Waters: A Solid Medical Devices Company

In the first quarter of 2023, eight investing gurus bought shares of Waters Corp. (NYSE:WAT), and only one sold. Why all that interest?

Was it driven by an expectation that the share price might begin to recover? It has been on a steady slide since late August of 2021. And it is now just 2% above its 52-week low.

Could it reflect the overall price stagnation in the medical diagnostics and research industry, which began slipping in September 2021?

No doubt price is a factor in their decisions, but it is also possible they might be impressed by Waters excellent fundamentals: an enviable 97 out of 100 on the GF Score.

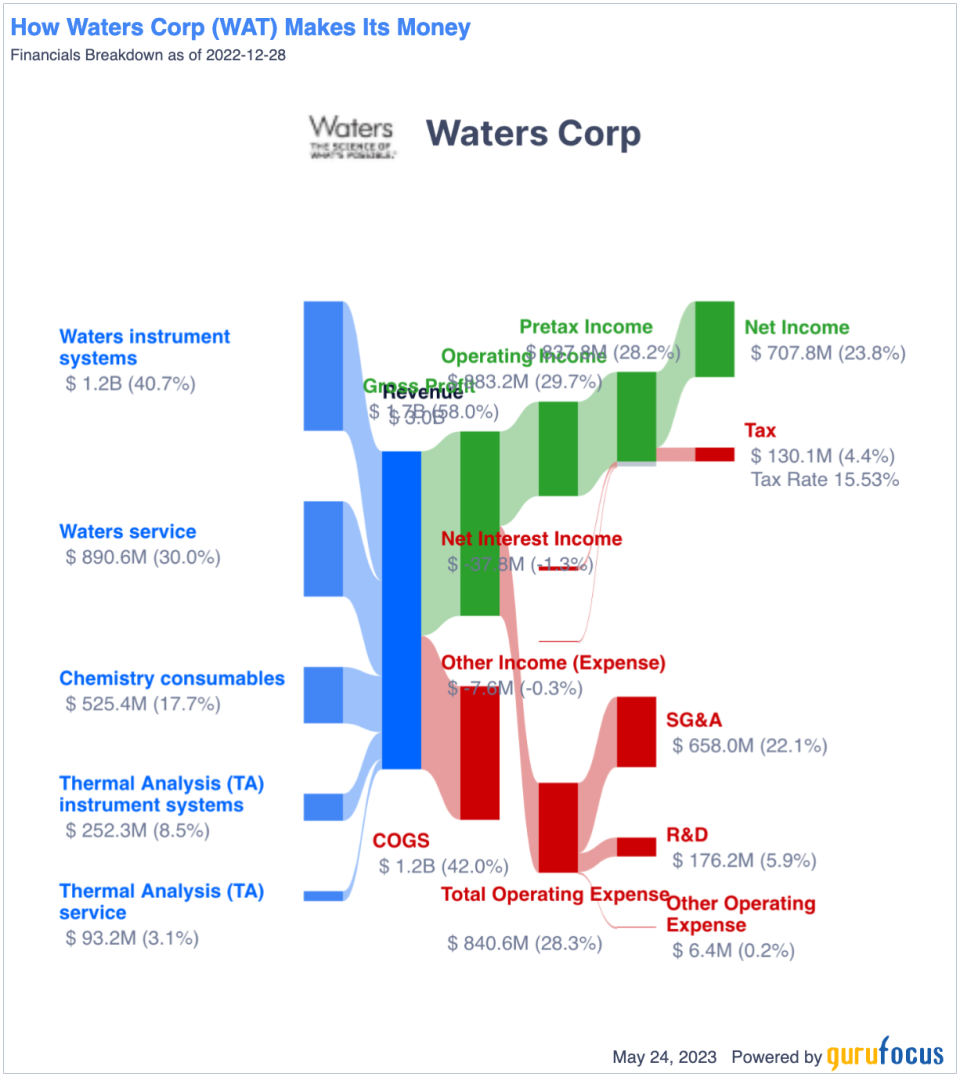

What does the company do? According to the 10-K for 2022, Waters has provided high-value analytical technologies and industry leading scientific expertise, with solutions that serve life, materials and food sciences.

