Warren Buffett's Firm Bolsters Holdings in Liberty SiriusXM Group

Buffett's Latest Portfolio Addition

Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway has recently increased its stake in Liberty SiriusXM Group (NASDAQ:LSXMA), adding 1,491,510 shares on March 6, 2024. This transaction, executed at a price of $29.22 per share, has expanded the firm's total holdings to 25,231,542 shares. The trade has a modest impact of 0.01% on Buffett's portfolio, yet it signifies a notable confidence in the media company, with the position now accounting for 0.21% of the portfolio and 7.73% of Liberty SiriusXM Group's shares outstanding.

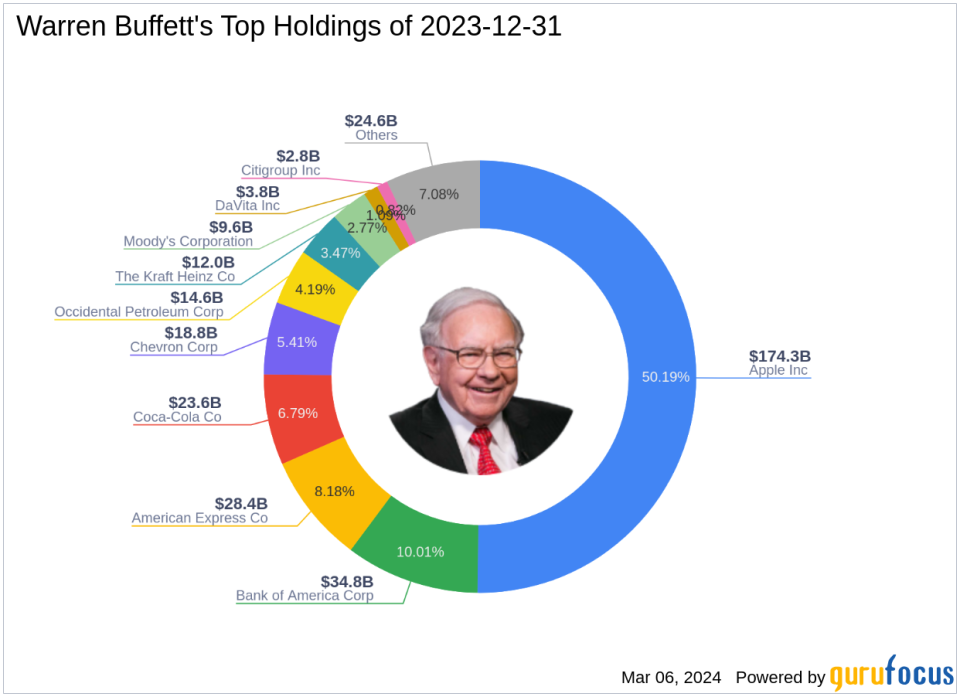

Warren Buffett (Trades, Portfolio): The Oracle of Omaha

Warren Buffett (Trades, Portfolio), the esteemed Chairman of Berkshire Hathaway, is a paragon of investment success. Known as "The Oracle of Omaha," Buffett's investment acumen is rooted in the teachings of Benjamin Graham. His value investing strategy, characterized by discipline, patience, and a keen eye for intrinsic value, has consistently outperformed the market. Berkshire Hathaway's portfolio, with top holdings in technology and financial services sectors, reflects Buffett's philosophy of investing in understandable businesses with favorable long-term prospects, honest management, and attractive prices. With an equity portfolio valued at $347.36 billion, Buffett's moves are closely watched by investors globally.

Liberty SiriusXM Group at a Glance

Liberty SiriusXM Group, a subsidiary of Liberty Media Corporation, operates a subscription-based satellite radio service. It provides a wide array of music, sports, entertainment, and news channels to the U.S. and U.K. markets. Since its IPO on April 18, 2016, the company has seen a 42.87% increase in its stock price. Currently, Liberty SiriusXM Group is fairly valued with a GF Value of $31.43 and a price to GF Value ratio of 0.94. The stock's PE Percentage stands at 12.85, indicating profitability, and the company holds a market capitalization of $9.57 billion.

Impact of Buffett's Trade on His Portfolio

The recent acquisition of Liberty SiriusXM Group shares by Buffett's Berkshire Hathaway has a subtle yet strategic impact on the portfolio. Although the trade impact is minimal, the increased stake in LSXMA reflects Buffett's confidence in the company's value and potential for long-term growth. This move aligns with his investment philosophy of acquiring shares in businesses with a clear understanding and favorable prospects.

