforming the S&P 500’s already impressive 24,708% return in the same timeframe.

What to read next

Thanks to Jeff Bezos, you can now cash in on prime real estate — without the headache of being a landlord. Here's how

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

Rising prices are throwing off Americans' retirement plans — here’s how to get your savings back on track

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.