Is Waters Corp (WAT) Modestly Undervalued? A Thorough GF Value Analysis

Waters Corp (NYSE:WAT) experienced a daily gain of 6.7%, with its Earnings Per Share (EPS) standing at 11.51. The question that arises is, does this make the stock modestly undervalued? This article presents a valuation analysis that will help you answer this question, so read on.

Company Overview

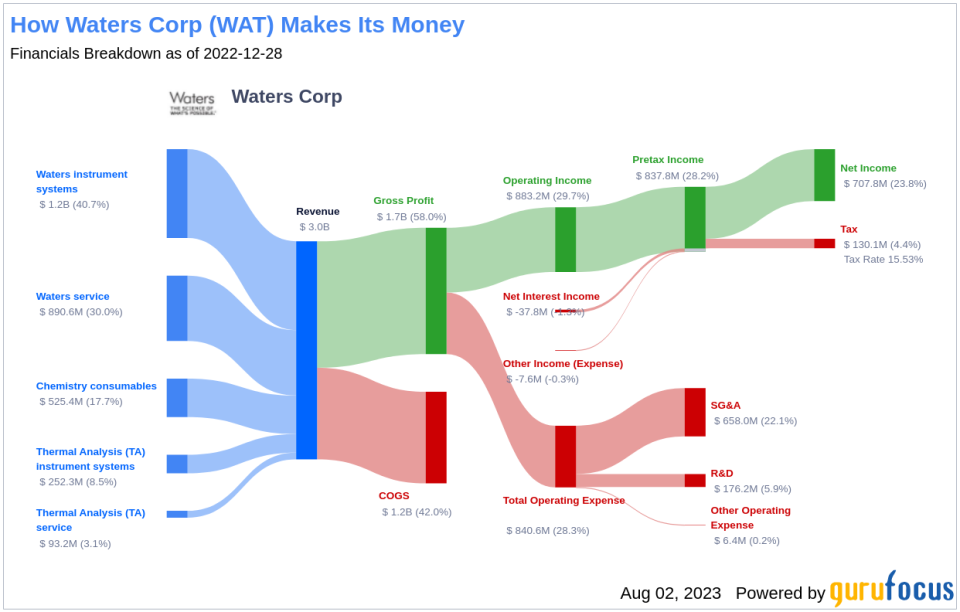

Waters Corp (NYSE:WAT) specializes in the production and distribution of liquid chromatography, mass spectrometry, and thermal analysis tools. These instruments provide critical information about various products, including their molecular structures and physical properties. This data assists clients in improving the health and well-being of their end users. In 2022, Waters generated 59% of its sales from pharmaceutical customers, 31% from industrial clients, and the remaining 10% from academic and government institutions.

Understanding GF Value

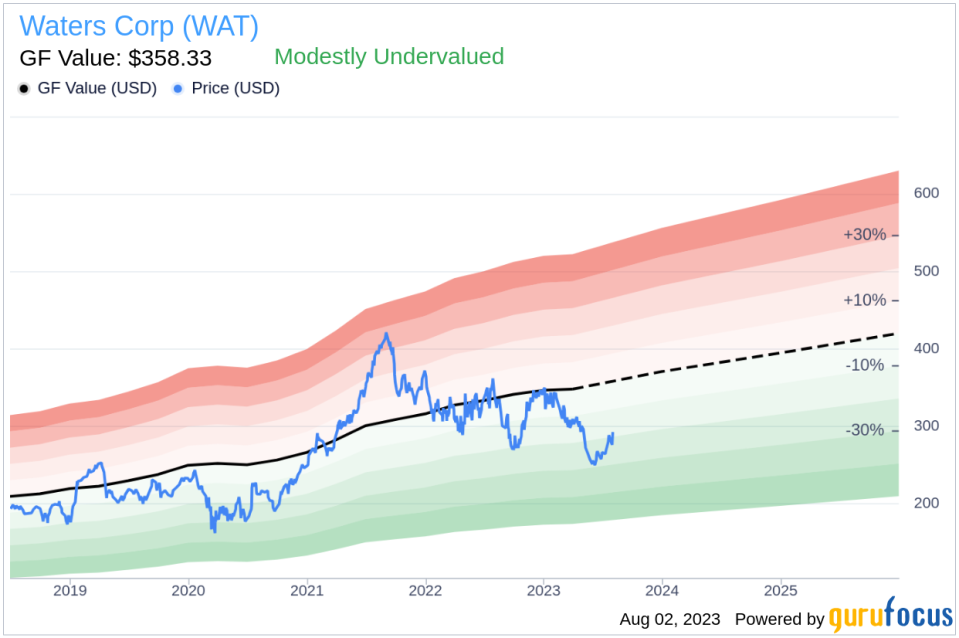

The GF Value is a proprietary measure of a stock's intrinsic value. It is computed considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line denotes the stock's ideal fair trading value.

