Washington Federal (WAFD) Beats on Q4 Earnings as NII Jumps

Washington Federal’s WAFD fourth-quarter fiscal 2022 (ended Sep 30) earnings of $1.07 per share handily surpassed the Zacks Consensus Estimate of 91 cents. The figure reflects a year-over-year jump of 48.6%.

Results were primarily aided by higher rates, robust deposits and improving loan balances, which drove net interest income (NII). However, an increase in expenses, a fall in total other income and higher provisions were the headwinds.

Net income available to common shareholders was $69.7 million, rising 43.2% from the prior-year quarter.

Fiscal 2022 earnings per share of $3.39 surged 41.8% and beat the consensus estimate of $3.22. Further, net income available to common shareholders increased 27.7% to $221.7 million.

Revenues Improve, Expenses Rise

Net revenues in the quarter were $188.1 million, up 17.6% from the year-ago quarter. The top line also outpaced the Zacks Consensus Estimate of $174.1 million.

Fiscal 2022 net revenues of $662 million grew 17%. The top line beat the consensus estimate of $639.1 million.

NII was $173.6 million, jumping 31.7% from the year-earlier period. The net interest margin was 3.64%, expanding 76 basis points (bps).

Total other income of $14.5 million slumped 23.8%. The decrease was mainly due to lower loan fee income.

Other expenses amounted to $93.1 million, up 8.7%. Higher compensation and benefits, occupancy, product delivery and information technology expenses largely led to the rise.

The company’s efficiency ratio was 49.52%, down from 56.75% a year ago. A fall in the efficiency ratio indicates improved profitability.

As of Sep 30, 2022, net loans receivable amounted to $16.1 billion, up 3.5% from the end of the prior quarter. Total customer deposits were $16 billion, on par with of Jun 30, 2022 level.

At the end of the fiscal fourth quarter, the return on average common equity was 14.22%, up from 10.36% at the end of the year-earlier quarter. Return on average assets was 1.44%, up from 1.07%.

Credit Quality: A Mixed Bag

As of Sep 30, 2022, the allowance for credit losses (including reserve for unfunded commitments) was 1.06% of gross loans outstanding, down 16 bps year over year. Also, the ratio of non-performing assets to total assets was 0.21%, down 1 bp.

In the reported quarter, the provision for credit losses was $1.5 million against a release of $0.5 million in the year-ago quarter.

Share Repurchase Update

During the quarter, Washington Federal repurchased 1,530 shares at an average price of $31.49 per share.

Our Viewpoint

Growth in loans, higher interest rates and a robust balance sheet will likely continue aiding Washington Federal’s financials. However, elevated operating expenses remain a major headwind.

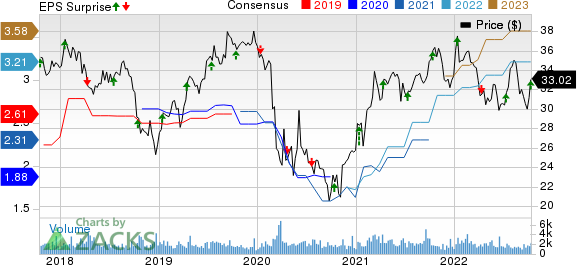

Washington Federal, Inc. Price, Consensus and EPS Surprise

Washington Federal, Inc. price-consensus-eps-surprise-chart | Washington Federal, Inc. Quote

Currently, Washington Federal carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Expected Earnings Release Dates of Other Banks

Hancock Whitney Corporation HWC is scheduled to release third-quarter 2022 results on Oct 18.

Over the past 30 days, the Zacks Consensus Estimate for HWC’s quarterly earnings has moved 1.3% north to $1.55. The estimate indicates a 6.9% rise from the prior-year quarter.

Associated Banc-Corp ASB is scheduled to release third-quarter 2022 numbers on Oct 20.

Over the past 30 days, the Zacks Consensus Estimate for Associated Banc-Corp’s quarterly earnings has been unchanged at 58 cents. The figure implies a 3.6% increase from the prior-year quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Washington Federal, Inc. (WAFD) : Free Stock Analysis Report

Associated BancCorp (ASB) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research