Should You Watch Comerica (CMA) for Its Solid Dividend Yields?

This year is turning out to be better for banks than 2023. The possibility of three rate cuts and higher chances of a soft landing of the U.S. economy have turned investors bullish on the banking sector.

Hence, keeping an eye on fundamentally solid lenders, which also have impressive dividend yields, will be wise now. One such bank is Comerica Incorporated CMA. This Dallas, TX-based company delivers financial services in three primary geographic markets — Texas, California and Michigan — as well as Arizona and Florida.

Since April 2023, CMAhas been paying a quarterly dividend of 71 cents per share. Over the last five years, it raised the dividend twice, with an annualized dividend growth rate of 1.1%.

Considering last day’s closing price of $53.98, Comerica’sdividend yield currently stands at 5.49%. This is impressive compared with the industry average of 3.74% and attractive for income investors as it represents a steady income stream.

Before making any investment decision, let us check out the company’s fundamentals to understand risk and rewards.

Apart from regular quarterly dividend payouts, CMA has a share buyback program in place. Since the inception of Comerica’s share repurchase program in 2010, it has been authorized to repurchase 97.2 million shares. As of Dec 31, 2023, approximately five million shares remained under the current authorization. While share repurchase activity remains suspended to accrete capital, it is expected to resume with stability in the banking sector and greater visibility on new capital requirements.

Also, we remain optimistic about Comerica’s income-generation capability, given its loan growth. The metric witnessed a four-year compound annual growth rate (CAGR) of 0.9% (ended 2023). Decent loan demand is likely to keep the growth trend stable.

NII saw a four-year CAGR of 1.8% (ended 2023). Higher yield and reduced notional on swaps are likely to lessen the pressure on NII. With interest rates likely to remain high in the near term, NII and net interest margin (NIM) are expected to remain decent.

Comerica’s focus on improving operational efficiency and reinvesting in strategic growth will drive earnings power. The company closed numerous banking centers and realigned corporate facilities. Moreover, it has streamlined managerial layers and eliminated positions, and made efforts for product optimization.

The execution of these initiatives will reduce expenses and improve return on equity (ROE). Notably, the company’s ROE of 19.41% compared favorably with 17.02% of the S&P Index, reflecting its superiority in terms of utilizing shareholders’ funds.

Comerica has a solid liquidity profile. As of Dec 31, 2023, the company’s total debt (comprising short-term borrowings, and medium and long-term debt) aggregated $9.77 billion. Its total liquidity capacity was $47.7 billion as of the fourth-quarter end. Further, it has a $26.7-billion capacity remaining in its discount window.

Hence, supported by fundamental strength and solid liquidity levels, dividend distributions seem sustainable. This is likely to stoke investor confidence in the stock.

Despite near-term headwinds that include elevated expenses and a tough operating environment, the CMA stock is fundamentally solid. Therefore, income investors should keep this stock on their radar, as it will help generate robust returns over time.

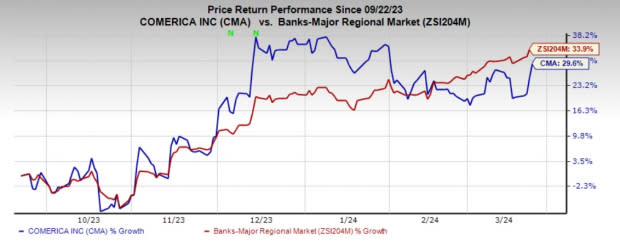

In the past six months, shares of this Zacks Rank #3 (Hold) company have gained 29.6% compared with the industry's rise of 33.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Other Bank Stocks With Solid Dividends

Banking stocks like KeyCorp KEY and Truist Financial TFC are worth a look as these, too, have robust dividend yields.

Considering the last day’s closing price, KEY’s dividend yield currently stands at 5.45%. In the past three months, KEY shares have rallied 45.9%.

Based on the last day’s closing price, TFC’s dividend yield currently stands at 5.65%. In the past three months, TFC shares have gained 34.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comerica Incorporated (CMA) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report