Watts Water (WTS) Q4 Earnings Beat Estimates, Revenues Up Y/Y

Watts Water Technologies, Inc WTS reported fourth-quarter 2023 adjusted earnings per share (EPS) of $1.97, which increased 23% on a year-over-year basis and beat the Zacks Consensus Estimate by 10.7%.

The company’s quarterly net sales rose 9% year over year to $548 million. The top line surpassed the Zacks Consensus Estimate by 2.8%. Organic sales were down 1% year over year.

The company’s performance benefited from higher revenue growth in Asia-Pacific, the Middle East and Africa (APMEA) and America amid rising inflation.

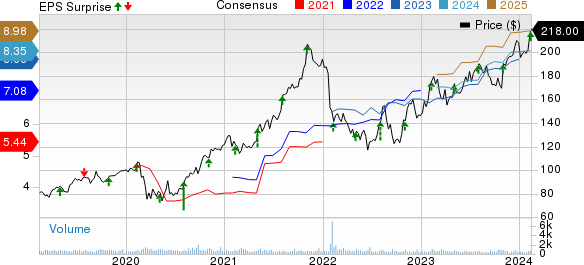

Watts Water Technologies, Inc. Price, Consensus and EPS Surprise

Watts Water Technologies, Inc. price-consensus-eps-surprise-chart | Watts Water Technologies, Inc. Quote

Segment Results

Americas: Net sales rose 10% year over year to $387 million. Organic sales increased 1% amid tougher year-over-year comparisons. Adjusted operating margin increased 150 basis points (bps) year over year to 20.2%, driven by increased price realization, favorable product mix and productivity, partly offset by inflation and higher investments.

Europe: Net sales were flat year over year to $128 million, including a favorable foreign exchange impact of 5%. Organic sales were down 5% due to lower volumes in both fluid solutions and drain products. Adjusted operating margin was up 220 bps year over year to 15%, owing to favorable price-cost dynamic and product mix.

APMEA: Net sales increased 40% to $33 million. Organic sales moved up 4% from Australia and New Zealand. The unfavorable foreign exchange impact was 1%. Adjusted operating margin decreased 180 bps to 12.6% due to affiliate charges and dilution from the Enware acquisition.

Other Details

Gross profit increased 17% year over year to $255.7 million. Selling, general and administrative expenses increased 17.8% year over year to $173.1 million. Operating income was $86 million, up 21% year over year.

GAAP operating margin increased 100 bps to 14.4%. The adjusted operating margin was 15.8%, up 150 bps year over year.

Cash Flow & Liquidity

For the year ended Dec 31, 2023, Watts Water generated $310.8 million of cash from operating activities compared with $224 million in the prior-year period.

As of Dec 31, 2023, free cash flow was $281.1 million compared with $201.1 million in the year-ago period. The increase was due to higher net income and reduced working capital investment.

The company repurchased 23,000 shares for $4.3 million in the fourth quarter.

As of Dec 31, 2023, the company had $350.1 million in cash and cash equivalents with $298.2 million of long-term debt compared with the respective figures of $362.7 million and $98.2 million as of Sep 24, 2023.

Guidance

For first-quarter 2024, the company expects organic sales to increase in the range of 1%-5%. The adjusted operating margin is estimated to be between 17% and 17.6%, while the adjusted margin is projected to decrease in the range of 20 bps-80 bps. The company expects the free cash flow performance to be seasonally slow.

For 2024, Watts Water expects organic sales to be down 5% to increase 1%. The adjusted operating margin is estimated to be between 16.9% and 17.5%. The adjusted margin is expected to fall between 30 bps and 90 bps.

Zacks Rank & Other Stocks to Consider

Watts Water currently has a Zacks Rank #2 (Buy).

Some other top-ranked stocks worth considering in the broader technology space are Itron ITRI, Woodward WWD and Microsoft MSFT. Woodward and Itron sport a Zacks Rank #1 (Strong Buy), while Microsoft carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Itron’s 2023 EPS has remained unchanged in the past 60 days to $2.88. ITRI’s long-term earnings growth rate is 23%.

Itron’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 289.3%. Shares of ITRI have gained 32.5% in the past year.

The Zacks Consensus Estimate for Woodward’s 2024 EPS has inched up 5.7% in the past 60 days to $5.20. WWD’s long-term earnings growth rate is 15.5%.

Woodward’s earnings beat the Zacks Consensus in each of the last four quarters, the average surprise being 27.2%. Shares of WWD have gained 33.1% in the past year.

The Zacks Consensus Estimate for Microsoft’s fiscal 2024 EPS is pegged at $11.60, indicating growth of 18.3% from the year-ago levels. The long-term earnings growth rate is pegged at 16.2%.

Microsoft’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 8.8%. MSFT has gained 61% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report