Waste Management's (WM) Q3 Earnings Beat on Lower Expenses

Shares of Waste Management Inc. WM have rallied 5.3% since the third-quarter 2023 earnings release.

The company reported quarterly adjusted earnings per share of $1.63, which surpassed the Zacks Consensus Estimate by 1.2% and improved 4.5% year over. Adjusted operating EBITDA of $1.54 billion increased 3.5% year over year. Adjusted operating EBITDA margin increased 100 basis points (bps) to 29.6% from the prior-year quarter.

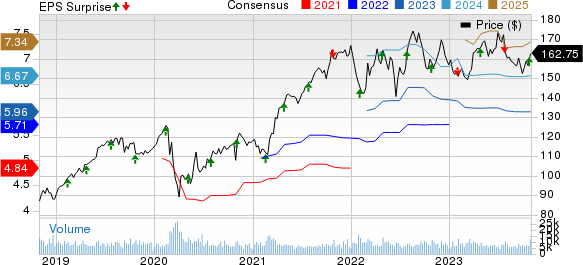

Waste Management, Inc. Price, Consensus and EPS Surprise

Waste Management, Inc. price-consensus-eps-surprise-chart | Waste Management, Inc. Quote

The impressive bottom-line performance in the quarter was aided by disciplined pricing and optimization of the cost structure. Strong operating leverage through cost optimization efforts helped in the year-over-year reduction of operating expenses, as a percentage of revenues, by 90 bps. Selling, general and administrative expenses, as a percentage of revenues, declined 30 bps year over year.

WM achieved pricing leverage with core price above cost inflation by around 100 bps. Prompt management of labor costs and costs associated with repair and maintenance has contributed significantly to reducing the cost of inflation to mid-single-digits on a year-to-date basis.

The company has reduced usage of rental trucks by more than 40% year to date. It has reduced costs of third-party technicians by two-thirds by the second half of 2023 on a year-over-year basis.

Currently, Waste Management carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Earnings Snapshots

The Interpublic Group of Companies, Inc.’s IPG third-quarter 2023 earnings and revenues missed the Zacks Consensus Estimate.

IPG’s adjusted earnings were 70 cents per share, which lagged the consensus estimate by 6.7% but increased 11.1% on a year-over-year basis. Net revenues of $2.31 billion missed the consensus estimate by 3.3%. In the year-ago quarter, IPG’s net revenues were $2.3 billion. Total revenues of $2.68 billion increased 1.5% year over year.

Equifax Inc. EFX reported lower-than-expected third-quarter 2023 results. Adjusted earnings (excluding 45 cents from non-recurring items) were $1.76 per share, missing the Zacks Consensus Estimate by 1.1% but increasing 1.7% from the year-ago figure.

EFX’s total revenues of $1.32 billion missed the consensus estimate by 0.7% and increased 6% from the year-ago figure on a reported basis and 6.5% on a local-currency basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Waste Management, Inc. (WM) : Free Stock Analysis Report