Warren Buffett's Berkshire Hathaway Acquires New Stake in Liberty Media Corp Junk

Introduction to the Transaction

Warren Buffett (Trades, Portfolio)'s investment firm, Berkshire Hathaway, has recently expanded its portfolio by purchasing a new holding in Liberty Media Corp Junk (NASDAQ:LLYVA). On August 3, 2023, the firm acquired 5,051,918 shares in the media conglomerate. This transaction marks a new investment avenue for Berkshire Hathaway, although the trade impact on the portfolio and the trade price data are currently not applicable.

Profile of the Investment Firm: Warren Buffett (Trades, Portfolio)

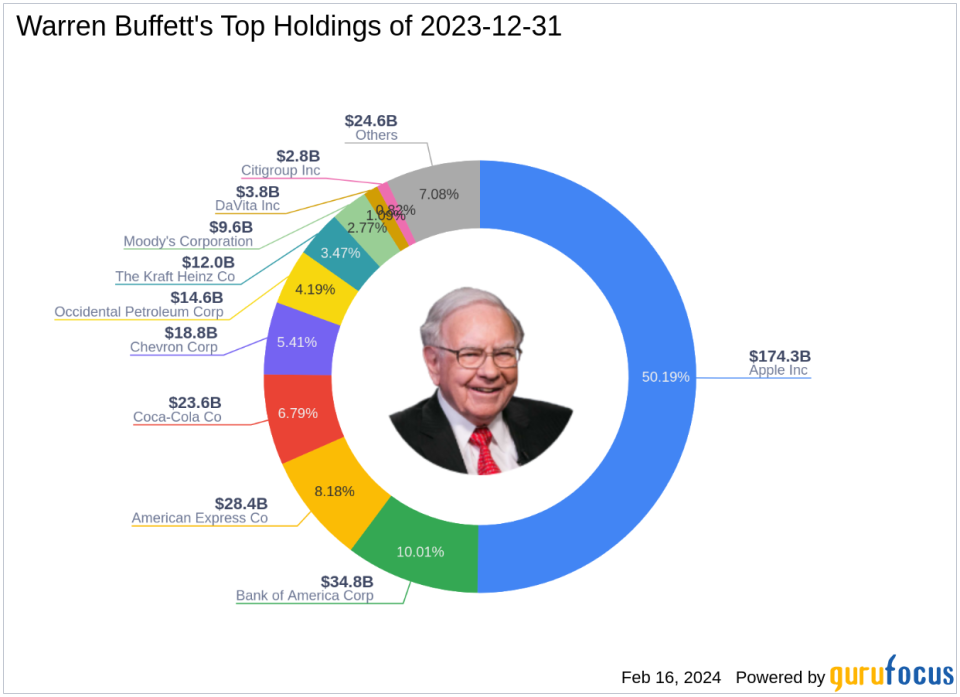

Warren Buffett (Trades, Portfolio), often referred to as "The Oracle of Omaha," is a towering figure in the investment world. His firm, Berkshire Hathaway, is a testament to his investment acumen, having evolved from a textile company into a colossal insurance and investment conglomerate. Buffett's value investing strategy, influenced by his mentor Benjamin Graham, emphasizes understanding a business, investing with a margin of safety, and choosing companies with favorable long-term prospects. Berkshire Hathaway's portfolio includes significant stakes in major companies across various sectors, with top holdings such as Apple Inc (NASDAQ:AAPL), American Express Co (NYSE:AXP), and Coca-Cola Co (NYSE:KO), showcasing the firm's diverse and strategic investments.

