Is Waters Corp (WAT) a Good Value Investment Pick?

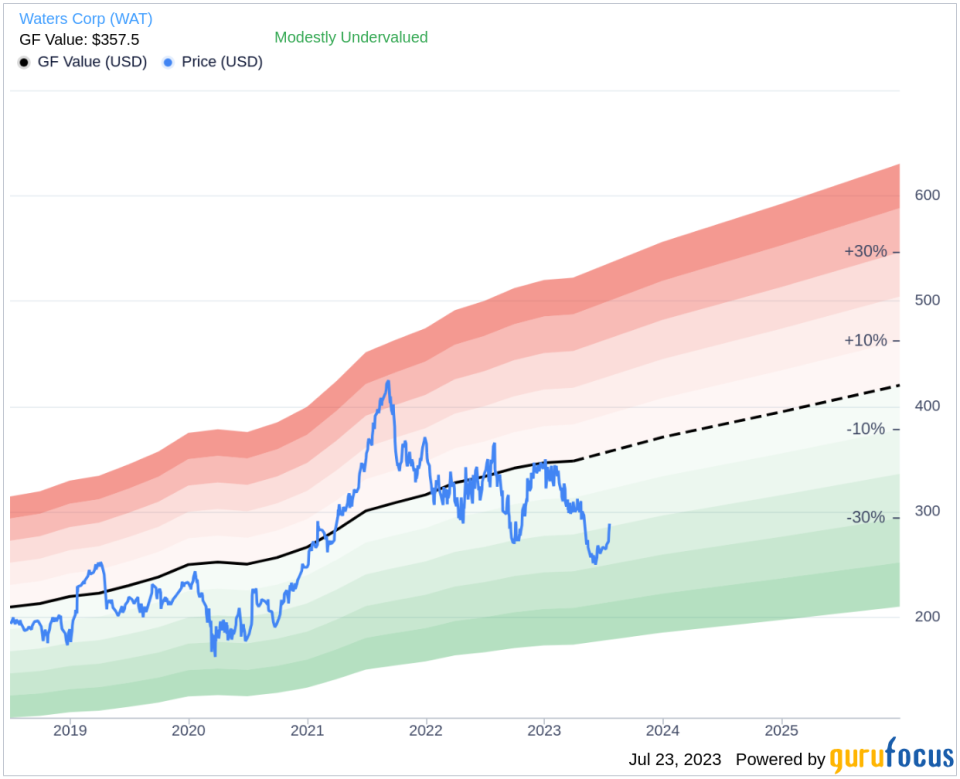

As of July 23, 2023, Waters Corp (NYSE:WAT) exhibited a promising upward trend, marking a gain of 3.2% with a stock price of $288.72. This gain, coupled with a solid GF Value of $357.5, suggests that the company's stock is modestly undervalued. This Massachusetts-based company, with a market cap of $17 billion, is a prominent player in the medical diagnostics and research industry, specializing in the production of liquid chromatography, mass spectrometry, and thermal analysis tools.

Waters Corp (NYSE:WAT) has a rich history of serving a diverse clientele, including pharmaceutical companies (59% of sales in 2022), industrial clients (31% of sales), and academic/government institutions (10% of sales). This diversity has enabled Waters to generate a steady sales revenue of $3 billion, demonstrating its resilience and potential for growth.

Understanding the GF Value of Waters Corp (NYSE:WAT)

The GF Value of Waters Corp, calculated at $357.5, is a unique valuation metric that combines historical trading multiples, an adjustment factor based on past performance and growth, and future business performance estimates. If the stock price significantly surpasses the GF Value Line, the stock is likely overvalued, predicting weak future returns. Conversely, if the stock price is considerably below the GF Value, the stock is potentially undervalued, promising higher future returns. In the case of Waters, the current stock price of $288.72 per share indicates that it is modestly undervalued.

Given this undervaluation, the long-term return of Waters' stock is likely to exceed its business growth. This is visually represented in the GF Value chart of Waters Corp, as shown below:

Link: Explore companies that may deliver higher future returns at reduced risk.