Liberty SiriusXM Group's Market Valuation

With a current stock price of $29.39, Liberty SiriusXM Group is positioned as fairly valued according to the GF Value. The stock's PE Percentage of 12.85 and a GF Value of $31.43 suggest that the company is priced reasonably in relation to its earnings. The stock has experienced a slight gain of 0.58% since Buffett's transaction, indicating a stable market response.

Comparing Buffett's Stake with Other Investment Gurus

While Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway holds a significant position in Liberty SiriusXM Group, other notable investors like Seth Klarman (Trades, Portfolio), Wallace Weitz (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio) also maintain stakes in the company. Buffett's recent trade has solidified Berkshire Hathaway's position as a major shareholder in LSXMA, reflecting a shared interest in the company's prospects among savvy investors.

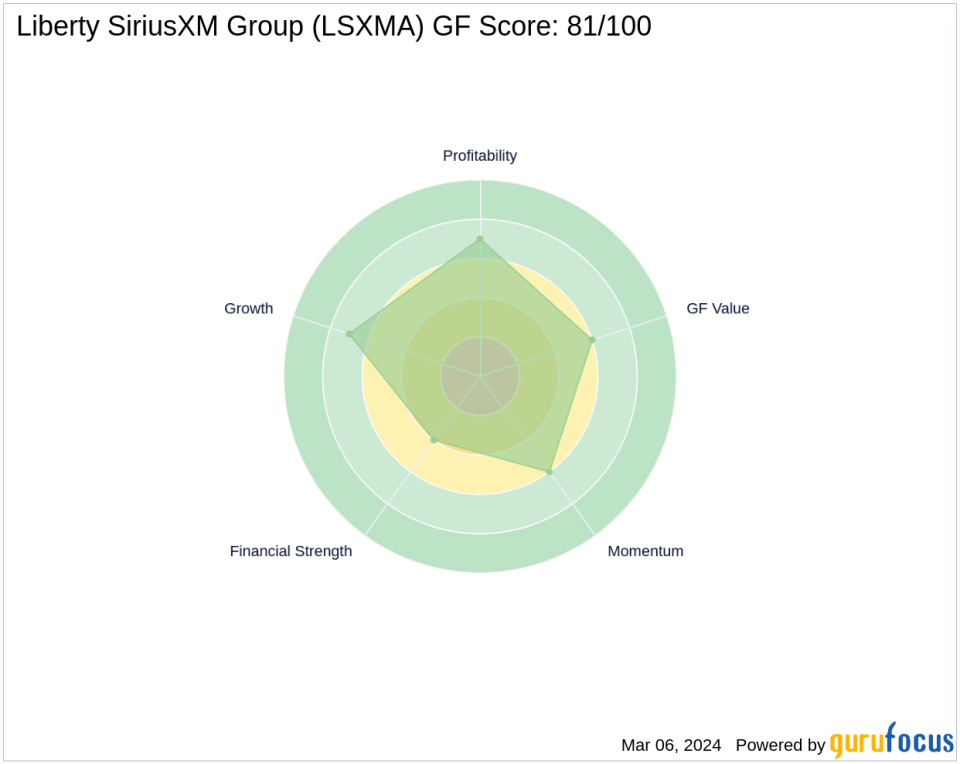

Financial Health and Prospects of Liberty SiriusXM Group

Liberty SiriusXM Group's financial health is assessed through various metrics. The company has a Financial Strength rank of 4/10 and a Profitability Rank of 7/10. Its Growth Rank is also 7/10, indicating a strong potential for future performance. The company's GF Score of 81/100 suggests good outperformance potential, while its Piotroski F-Score of 6 points to a stable financial situation.

Conclusion

In conclusion, Warren Buffett (Trades, Portfolio)'s recent addition of Liberty SiriusXM Group shares to Berkshire Hathaway's portfolio is a strategic move that aligns with his long-standing investment philosophy. The company's solid financial metrics and favorable GF Score indicate potential for future growth, making it a noteworthy investment. As Buffett continues to adjust his holdings, the investment community will undoubtedly keep a close eye on his decisions, seeking insights into the ever-evolving landscape of value investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.