Overview of Liberty Media Corp Junk

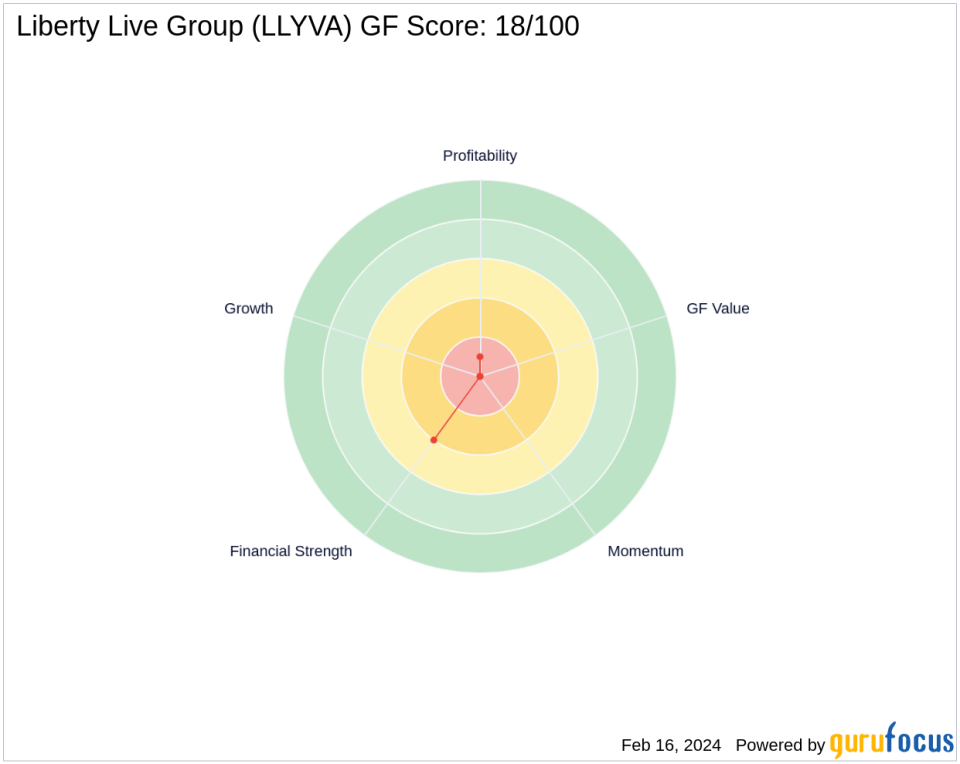

Liberty Media Corp Junk, with the stock symbol LLYVA, operates within the diversified media industry in the United States. Since its IPO on August 4, 2023, the company has been involved in managing investments in Live Nation and other media-related assets. Despite the lack of sufficient data to evaluate the company's GF Value, Liberty Media Corp Junk has a market capitalization of $3.42 billion and a current stock price of $36.34. However, the stock's GF Score stands at a low 18 out of 100, indicating potential challenges in future performance.

Analysis of the Trade Impact

The designation of "New Holdings" signifies that Berkshire Hathaway has initiated a position in Liberty Media Corp Junk for the first time. Given the absence of trade impact and price data, it is challenging to assess the immediate influence of this transaction on the stock's performance or Berkshire Hathaway's portfolio. However, the firm's decision to invest in Liberty Media Corp Junk could be indicative of Buffett's confidence in the company's long-term value proposition.

Berkshire Hathaway's Portfolio Composition

Berkshire Hathaway's equity portfolio is valued at $347.36 billion, with a strong presence in the technology and financial services sectors. The addition of Liberty Media Corp Junk to its portfolio diversifies its investments further into the media industry. Although the new holding's position size is not disclosed, it represents a strategic move within Berkshire Hathaway's broad investment landscape.

Market Performance and Valuation Metrics of Liberty Media Corp Junk

Liberty Media Corp Junk's stock has seen a price increase of 3.98% since its IPO, with a year-to-date change of 1.74%. However, the company's PE percentage is not applicable, indicating that it is currently not profitable. The lack of data on the GF Valuation and other ranking metrics such as Financial Strength, Profitability Rank, and Growth Rank, suggests that investors may need to rely on future performance and strategic developments for valuation insights.

Other Notable Investors in Liberty Media Corp Junk

Aside from Berkshire Hathaway, other prominent investors such as Seth Klarman (Trades, Portfolio), Tom Gayner (Trades, Portfolio), and Wallace Weitz (Trades, Portfolio) have also taken positions in Liberty Media Corp Junk. The comparison of their stakes with that of Berkshire Hathaway could provide a broader perspective on the stock's appeal to value investors.

Conclusion

In summary, Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway has made a notable entry into Liberty Media Corp Junk, reflecting a potential strategic interest in the media sector. While the immediate impact of this transaction is not quantifiable due to the lack of trade impact and price data, the investment firm's track record suggests a calculated move based on long-term value. As the company's financial and performance metrics evolve, investors will be watching closely to understand the implications of this new holding within Berkshire Hathaway's diverse and influential portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.