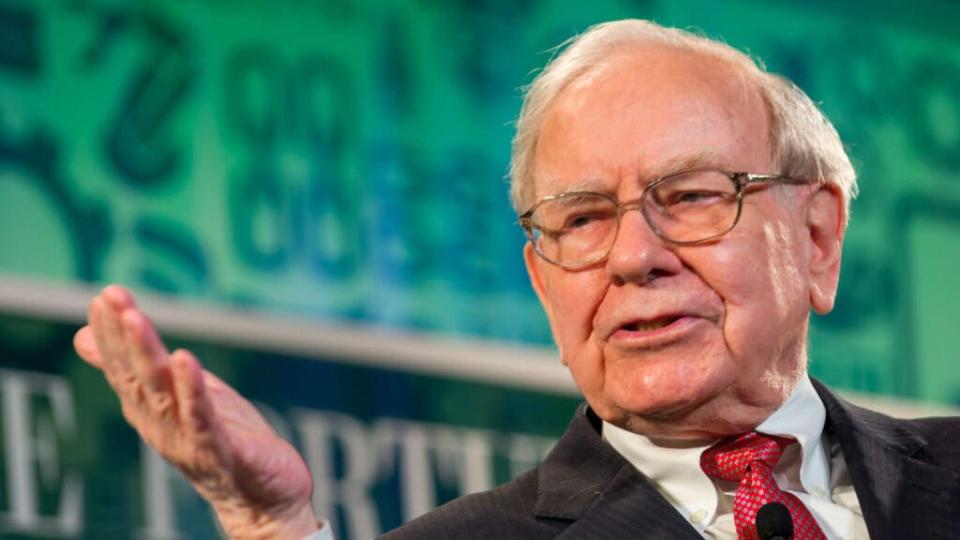

Warren Buffett Says, 'If They Stick Fudge Down In Front Of Me, I Eat It. I'm Not Thinking About 25 Other Choices'

When it comes to success and personal development, the insights of seasoned trailblazers like Warren Buffett are sought after. The billionaire investor and Berkshire Hathaway Inc. CEO has amassed a following that hangs on his words of wisdom. However, after decades in the public eye, certain anecdotes and supposed philosophies get misattributed or distorted over time.

Don't Miss:

Are you rich? Here’s what Americans think you need to be considered wealthy.

Can you guess how many Americans successfully retire with $1,000,000 saved? The percentage may shock you.

At the Berkshire Hathaway 2013 shareholder meeting, Alex Banayan, author of “The Third Door,” inquired about a supposed technique attributed to Buffett involving listing 25 goals, focusing solely on the top five and disregarding the rest. This "5/25 rule" has been linked to Buffett countless times. Buffett’s response was not only surprising but also candid.

Buffett dismissed the notion of such a structured approach to goal setting, revealing a more spontaneous and unpretentious side to his nature.

“I’m actually more curious about how you came up with it because it really isn’t the case. It sounds like a really good method of operating, but it’s much more disciplined than I actually am,” Buffett said.

His admission that fudge could derail his focus was humanizing. “If they stick fudge down in front of me, I eat it. I’m not thinking about 25 other choices.”

Adding to the banter, the late Charlie Munger, Buffett’s longtime business partner, chimed in with his perspective on energy and decision-making. Munger highlighted the significance of good habits, rest, sugar and caffeine in maintaining the mental energy required for impactful decisions. Munger’s observation that Buffett doesn’t dwell on his food choices — “he just eats it” — offers a peek into the less rigid and more intuitive aspects of decision-making among successful individuals.

Trending: How to turn a $100,000 investment into $1 Million — and retire a millionaire.

While Buffett did not come up with the 5/25 rule, a structured approach that centers on the belief that too many tasks and distractions can dilute focus and lead to less effective outcomes, it's a valid approach that may work for some.

Buffett’s fudge analogy illustrates his approach, which leans toward prioritizing what appeals to or interests him at the moment rather than adhering to a predetermined list of priorities. This methodology emphasizes the importance of flexibility and intuition in decision-making, suggesting that sometimes, the best choice is the one that feels right in the moment, even if it’s as simple as choosing to enjoy a piece of fudge.

Buffett’s approach doesn't mean acting without thought or strategy but rather integrating natural inclinations and passions into the decision-making process, making it more personalized and, arguably, more effective.

Just as there is no universal approach to decision-making, there is no singular blueprint for financial success either. Each person’s circumstances, goals and risk tolerance are unique, which is why seeking guidance from a qualified financial adviser can be invaluable. A financial adviser can provide personalized strategies tailored to your specific needs, whether it’s managing debt, creating a budget, investing for the future or developing a comprehensive financial plan.

Read Next:

For many first-time buyers, a house is about 3 to 5 times your household annual income – Are you making enough?

Can living off interest from a $1 million investment support my retirement dreams?

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Warren Buffett Says, 'If They Stick Fudge Down In Front Of Me, I Eat It. I'm Not Thinking About 25 Other Choices' originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.