Warren Buffett says Jack Bogle is a 'hero' to investors

Warren Buffett hates fees.

In his latest annual letter to shareholders, the Berkshire Hathaway (BRK-A, BRK-B) CEO goes on a lengthy missive about how nothing hurts the average investor more than fees charged by Wall Street pros. “As Gordon Gekko might have put it: ‘Fees never sleep,'” Buffett quipped.

It is, then, not superior investment returns but lower fees that Buffett sees as the real innovation made over the last generation of investors. And in Buffett’s view, no one has done more for the average investor than Vanguard founder Jack Bogle.

“If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle,” Buffett writes.

“For decades, Jack has urged investors to invest in ultra-low-cost index funds. In his crusade, he amassed only a tiny percentage of the wealth that has typically flowed to managers who have promised their investors large rewards while delivering them nothing — or, as in our bet, less than nothing — of added value.

“In his early years, Jack was frequently mocked by the investment-management industry. Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me.” (Emphasis added.)

Vanguard, which has about $4 trillion in assets under management, is seen as the industry leader in cutting fees for investors. Their S&P 500 index mutual fund, which is designed to simply track the performance of the benchmark index, charges 5 basis points per year in fees.

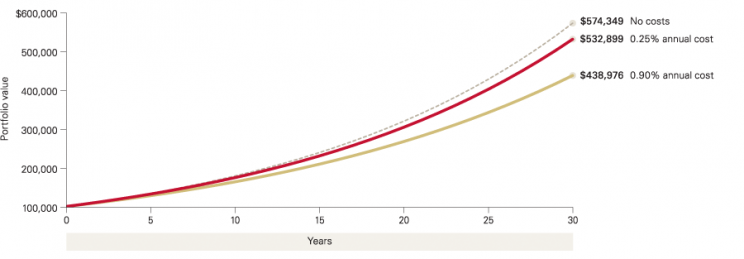

And this chart from Vanguard is perhaps the easiest distillation of the company’s motivating principle: minimize fees to maximize returns.

This philosophy has led to an industry-wide “race to zero,” as a Bloomberg article recently put it, as firms compete to lower expenses for mutual funds and ETFs.

Now Buffett, as someone who over the course of his investing career has significantly outperformed the S&P 500, knows that it is not an entirely futile effort for those who enter the field.

“The job, after all, is not impossible,” Buffett writes.

“The problem simply is that the great majority of managers who attempt to over-perform will fail. The probability is also very high that the person soliciting your funds will not be the exception who does well.”

And so for Buffett, choosing low-cost investments are simply about stacking the odds in your favor.

As Buffett writes, “The bottom line: When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds.”

Ahead of the letter, many expected Buffett to weigh in on the “active vs. passive” debate that has been heating up over the last couple years in the investing world. Both “active” and “passive,” however, carry a somewhat negative connotation.

Active implies investors — or, more specifically, fund managers — making changes to a portfolio simply for the sake of change. Passive implies that investors are simply lemmings, sitting back and doing nothing while potentially losing money.

But Buffett’s discussion of the issue in his latest letter also re-focuses that debate towards one that is more productive and captures what “active vs. passive” really means. This debate is not about how you invest but how much it costs for you to invest.

As Buffett writes elsewhere in the letter, the stock market — a collection of American businesses — is almost certain to be worth more in the future. There will be declines along the way and periods when market drops will make investors of all sizes afraid.

There is, in Buffett’s view, a simple antidote: “Investors who avoid high and unnecessary costs and simply sit for an extended period with a collection of large, conservatively-financed American businesses will almost certainly do well.”

And, because of Jack Bogle, this investment won’t cost much.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: