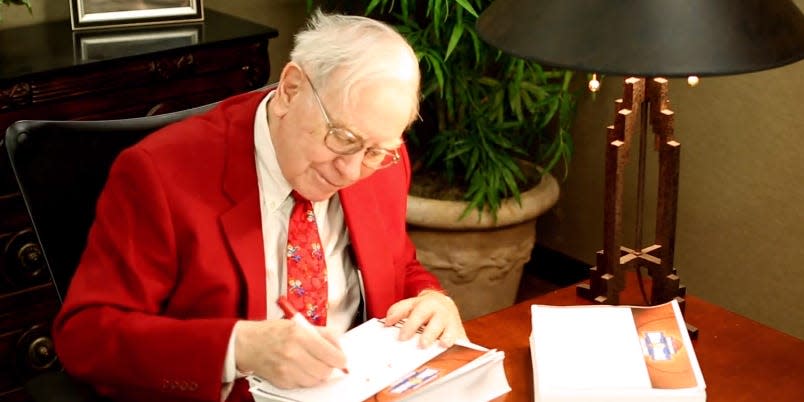

Warren Buffett scored big wins but suffered a devastating loss in 2023. Here are the 7 key moments of his year.

Warren Buffett enjoyed some big wins but suffered a devastating loss in 2023.

The investor made a key acquisition, flew to Tokyo, and made waves with his annual letter and bash.

The Berkshire Hathaway CEO also gifted $6 billion, bought a mystery stock, and lost Charlie Munger.

Warren Buffett had a year of thrilling highs and heartbreaking lows in 2023.

The 93-year-old investor and Berkshire Hathaway CEO closed a major acquisition, took a business trip to Tokyo, reflected on the best bets of his career in his shareholder letter, and tackled topics ranging from bad banks to Elon Musk at his company's yearly gathering.

Buffett also gifted nearly $6 billion to good causes, exited some long-held positions and added at least one mystery stock to his portfolio, and bid farewell to one of the most important people in his life.

Here are Buffett's 7 biggest moments of 2023:

1. A deal and a fight

Buffett started the year in style, shelling out $8.2 billion in January to raise Berkshire's stake in Pilot Travel Centers from 38.6% to 80%.

Soaring corporate valuations and fierce competition from other suitors has made it tough for Buffett and his team to find and complete compelling acquisitions in recent years, making Pilot a rare addition to Berkshire's stable.

The truck-stop chain grew its revenues from $20 billion in 2017, when Berkshire first purchased a stake, to $45 billion in 2021. It raked in over $13 billion of revenue and nearly $300 million in pre-tax earnings in the third quarter of this year alone.

It's worth noting that at the time of writing, Berkshire and the Haslam family are locked in a legal battle. The Haslams have sued Berkshire over accounting changes that they claim will depress Pilot's valuation and make it cheaper for Berkshire to buy their remaining 20% stake. Berkshire has countersued, claiming that billionaire Jimmy Haslam promised secret payments to staff that would force Berkshire to pay more for the rest of the company.

2. The annual letter

Buffett waxed nostalgic in his iconic yearly letter to shareholders in February, reflecting on Berkshire's greatest achievements like a proud father.

The investor noted his company's success was pretty much down to "about a dozen truly good decisions — that would be about one every five years."

Buffett highlighted Berkshire's stakes in Coca-Cola and American Express, which cost it about $1.3 billion each nearly 30 years ago. They're now individually worth over $20 billion, and collectively yield over $1 billion in yearly dividends.

The stock picker also defended prudent stock buybacks and slammed blanket criticism of them.

"When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive)," he wrote.

Buffett also declared it was "disgusting" when company bosses fiddle with their companies' financials to beat Wall Street's expectations. Moreover, he trumpeted Berkshire's tax contributions, and reiterated his belief that Berkshire's success will continue long past his death.

3. The Tokyo trip

Buffett, 93, made a rare overseas trip to Tokyo in April after building multibillion-dollar stakes in five Japanese trading companies over the previous few years. He disclosed that Berkshire had boosted its ownership to about 7.4% across the board, and shared his thoughts on the spate of regional-bank failures in March, during a live CNBC interview while in Japan.