Financial Strength of Waters Corp (NYSE:WAT)

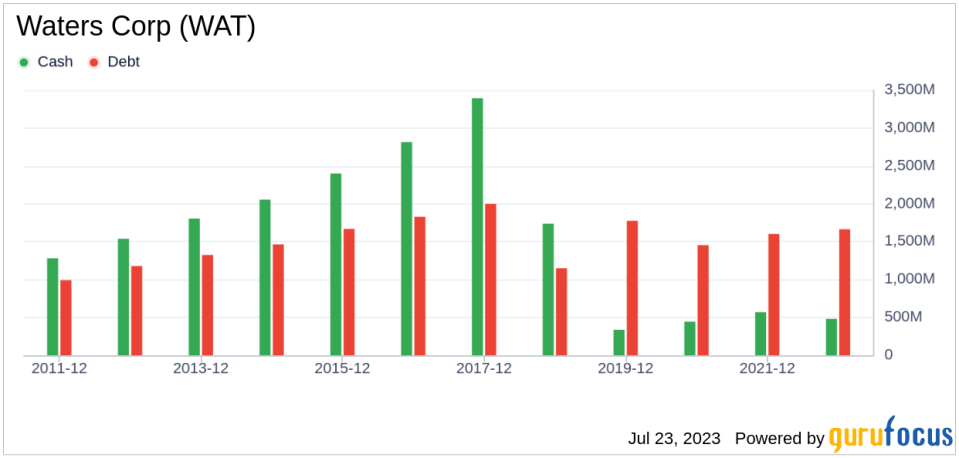

Before investing in a company, it is crucial to assess its financial strength. Companies with weak financial health pose a higher risk of permanent loss. Key indicators of financial strength, such as the cash-to-debt ratio and interest coverage, can provide valuable insights. Waters Corp has a cash-to-debt ratio of 0.31, which falls short compared to 74.58% of companies in the Medical Diagnostics & Research industry. However, with an overall financial strength score of 6 out of 10, Waters Corp maintains fair financial health.

Profitability and Growth of Waters Corp (NYSE:WAT)

Investing in profitable companies minimizes risk, particularly if the company consistently demonstrates profitability over the long term. Waters Corp, with 10 profitable years in the past decade, has shown strong Earnings Per Share (EPS) of $11.51 and an impressive operating margin of 28.73%, ranking better than 95.15% of companies in the same industry.

Growth is a vital factor in a company's valuation. Waters Corp's 3-year average annual revenue growth rate is 11.7%, outperforming 51.49% of companies in the Medical Diagnostics & Research industry. However, its 3-year average EBITDA growth rate is 11.4%, slightly underperforming 50.52% of industry counterparts.

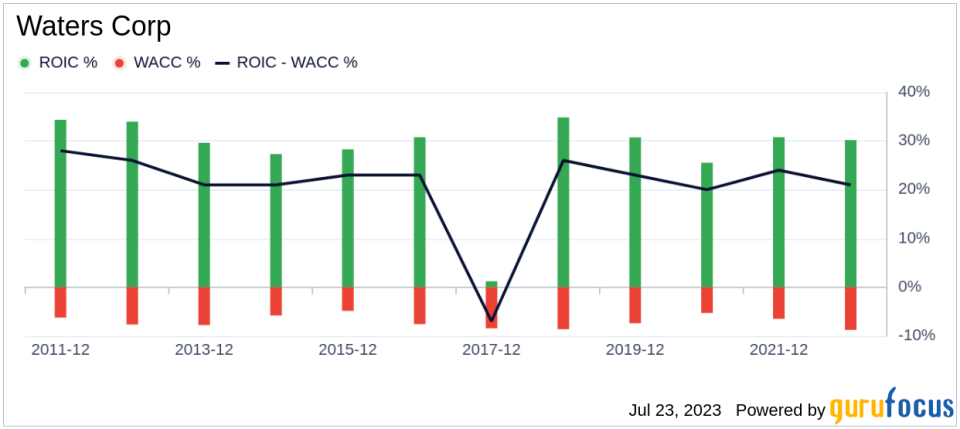

Evaluating Waters Corp's ROIC vs. WACC

Comparing a company's return on invested capital (ROIC) with its weighted average cost of capital (WACC) can provide a useful measure of profitability. Waters Corp's ROIC of 29.13 outpaces its WACC of 8.98, suggesting that the company is creating value for its shareholders.

Conclusion

In conclusion, Waters Corp (NYSE:WAT) appears to be modestly undervalued. The company's financial condition is fair, and its profitability is robust. Despite growth that falls slightly short compared to some industry counterparts, Waters Corp presents a potentially rewarding investment opportunity. For a deeper understanding of Waters Corp's financial performance, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.