Warrior Met Coal Inc Spearheads Mohnish Pabrai's Latest Portfolio Moves with a 15.47% Stake

Insights into Pabrai's Q4 2023 Investment Strategies and Key Stock Updates

Mohnish Pabrai (Trades, Portfolio), the Managing Partner of Pabrai Investment Funds, is renowned for his focused value investment approach. His latest 13F filing for Q4 2023 reveals strategic moves within his U.S.-based portfolio, which, while a smaller portion of his total assets under management, reflects his preference for undervalued smaller companies. Pabrai's investment philosophy is deeply rooted in value investing, often targeting companies with a market cap around the half-billion-dollar range that are currently out of favor, and he is known for maintaining a concentrated portfolio.

Summary of New Buys

Mohnish Pabrai (Trades, Portfolio) added a total of 1 stock to his portfolio this quarter. Among them:

The most significant addition was Warrior Met Coal Inc (NYSE:HCC), with 629,712 shares, accounting for 15.47% of the portfolio and a total value of $38.39 million.

Key Position Increases

Pabrai also increased stakes in a total of 1 stock. Among them:

The most notable increase was in Arch Resources Inc (NYSE:ARCH), with an additional 156,756 shares, bringing the total to 234,994 shares. This adjustment represents a significant 200.36% increase in share count, a 10.49% impact on the current portfolio, and a total value of $38.99 million.

Key Position Reductions

Pabrai reduced positions in 2 stocks. The most significant changes include:

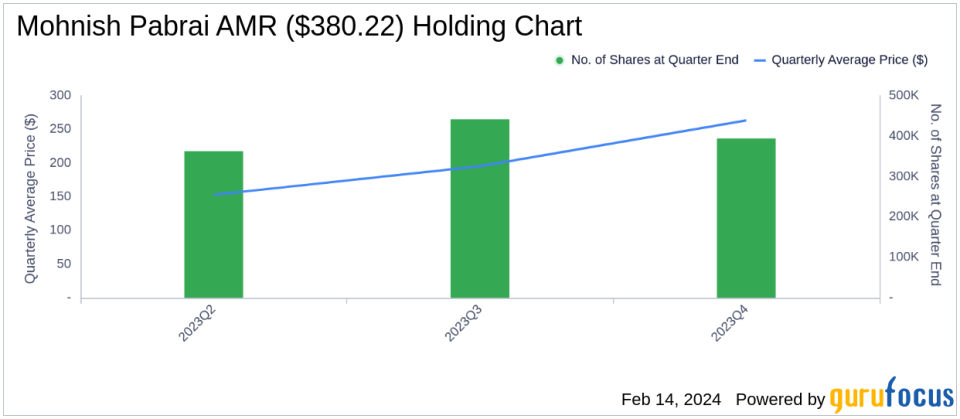

Reduced Alpha Metallurgical Resources Inc (NYSE:AMR) by 47,197 shares, resulting in a -10.69% decrease in shares and a -7.23% impact on the portfolio. The stock traded at an average price of $263.31 during the quarter and has returned 67.53% over the past 3 months and 12.19% year-to-date.

Reduced CONSOL Energy Inc (NYSE:CEIX) by 27,563 shares, resulting in a -6.95% reduction in shares and a -1.7% impact on the portfolio. The stock traded at an average price of $101.64 during the quarter and has returned -13.60% over the past 3 months and -18.36% year-to-date.

