Warren Buffett's Berkshire Trims Stake in HP Inc

Overview of Warren Buffett (Trades, Portfolio)'s Recent HP Inc Transaction

Warren Buffett (Trades, Portfolio), the esteemed investor known as the "Oracle of Omaha," has recently adjusted his holdings in HP Inc (NYSE:HPQ). On November 30, 2023, Buffett's firm reduced its stake in the technology company by a significant 47.37%, selling 46,351,068 shares. On the transaction date, HPQ's shares averaged $29.34 per share. This move has altered the landscape of Buffett's investment portfolio, where HP Inc now represents a 0.48% position, down from the previous 0.91%.

The Investment Strategy of Warren Buffett (Trades, Portfolio)

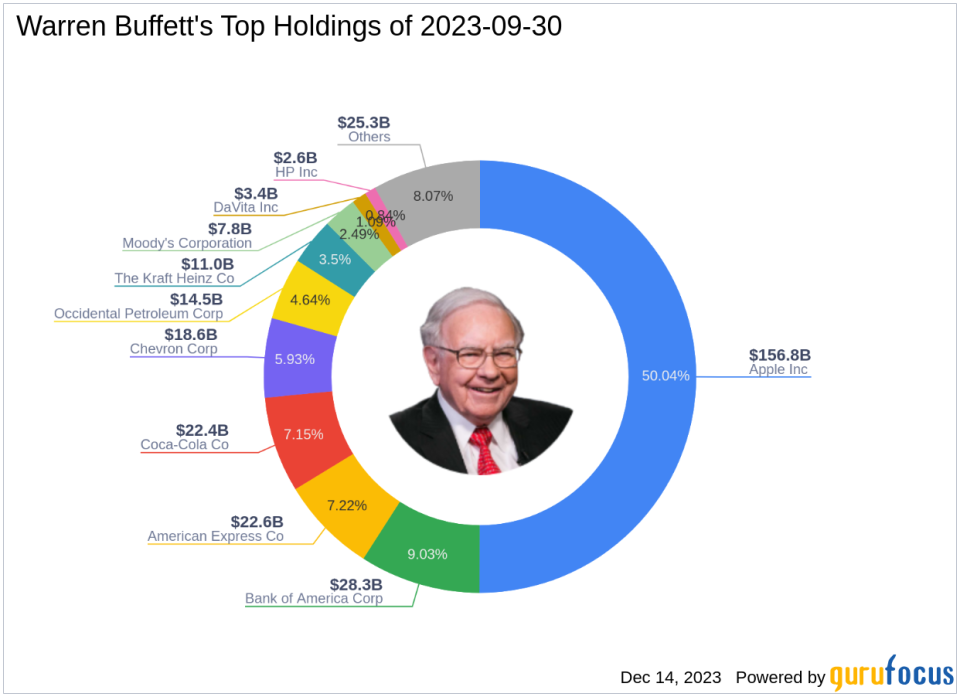

Warren Buffett (Trades, Portfolio)'s investment philosophy has long been a beacon for value investors worldwide. As the chairman of Berkshire Hathaway, Buffett has transformed a modest textile company into a colossal conglomerate, primarily focusing on insurance and other diverse investments. His strategy, deeply influenced by Benjamin Graham, emphasizes understanding a business, investing with a margin of safety, and choosing companies with favorable long-term prospects and competent management. Buffett's top holdings reflect this approach, with major stakes in Apple Inc (NASDAQ:AAPL), American Express Co (NYSE:AXP), and Bank of America Corp (NYSE:BAC), among others.

Details of Buffett's HP Inc Trade Action

The transaction on November 30 marked a reduction in Buffett's position in HP Inc, with the shares now accounting for 5.20% of the company's outstanding stock. The trade had a moderate impact on Buffett's portfolio, decreasing its weight by 0.43%. Despite the reduction, HP Inc remains a notable holding within the portfolio, showcasing Buffett's continued, albeit reduced, confidence in the company's value proposition.

Impact on Buffett's Portfolio

Following the sale, HP Inc stands as a smaller, yet still significant, component of Buffett's investment holdings. The current 0.48% portfolio position indicates a strategic shift, possibly suggesting a reallocation of capital towards other opportunities or a response to changing market conditions. Nevertheless, HP Inc continues to be a part of Buffett's diverse and carefully selected investment mosaic.