More specifically, it designs, manufactures and sells tools for liquid chromatography, mass spectrometry and thermal analysis. However, it has a relatively diverse set of revenue generators within its niche.

The original company was formed by Jim Waters in 1958. Organically and through acquisitions, it has grown into a $15.26 billion company, with 2022 revenue of $2.97 billion.

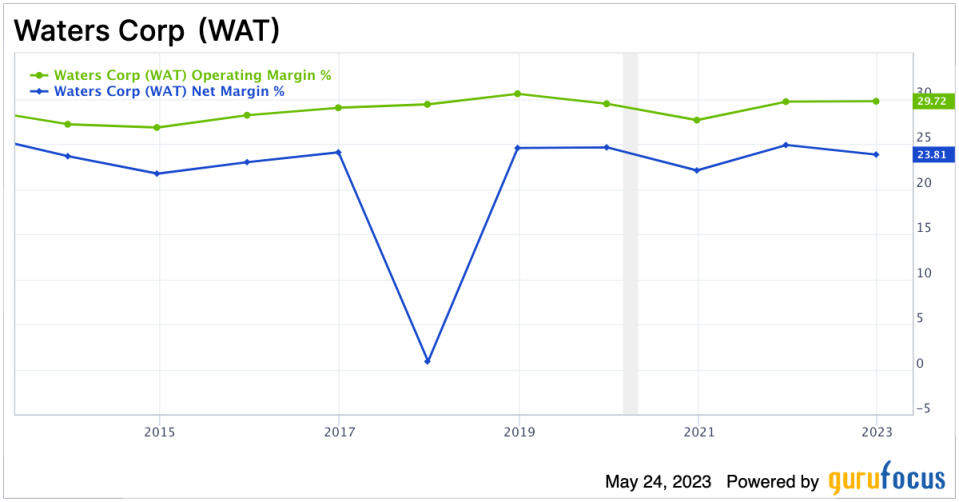

One starting point for examining the strength of its fundamentals would be its margins. They have been relatively high and consistent, with one exception in 2018.

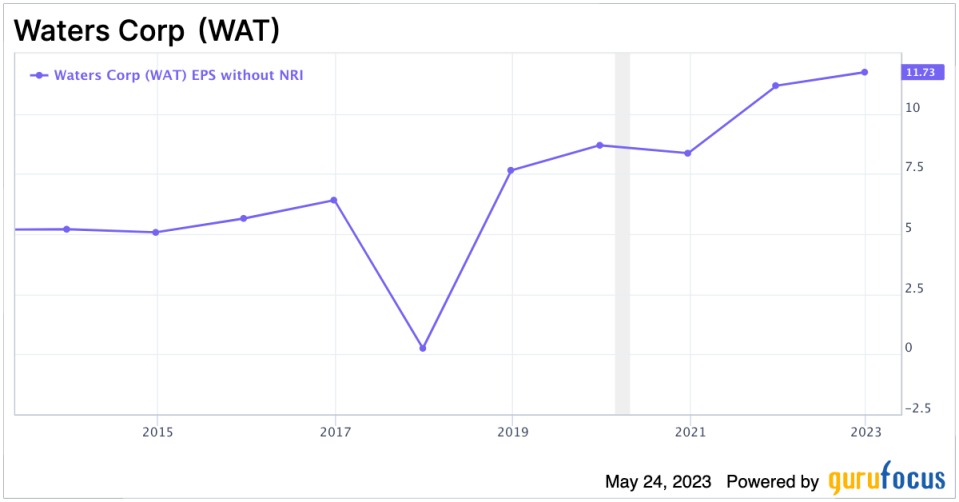

Those margins also support net income and help provide funding for share repurchases. Combining higher net income and fewer shares leads to greater earnings per share.

