Watsco (WSO) Q4 Earnings & Revenues Miss, Margins Down Y/Y

Watsco, Inc. WSO reported dismal fourth-quarter 2023 results, with earnings and revenues missing the Zacks Consensus Estimate. On a year-over-year basis, the top line grew while the bottom line dwindled.

The quarter’s results reflect a seasonal sales trend, wherein HVAC equipment witnessed flat sales while sales in other HVAC products declined, year over year. Also, sales volume for commercial refrigeration products was down. Furthermore, high costs and expenses impacted the bottom line of the company.

Nonetheless, the company’s focus on improving its operating efficiency, conforming inventory levels to current conditions and generating cash flow are encouraging through 2024.

Following the announcement, shares of Watsco declined 6.4% during the trading session on Feb 13.

Inside the Numbers

Watsco reported quarterly earnings of $2.06 per share, lagging the Zacks Consensus Estimate of $2.50 by 17.6%. In the year-ago quarter, the company reported adjusted earnings per share of $2.35.

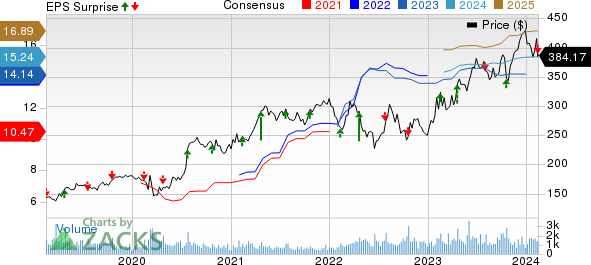

Watsco, Inc. Price, Consensus and EPS Surprise

Watsco, Inc. price-consensus-eps-surprise-chart | Watsco, Inc. Quote

Revenues of $1.6 billion missed the consensus mark of $1.64 billion by 2.2% but increased 1.4% year over year.

Sales of HVAC equipment (heating, ventilating and air conditioning, comprising 69% of sales) were flat year over year. Sales of other HVAC products (27% of sales) dropped 6% from the year-ago quarter. Sales from commercial refrigeration products (4% of sales) declined 3% year over year.

Operating Highlights

The gross margin contracted 160 basis points (bps) in the fourth quarter to 25.8%. Our model predicted the gross margin to contract 10 bps year over year. SG&A expenses, as a percentage of sales, increased 40 bps year over year to 19.5% in the quarter, much ahead of our expectation of a decline of 110 bps year over year.

The operating margin declined 200 bps year over year in the fourth quarter to 6.7%. Our estimate for the metric was 9.8%.

2023 at a Glance

Total revenues inched up 0.1% to $7.28 billion compared with $7.27 billion reported in the year-ago period. During 2023, Watsco’s earnings were $13.67 per share, down from the 2022 reported adjusted figure of $14.20.

The company’s gross margin contracted 50 bps year over year to 27.4%. Also, the operating margin of 10.9% declined 50 bps compared with the prior year value of 11.4%.

Financial Operations

As of Dec 31, 2023, Watsco’s cash and cash equivalents were $210.1 million compared with $147.5 million in 2022-end. For 2023, the net cash provided by operating activities was $562 million compared with $572 million in the prior-year period.

Zacks Rank & Recent Construction Releases

Watsco currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Masco Corporation MAS reported better-than-expected results for fourth-quarter 2023. Both the top and bottom lines surpassed the Zacks Consensus Estimate and increased from the prior year. Strong pricing actions and operational efficiency helped deliver solid results.

Despite facing challenges in end markets and experiencing lower volume, Masco achieved 2% growth in adjusted earnings per share (EPS) in 2023. Looking forward to 2024, Masco anticipates that sales will remain relatively unchanged throughout the year, reflecting a market that is expected to be flat to slightly declining in the low single digits.

AECOM ACM reported results for first-quarter fiscal 2024, where earnings surpassed the Zacks Consensus Estimate. On a year-over-year basis, the top and bottom lines increased, backed by solid organic net service revenues (NSR) growth in its design business.

ACM still anticipates to generate 8-10% organic NSR growth in fiscal 2024. It expects adjusted EPS in the range of $4.35-$4.55. This indicates a 20% improvement from the fiscal 2023 levels on a constant-currency basis, considering the mid-point of the guidance.

Otis Worldwide Corporation OTIS reported impressive results in fourth-quarter 2023. Its earnings and net sales surpassed the Zacks Consensus Estimate and grew on a year-over-year basis.

OTIS’ quarterly results indicated 13 consecutive quarters of organic sales growth and the results were marked by mid-teens growth in adjusted EPS, the third consecutive quarter of high-single-digit organic sales growth in the Service segment and a resurgence in New Equipment orders growth. Full-year 2023 also registered a notable mid-single-digit increase in organic sales, coupled with an expansion in operating profit margin and robust low-teens growth in adjusted EPS.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watsco, Inc. (WSO) : Free Stock Analysis Report

Masco Corporation (MAS) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report