The Berkshire chief revealed he had unloaded a bunch of bank stocks over the previous couple of years because he saw red flags in their financials and expected them to get into trouble. He also warned inflation and recession are painful for many people, and compared the bitcoin boom to playing a roulette wheel with dismal odds of winning that makes loud noises when it pays out to attract more punters.

4. The Berkshire meeting

Buffett welcomed tens of thousands of Berkshire shareholders to his company's annual gathering in Omaha in May. He and his business partner, Charlie Munger, fielded questions for over five hours on a wide variety of topics.

The Berkshire CEO said the US government was right to step in and guarantee people's deposits during this spring's banking debacle, as failing to do so would have triggered widespread bank runs and sent shockwaves through the global financial system.

"A lighted match can be turned into a conflagration, or it can be blown out," he said.

Buffett also said he was wary of owning bank stocks, concerned about commercial real estate's overreliance on debt, and feared an incredible period for the US economy fueled by near-zero interest rates and carefree government spending had ended.

The investor also dismissed fears of de-dollarization as he didn't see any obvious substitutes to the greenback, and trumpeted ChatGPT's innovativeness but flagged the risks of AI. Moreover, he noted Berkshire was set to collect over $5 billion in interest from its cash and Treasury bills this year thanks to higher rates, and hailed Apple as a "better business than any we own."

Buffett also preached the importance of personal thriftiness, emphasized the huge impact of finding the right spouse and teaching kids the right values, and encouraged people to write their own obituaries then try to live up to them.

Close listeners were treated to plenty of nuggets, including details about the dollar value of Buffett's personal bank account, an oil deal that still paid Munger $70,000 a year more than six decades later, and the red flags that Buffettspotted in banks' financials.

Buffett and Munger also saluted Elon Musk for trying to do the impossible. "Warren and I are looking for the easy job. We don't want that much failure," Munger said.

5. The nearly $6 billion of gifts

Buffett donated about $4.6 billion of Berkshire shares to the Bill & Melinda Gates Foundation and four of his family's foundations in June. He gifted another $900 million worth of stock to the same family foundations just before Thanksgiving.

The investor made similar-sized gifts in 2022, and has now given away more than half of his Berkshire stock since 2006. All else being equal, if he'd retained the shares then his net worth would be about $260 billion today, making him the world's wealthiest person instead of Elon Musk ($235 billion).

Buffett marked his latest gift by offering fresh details about his estate. His three children will be executors of his will and the named trustees of the charitable trust that will receive over 99% of his fortune, he wrote, as he now believes they're ready for that "awesome responsibility."

The Berkshire chief also underscored that he wants to maximize the philanthropic impact of his accumulated riches. The trust will self-liquidate after a decade and operate with a lean staff, he said. He added that to ensure transparency, his will would be kept at the county courthouse for anyone to inspect.

6. The stock portfolio

Buffett and his team made several notable changes to Berkshire's stock portfolio in 2023. They exited positions like Taiwan Semiconductor, US Bancorp, and BNY Mellon, as well as long-held holdings such as General Motors, Procter & Gamble, and Johnson & Johnson. They also pared their stakes in Amazon, Chevron, HP, and other stocks.

On the other hand, they established new positions in Capital One and a trio of homebuilders, and boosted their Occidental Petroleum stake to nearly 28%. Moreover, they requested confidential treatment from the SEC for one of more positions in the third quarter as they were still building them, just as they did with Chevron and Verizon in 2020.

Yet Berkshire sold nearly $30 billion worth of stocks on a net basis in the first three quarters of 2023, suggesting Buffett struggled to find much worth buying in the period.

The big star of Buffett's portfolio was Apple, by far its biggest holding. The iPhone maker's stock price closed at a record $198 on December 11, valuing Berkshire's nearly 6% stake at over $180 billion.

Farewell to Munger

Buffett's year ended on a tragic note with the death of Charlie Munger, his business partner and right-hand man for over six decades, just a few weeks shy of his 100th birthday.

Munger steered Buffett away from only caring about value for money to instead seeking to purchase "wonderful businesses at fair prices." He also served as the "Abominable No-man" who helped Buffett turn down all but the absolute best opportunities, and helped nurture a culture of honor and morality at Berkshire.

"Berkshire Hathaway could not have been built to its present status without Charlie's inspiration, wisdom and participation," Buffett said in a press release. He'll undoubtedly give Munger a fuller eulogy in his next annual letter in February.

Read the original article on Business Insider