WAVE Life Sciences Ltd. Sees a 23% Stock Price Surge Over the Past Three Months

WAVE Life Sciences Ltd. (NASDAQ:WVE), a preclinical biopharmaceutical company, has seen a significant increase in its stock price over the past three months. The company's market cap currently stands at $468.19 million, with a stock price of $4.73, marking a 23.45% increase from its price three months ago at $3.83. Over the past week, the stock price has also seen a gain of 3.62%.

GF Value and Valuation

The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The current GF Value of WAVE Life Sciences Ltd. is $6.61, slightly higher than its value three months ago at $6.49. The current GF Valuation suggests that the stock is modestly undervalued, a significant improvement from its past valuation, which was considered a possible value trap.

About WAVE Life Sciences Ltd.

Based in Singapore, WAVE Life Sciences Ltd. operates in the biotechnology industry. The company owns a diverse pipeline of nucleic acid therapeutics designed to address rare genetic diseases related to the central nervous system, muscles, eyes, liver, and skin. Its therapeutics target genetic defects to either reduce the expression of disease-promoting proteins or transform the production of dysfunctional mutant proteins into the production of functional proteins.

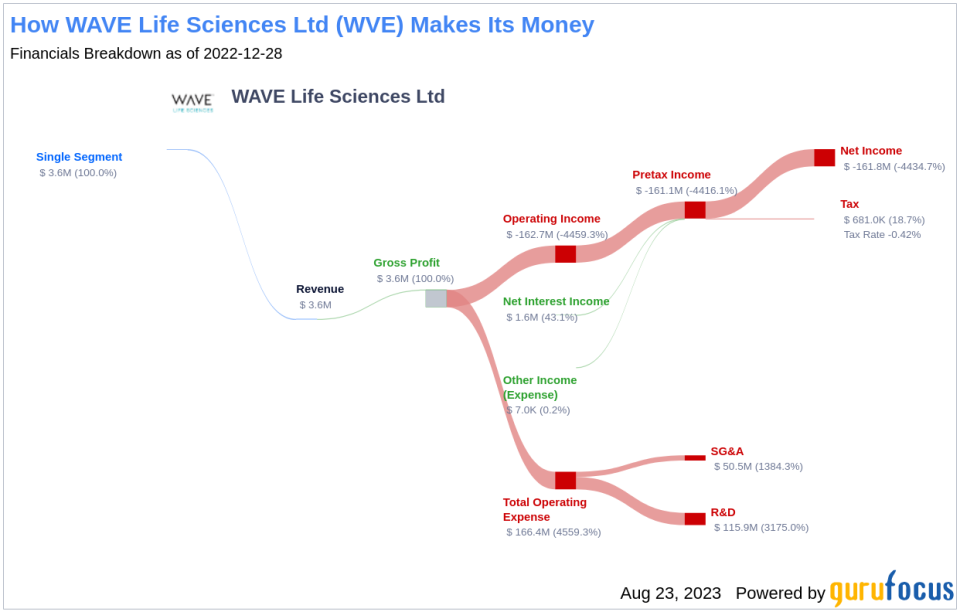

Profitability Analysis

WAVE Life Sciences Ltd.'s Profitability Rank is 1/10, indicating that the company's profitability is relatively low compared to other companies. The company's Operating Margin is -372.60%, which is better than 41.4% of companies in the same industry. The ROA is -63.18%, better than 28.6% of companies, and the ROIC is -109.01%, better than 50.26% of companies.

Growth Prospects

The company's Growth Rank is 2/10, indicating relatively low growth compared to other companies. The 3-Year Revenue Growth Rate per Share is -54.00%, better than 7.58% of companies, and the 5-Year Revenue Growth Rate per Share is -11.70%, better than 23.1% of companies. The 3-Year EPS without NRI Growth Rate is 29.00%, better than 76.13% of companies, and the 5-Year EPS without NRI Growth Rate is 15.40%, better than 58.99% of companies.

Top Holders

The top three holders of WAVE Life Sciences Ltd.'s stock are Lee Ainslie (Trades, Portfolio), holding 6,596,778 shares (6.66%), PRIMECAP Management (Trades, Portfolio), holding 3,811,408 shares (3.85%), and Jim Simons (Trades, Portfolio), holding 164,820 shares (0.17%).

Competitors

The top three competitors of WAVE Life Sciences Ltd. in the biotechnology industry are Viracta Therapeutics Inc. (NASDAQ:VIRX) with a stock market cap of $49.961 million, Vicapsys Life Sciences Inc. (VICP) with a stock market cap of $31.188 million, and aTyr Pharma Inc. (NASDAQ:LIFE) with a stock market cap of $104.964 million.

Conclusion

In conclusion, WAVE Life Sciences Ltd. has seen a significant increase in its stock price over the past three months. Despite its low profitability and growth ranks, the company's stock is currently considered modestly undervalued according to its GF Value. With a diverse pipeline of nucleic acid therapeutics, the company has the potential to address a range of rare genetic diseases, which could contribute to its future growth and profitability.

This article first appeared on GuruFocus.