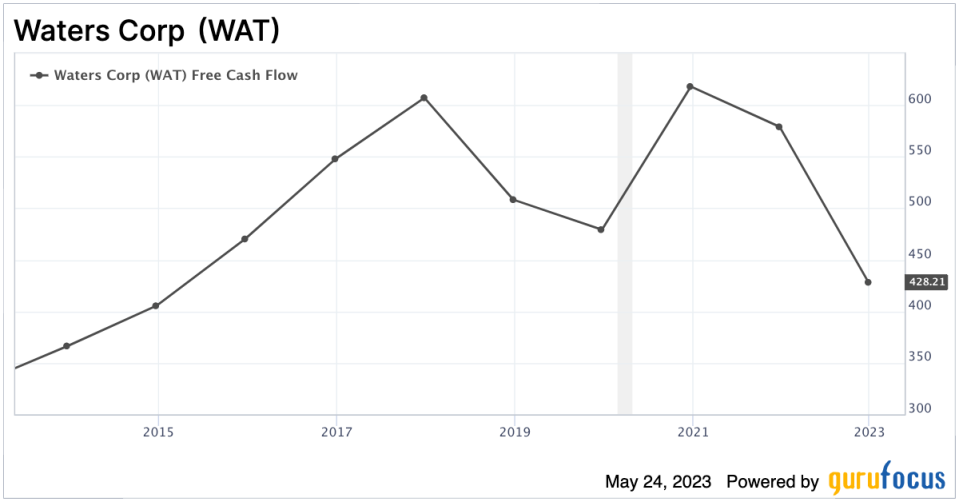

High levels of profitability should also generate free cash flow, which can then be invested for more growth in the future. Unfortunately, FCF has fallen in four of the past five years.

Waters' annual filing for 2022 had an explanation for the pullback: The Company generated $612 million, $747 million and $791 million of net cash flows provided by operating activities in 2022, 2021 and 2020, respectively. The decrease in 2022 operating cash flow was primarily a result of higher inventory levels, slower cash collections and higher incentive compensation payments in 2022 compared to 2021.

The filing for 2021 provided this information for that year: The decrease in operating cash flow in 2021 was primarily a result of the $100 million of 2020 cost actions and working capital improvements implemented being reinstated once customer demand increased.

So it does not seem that the slower cash flow is the result of some deep-seated problem; instead, it is more like the meat and potatoes of running a business in turbulent times.

Theoretically, that still leaves a hefty amount of cash available for organic growth, since it does not pay a dividend. However, Waters board of directors had other ideas. It noted, During the years ended December 31, 2022 and 2021, the Company repurchased $616 million and $640 million of the Companys outstanding common stock, respectively, under authorized share repurchase programs.

From a financial strength perspective, it carries a modest debt load. That produces a comfortable interest coverage ratio of 16.33 and a high Altman Z-Score of 9.26.

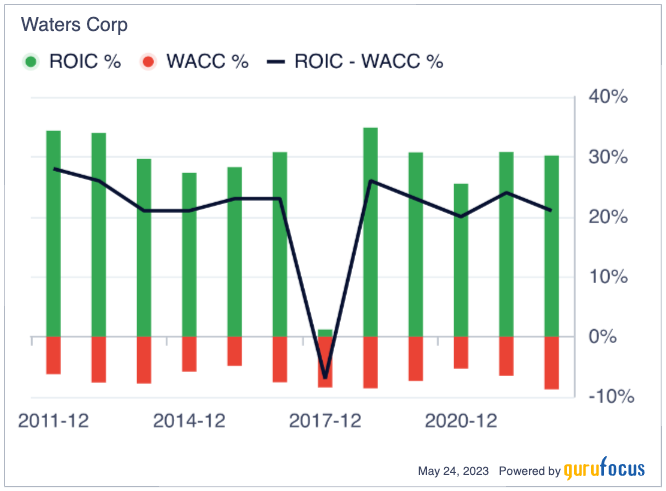

What is most striking about its financial metrics is the return on invested capital versus the weighted average cost of capital relationship. Waters is clearly a value creator:

For 2022, the WACC was 8.77% and the ROIC was 30.19%.