With a current price of $292.78 per share, Waters (NYSE:WAT) appears to be modestly undervalued according to the GF Value. This assessment is based on historical multiples, an internal adjustment factor related to the company's past growth, and analyst estimates of future business performance. If a stock's price significantly exceeds the GF Value Line, it may be overvalued and likely to yield poor future returns. Conversely, if the price is significantly below the GF Value Line, the stock may be undervalued, promising higher future returns.

Considering Waters' relative undervaluation, the long-term return of its stock is likely to exceed its business growth. Here are some other companies that may deliver higher future returns at reduced risk.

Assessing Financial Strength

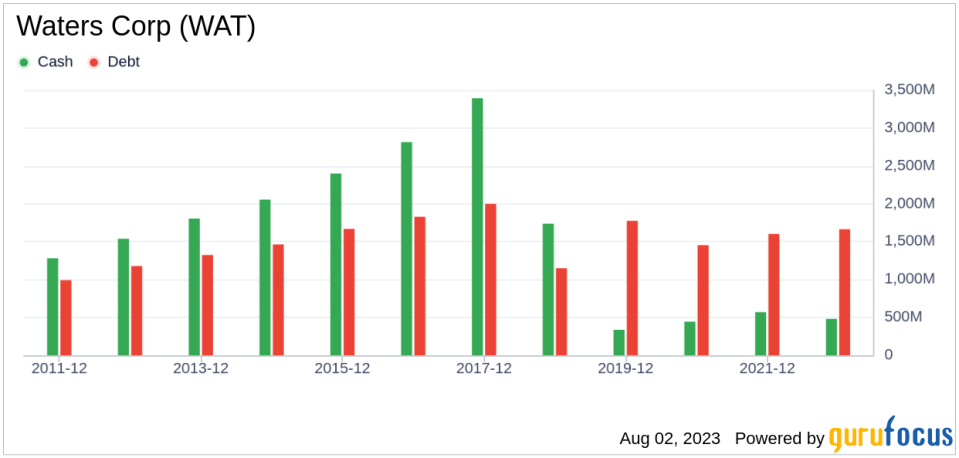

Before investing in a company, it's crucial to evaluate its financial strength. Companies with weak financial health pose a higher risk of permanent loss. The cash-to-debt ratio and interest coverage can provide a good understanding of a company's financial strength. Waters has a cash-to-debt ratio of 0.31, which is lower than 75.21% of companies in the Medical Diagnostics & Research industry. This indicates that Waters' financial strength is fair, with a score of 6 out of 10.

Profitability and Growth

Investing in profitable companies, especially those with consistent long-term profitability, tends to be less risky. Waters Corp (NYSE:WAT) has been profitable for 10 out of the past 10 years. Over the past twelve months, the company had a revenue of $3 billion and Earnings Per Share (EPS) of $11.51. Its operating margin is 28.73%, ranking better than 95.15% of companies in the Medical Diagnostics & Research industry. Overall, GuruFocus ranks Waters' profitability at 10 out of 10, indicating strong profitability.

One of the most crucial factors in a company's valuation is its growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. The average annual revenue growth of Waters is 11.7%, ranking better than 51.49% of companies in the Medical Diagnostics & Research industry. However, its 3-year average EBITDA growth is 11.4%, which ranks worse than 50.52% of companies in the industry.

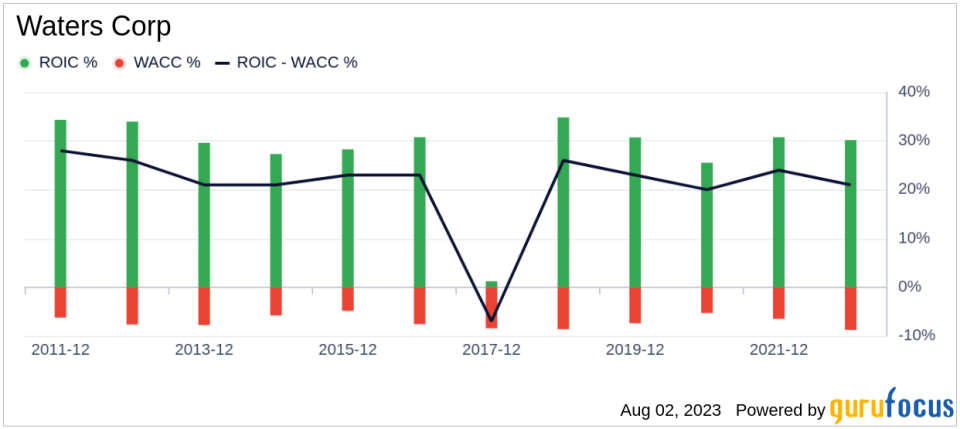

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) is another effective way to assess its profitability. If the ROIC is higher than the WACC, it suggests that the company is creating value for shareholders. Over the past 12 months, Waters' ROIC was 29.13, while its WACC was 9.12.

Conclusion

In conclusion, the stock of Waters Corp (NYSE:WAT) shows signs of being modestly undervalued. The company's financial condition is fair, its profitability is strong, and its growth ranks below 50.52% of companies in the Medical Diagnostics & Research industry. To learn more about Waters stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.