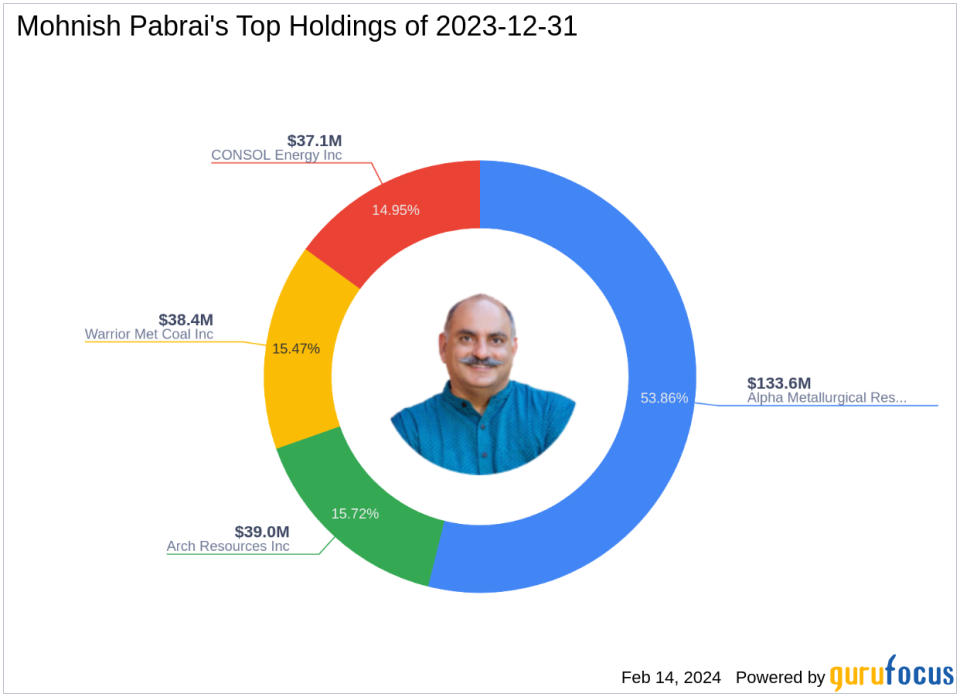

Portfolio Overview

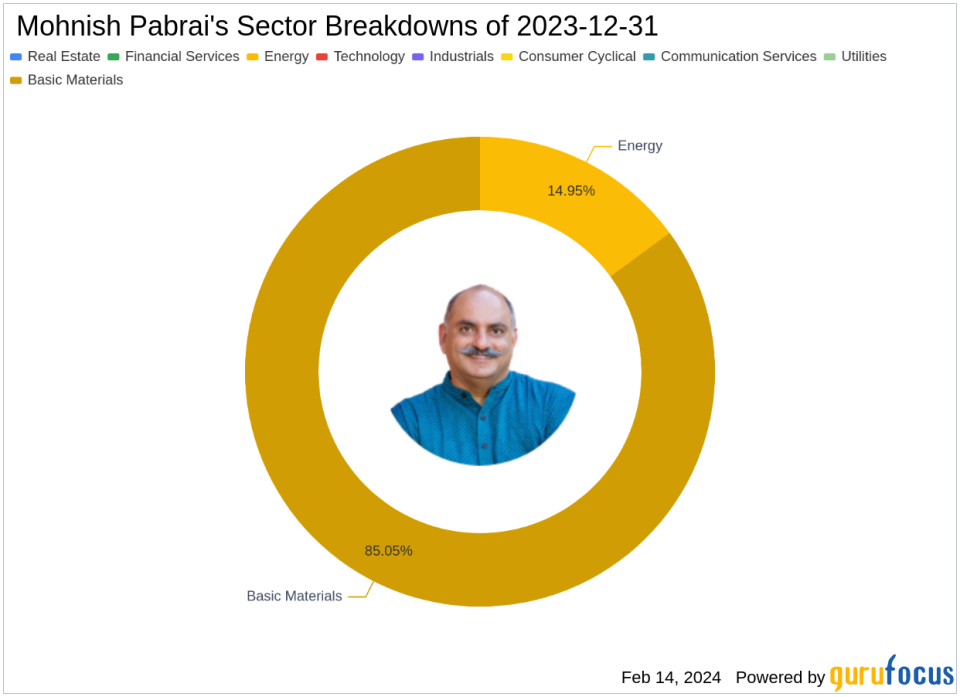

At the end of the fourth quarter of 2023, Mohnish Pabrai (Trades, Portfolio)'s portfolio included 4 stocks, with top holdings comprising 53.86% in Alpha Metallurgical Resources Inc (NYSE:AMR), 15.72% in Arch Resources Inc (NYSE:ARCH), 15.47% in Warrior Met Coal Inc (NYSE:HCC), and 14.95% in CONSOL Energy Inc (NYSE:CEIX). The holdings are mainly concentrated in 2 of all the 11 industries: Basic Materials and Energy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.