Its growth rates are not particularly high, but they are sufficient for most investors. Over the past three years, revenue grew by an average of 11.70% per year, Ebitda increased by an average of 11.40% and earnings per share without NRI averaged growth of 10.50% per year.

The company has been able to grow both its revenue and Ebitda quite consistently. That has resulted in a high predictability ranking of 4.5 out of five stars.

As noted, Waters has aggressively bought back its own shares, and over the past 10 years that has worked out to an average of just under 3% per year. Thats good for shareholdersand makes it easier for management to grow earnings per share.

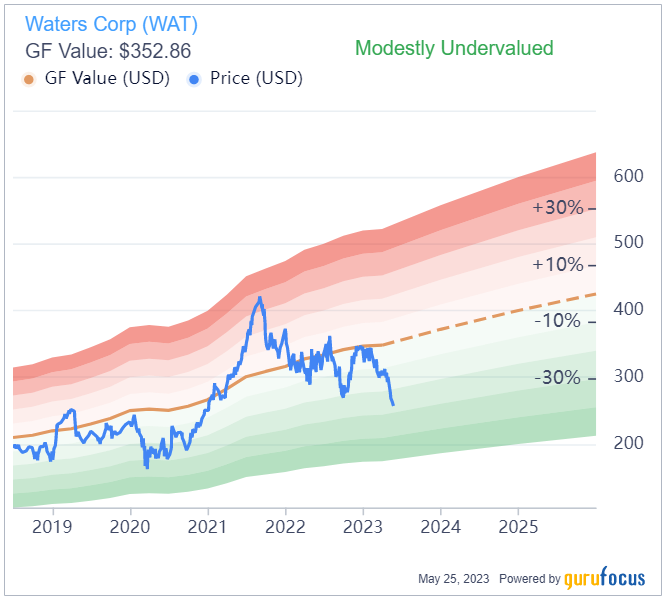

Turning to valuation, the GF Value Line considers the company to be modestly undervalued. It sees an intrinsic value of $352.77, while the closing price on May 24 was $256.99. That is a $95.78 difference, or a 37% margin of safety.

Waters has a price-earnings multiple of 22.33, which is very close to the industry median of 23.10. The PEG ratio, based on a five-year Ebitda growth rate of 11.50% per year, works out to 1.94. Thats near the top end of the fair valuation range.

The discounted cash flow calculator comes to a bearish conclusion. Based on an initial growth rate of 9.20%, which is the 10-year average for earnings per share without NRI, it puts the fair value at $190.21. Thats $66.78 below the current price, and indicates a negative margin of safety of 35.11%.

If we put a trendline on a 10-year chart, we end up with a price that is very close to the GF Value price:

Potential investors will need to pick the optimistic, pessimistic or current value option when they assess the company.

Eight of the guru investors added to or set up new Waters holdings in the first quarter of this year. One reduced its holding and two others made no changes, according to 13F filings.

The top three investors as of March 31 were the Vanguard Health Care Fund (Trades, Portfolio) (811,122 shares), PRIMECAP Management (Trades, Portfolio) (77,844 shares) and Baillie Gifford (Trades, Portfolio) with 55,543 shares.

Institutional investors have a solid position in the company, holding 69.03% of the shares outstanding. Insiders accounted for another 4.94%. The largest single shareholder among the insiders is Edward Conrad, a former director, who held 74,542 shares at the end of March. Dr. Udit Batra, the president and CEO, has a relatively small investment of 8,523 shares.

Investors should be aware 13F filings do not give a complete picture of a firms holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

In conclusion, Waters is a solid company with a fair to depressed share price (I'm an optimist). It is a reasonable candidate for investors who want capital gains, especially when the size of the gains may be helped along by share repurchases.

This article first appeared on GuruFocus.