Warrior Met Coal Inc (HCC) Reports Strong Earnings Amidst Increased Production and Sales Volumes

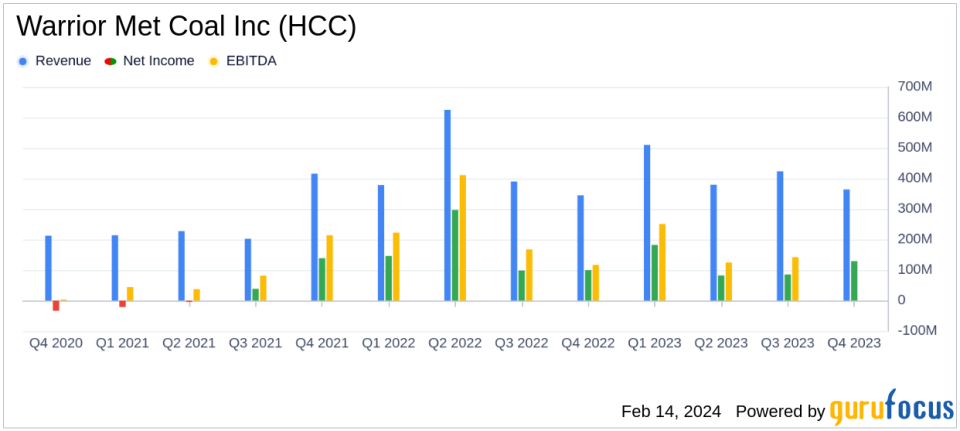

Net Income: Reported $128.9 million in Q4 and $478.6 million for the full year 2023.

Adjusted EBITDA: Reached $163.7 million in Q4 and $698.9 million for the full year.

Sales Volumes: Increased by 34% for the full year, with 7.5 million short tons sold.

Production Volumes: Grew by 21% for the full year, with record high annual production at Mine 4.

Cash Flow: Generated $701.1 million from operating activities in 2023.

Dividends: Raised quarterly dividend by 17% for the second consecutive year.

Blue Creek Project: Invested $319.1 million in 2023, with continuous miner units expected to produce in Q3 2024.

On February 14, 2024, Warrior Met Coal Inc (NYSE:HCC) released its 8-K filing, detailing its financial performance for the fourth quarter and the full year of 2023. The company, a leading U.S.-based producer and exporter of high-quality steelmaking coal, has met or exceeded its sales and production volume targets for the year, demonstrating a robust operational capacity and strategic growth.

Operational Excellence and Financial Highlights

Warrior Met Coal Inc (NYSE:HCC) achieved a net income of $128.9 million in the fourth quarter, with an Adjusted EBITDA of $163.7 million. For the full year, the net income stood at $478.6 million with an Adjusted EBITDA of $698.9 million. The company's sales volumes saw a significant 34% increase, while production volumes rose by 21% compared to the previous year, reaching run rates not seen since 2020. This performance underscores the company's operational excellence and its ability to capitalize on favorable market conditions.

The company's financial achievements are particularly important in the steel industry, where efficient production and cost management are critical. Warrior Met Coal's ability to generate strong cash flow from operations, amounting to $701.1 million, has enabled substantial capital expenditures and mine development, including the advancement of the Blue Creek growth project. This project is expected to further solidify the company's position in the market by adding premium High Vol A coal to its product mix.

Strategic Growth and Market Outlook

Warrior Met Coal's CEO, Walt Scheller, commented on the company's progress, stating,

Our fourth quarter results reflect the culmination of a highly productive year where we made meaningful progress on strategic priorities to build significant, sustainable shareholder value."

The company's strategic initiatives, such as the development of the Blue Creek project and the reduction of leverage by nearly 50%, have positioned it well for continued growth and shareholder returns.

Looking ahead, the company has a favorable outlook for 2024, with expectations of higher coal production and sales. The global markets for steelmaking coal are experiencing tight supply, particularly for premium quality coals, which supports higher pricing. Warrior Met Coal's full-year outlook takes into account this favorable landscape, suggesting another strong operational year ahead.

Financial Performance and Capital Allocation

Warrior Met Coal reported total revenues of $363.8 million in the fourth quarter of 2023, with an average net selling price increase of 3% per short ton. The company's cost management efforts are evident in the decreased cash cost of sales per short ton, which fell to $120.69 in the fourth quarter from $123.40 in the same period of the previous year.

The company's capital allocation strategy reflects a balance between growth investments and shareholder returns. The Board declared a regular quarterly cash dividend of $0.08 per share, marking the third consecutive year of dividend increases. Additionally, a special cash dividend of $0.50 per share was announced, demonstrating the company's commitment to returning excess cash to stockholders.

Warrior Met Coal's liquidity position remains strong, with total liquidity of $845.6 million as of December 31, 2023. This financial strength provides the company with the flexibility to pursue strategic growth opportunities and optimize its capital structure for enhanced stockholder returns.

For investors seeking detailed financial information, the company's earnings report and conference call details are available on its website, providing insights into its operational and financial strategies.

Warrior Met Coal Inc (NYSE:HCC) continues to navigate the complexities of the steelmaking coal market with strategic foresight and operational efficiency. The company's strong financial performance and ongoing investment in growth projects like Blue Creek are indicative of its commitment to long-term value creation for its shareholders.

Explore the complete 8-K earnings release (here) from Warrior Met Coal Inc for further details.

This article first appeared on GuruFocus.