HP Inc at a Glance

HP Inc, a leading player in the PC and printing industries, has been a household name since its inception. With a global customer base and a focus on the commercial market, HP Inc has strategically positioned itself since separating from Hewlett Packard Enterprise in 2015. The company's reliance on channel partners and outsourced manufacturing has allowed it to maintain a strong presence in its market segments, including Corporate Investments, Personal Systems, and Printing.

Financial Health of HP Inc

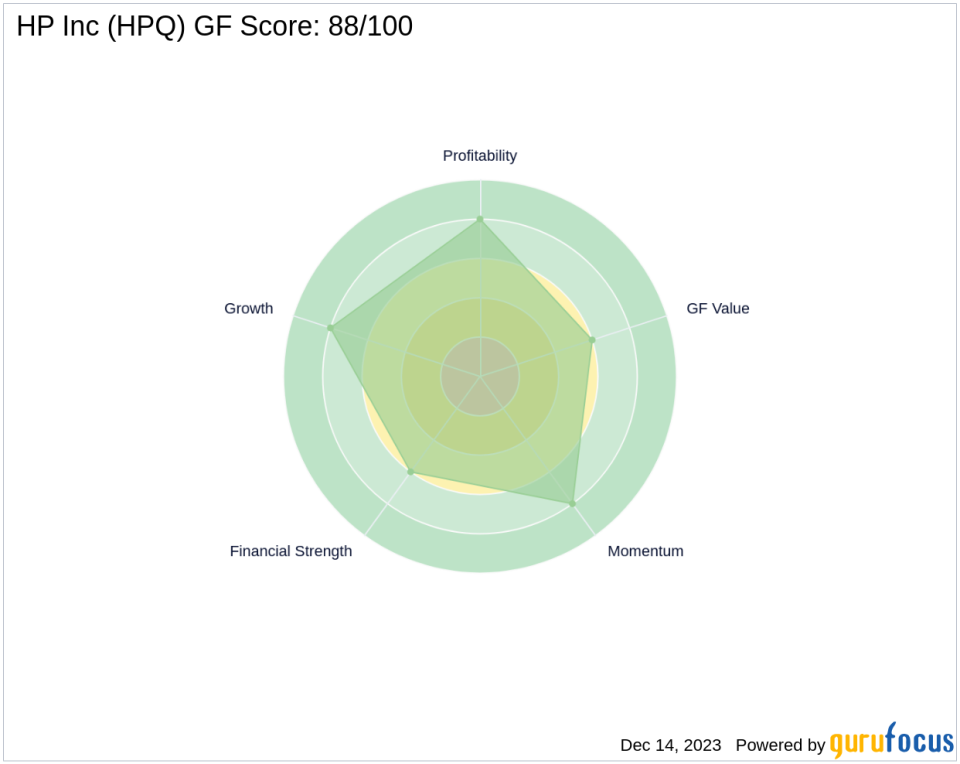

As of the latest data, HP Inc boasts a market capitalization of $30.57 billion, with a stock price of $30.93. The company is fairly valued according to the GF Value, with a GF Value of $31.56 and a price to GF Value ratio of 0.98. HP Inc's financial strength is evident in its PE Ratio of 9.40, indicating profitability, and a GF Score of 88/100, suggesting a high potential for outperformance. The company's balance sheet, profitability, and growth ranks are commendable, further solidifying its financial stability.

Other Notable Investors in HP Inc

Buffett is not the only guru with a vested interest in HP Inc. Other prominent investors include Dodge & Cox, Joel Greenblatt (Trades, Portfolio), and Jefferies Group (Trades, Portfolio), each maintaining their own positions in the company. Buffett's holdings, however, remain significant in comparison, reflecting his unique investment strategy and market influence.

Market Reaction and Prospects for HP Inc

Since the trade date, HP Inc's stock has experienced a 5.42% increase, indicating a positive market reaction. The company's year-to-date performance also shows a 15.63% increase, suggesting a strong trajectory. With a solid GF Score and a stable financial outlook, HP Inc appears well-positioned for future growth, aligning with the market's optimistic view of its potential.

Transaction Analysis and Influence

Warren Buffett (Trades, Portfolio)'s decision to reduce his stake in HP Inc has undoubtedly caught the attention of the investment community. While the trade has slightly decreased the prominence of HP Inc within Buffett's portfolio, it remains a noteworthy holding, reflecting a calculated adjustment rather than a complete withdrawal. This move may signal Buffett's nuanced approach to portfolio management, balancing long-term value with the agility to adapt to market dynamics.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.