Watsco (WSO) Rewards Investors With a 11% Dividend Increase

Watsco, Inc. WSO gained 2.4% on Jan 3 after it announced a 11% hike in its quarterly cash dividend. The largest distributor of heating, ventilation, air conditioning and refrigeration equipment (HVAC/R) in North America will pay out a quarterly dividend of $2.45 per share on Jan 21, 2023, to shareholders on record as of Jan 17.

The company currently has a dividend payout ratio of 63% and a dividend yield of 3.53%, based on the closing share price of $255.38 on Jan 3. This marks the company’s 49th consecutive annual dividend increase.

With the recent move, Watsco is maintaining its commitment to increase stockholders’ returns regularly. This move reflects the company’s sound and stable financial position and commitment to rewarding shareholders amid industry-wide challenges.

Will This Sustain?

Watsco has been paying cash dividends for decades. It has been consistently sharing its cash flows with shareholders and maintaining a strong financial position. Watsco ended third-quarter 2022 with cash and cash equivalents of $130.2 million versus $118.3 million at 2021-end. The company has sufficient funds to meet the short-term obligation of $89.2 million. Operating lease liabilities, net of the current portion, at September-end was $227.6 million, up from $187 million at 2021-end. Nonetheless, it has no significant debt maturity in recent years.

Additionally, cash provided by operating activities was $358.9 million for third-quarter 2022 versus $319.7 million a year ago. This reflects significantly improved levels of cash flow for the quarter.

Since entering distribution in 1989, Watsco’s dividends have grown at a 21% CAGR. The company’s financial strength, access to low-cost capital and its ability to generate cash flow provide confidence to the stakeholders.

Investors always prefer a return-generating stock. A high-dividend-yielding one is much coveted. It goes without saying that stockholders are always on the lookout for companies with a track record of consistent and incremental dividend payments.

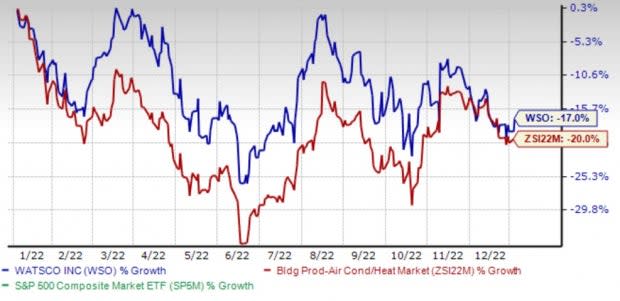

Image Source: Zacks Investment Research

Shares of the company outperformed the industry in the past year. The trend is likely to continue, given the strength in the e-commerce business. The company is aggressively leveraging technology platforms to better serve and protect customers and employees.

Zacks Rank & Key Picks

Currently, Watsco carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks that warrant a look in the Zacks Construction sector include EMCOR Group Inc. EME, Altair Engineering Inc. ALTR and ChampionX Corp. CHX, each carrying a Zacks Rank #2 (Buy).

EMCOR: Headquartered in Norwalk, CT, this heavy construction company provides electrical and mechanical construction and facilities services in the United States. EMCOR has been benefiting from solid execution in the U.S. Construction segment — comprising the U.S. Mechanical and Electrical Construction units — as well as disciplined cost control. Also, accretive buyouts have been strengthening its overall results by adding new markets, opportunities and capabilities.

EMCOR’s 2023 earnings estimates have increased to $9.10 per share from $8.79 over the past 60 days. Earnings for 2023 are expected to grow nearly 17%.

Altair: This Troy, Michigan-based company provides software and cloud solutions in simulation, high-performance computing, data analytics and artificial intelligence worldwide. Despite significant macroeconomic uncertainty, ALTR has been registering solid growth in billings on a constant-currency basis and witnessing strong demand across all geographies. The company’s focus on delivering services with outstanding technology developments and applications is expected to drive growth.

Altair’s earnings for 2023 are expected to witness 21.5% growth from the year-ago report.

ChampionX: This engineering services company provides chemistry solutions, engineered equipment and technologies to companies that drill for and produce oil and gas. CHX’s Chemical Technologies offering consists of chemistry solutions for flowing oil and gas wells as well as chemistry solutions used in drilling and completion activities. The company has successfully implemented price increases and surcharges to offset cost inflation. Moreover, CHK remains optimistic about the constructive demand tailwinds in its businesses that support a favorable multi-year outlook for the sector.

ChampionX has an expected earnings growth rate of 46.3% for the next year. The Zacks Consensus Estimate for next-year earnings has improved 4.7% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altair Engineering Inc. (ALTR) : Free Stock Analysis Report

Watsco, Inc. (WSO) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

ChampionX Corporation (CHX) : Free Stock Analysis Report