Waste Management Has Been a Big Winner for Bill Gates

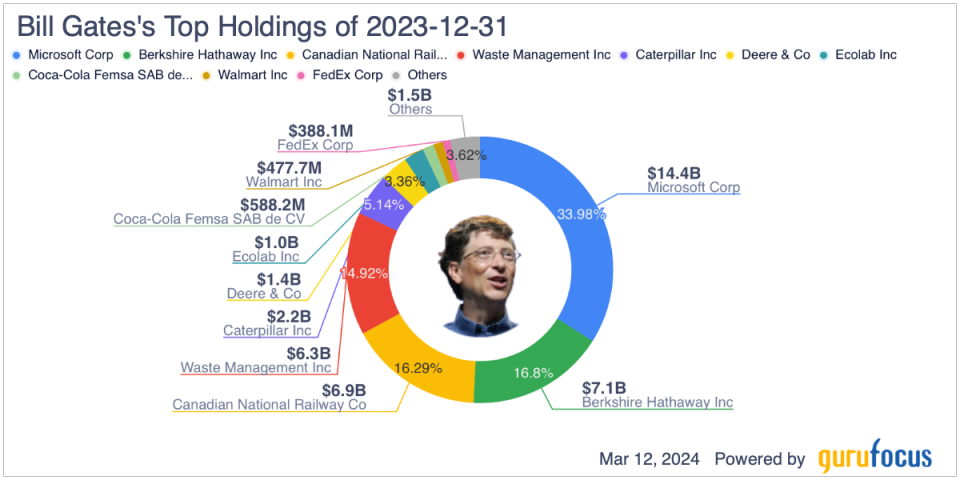

Bill Gates (Trades, Portfolio) made his fortune as the founder of Microsoft (NASDAQ:MSFT). However, the portfolio of his charitable foundation outside of Microsoft is generally far removed from the technology sector. One of such holding is Waste Management Inc. (NYSE:WM), which has been a big winner for his foundation since it was added to its porfolio in 2002.

Company profile

As its name suggests, Waste Management is in the waste disposal business. It is involved in the collection and disposal of trash, as well as material processing, recycling and recycling brokerage services. It owns a network of trucks, landfills, transfer stations and material recovery stations, which are used to recover items that are recyclable.

The company has been very involved in green technology as well. Its renewable energy segment converts landfill gas into renewable energy, including renewable natural gas, electricity and steam. The company gets royalties from third-party facilities to which it provides landfill gas.

Opportunities and risks

Waste disposal tends to be a steady growing business. Over the last few years, Waste Management has been focused on driving price, while willing to sacrifice some lower-margin business. This formula allows the company to steadily grow its core Disposal and Collections revenue by mid-single digits each year. 2023 was a typical year for this algorithm, in which this segment saw its revenue grow 6% to $18.90 billion. For 2024, the company is looking to increase its prices by 6% to 6.5%. Volumes are expected to rise a modest 1%.

Waste Management is also in the process of undertaking several high-return sustainability growth projects. The company currently is in the midst of spending between $2.80 billion and $2.90 billion on these projects from 2022 through 2026. Once complete, it is forecasting these projects will add approximately $800 million in annual Ebitda. It recorded $5.90 billon in adjusted Ebitda in 2023. There are some commodity price sensitivities with these projections, which assumes it gets $125 per ton for recycled commodities and $26 per MMBtu for renewable natural gas. Among the projects set to be complete this year are five renewable natural gas facilities set to go online by year end.

The company is also focused on labor cost management. This coincides with investments the company is making into technology and automation. It is on track to finish automation upgrades at 10 recycling facilities and add three recycling facilities in new markets this year. Increasing its use of automation in these facilities has been helping Waste Management nicely improve its operating margins. It saw a 90-basis point increase in adjusted operating Ebitda margin in 2023 to 28.90%. It is looking for these initiatives to increase adjusted operating margins by another 30 basis points this year.

Waste Management will also look toward mergers and acquisitions to help bolster its results. It said its tuck-in acquisition pipeline is currently robust, so it expects 2024 activity to be higher than normal. However, the company plans to take a disciplined approach, especially given the high return nature of its growth projects. Currently, it is looking to invest between $100 million and $200 million in bolt-on acquisitions.

When it comes to risks, the economy remains front and center, just like many other businesses. While its residential business tends to be pretty steady throughout economic cycle, its commercial and industrial businesses can be a bit more economically sensitive. In general, though, more consumption creates more waste, and less consumption creates less waste. A weak market for consumer goods can also lower demand for recycled corrugated cardboard used in packaging, which can impact Waste Management's recycling business as well.

Competitors chasing volumes and looking to undercut on pricing is another risk. This is a large industry with many different competitors, both large and small. The waste disposal industry has gone through periods of chasing volumes, although more recently it has shied away from doing this to the benefit of all in the industry.

Waste Management also does have commodity exposure with its recycling business, and this can impact its results. For example, average market prices for single-stream recycled commodities were down 40% in 2023. This led to a 17% decline in its recycling segment to $1.26 billion.

Valuation

Waste Management trades at 15.70 times adjusted Ebitda based on 2024 analyst estimates of $6.40 billion and at 14.50 times the 2025 consensus of $6.95 billion.

On a price-earnings basis, its valued at over 30 times the 2024 consensus of $6.94 and about 27 times the 2024 consensus of $7.79.

It is projected to grow revenue by 6.50% both this year and next.

If Waste Management can continue to grow its core revenue at 6% per year, mostly through pricing, while improving adjusted Ebitda margins by 110 basis points over the next three years to 30%, the company would generate $7.3 billion in adjusted Ebitda from its current operations. Add in another $700 million from its growth projects and its 2026 adjusted Ebitda would be $8 billion in 2026.

The stock has traded between 13 and 17 times Ebitda over the past five years.

Based on that $8 billion in 2026 Ebitda, if the company trades towards the high end of that historical range, it would have upside to $300.

Conclusion

Waste Management has been a great stock for Gates and other investors over the years. It is a classic example of a growth compounder, and its performance over the past decade has been remarkable.

While I would prefer it on a bit of pullback given its valuation, this is a core type of holding. With Waste Management continuing to focus of price and a number of growth projects set to come online in the next few years, expect the company to continue to be a steady performer for years to come. I see over 40% return potential over the next few years.

This article first appeared on GuruFocus.