Wayfair (W) Q2 Earnings Better Than Expected, Revenues Fall Y/Y

Wayfair W delivered non-GAAP earnings of 21 cents per share for second-quarter 2023, which compares favorably with the Zacks Consensus Estimate for a loss of 67 cents per share. The company reported a loss of $1.94 per share in the year-ago quarter.

Total net revenues of $3.17 billion beat the consensus mark of $3.12 billion. However, the top line declined 3.4% year over year due to decreasing domestic and international revenues.

A decline in active customers affected the results.

Quarter Details

Net revenues in the United States decreased 0.4% year over year to $2.79 billion (87.8% of total net revenues). The figure beat the Zacks Consensus Estimate of $2.68 billion.

International net revenues also declined 20.9% from the prior-year quarter’s figure to $386 million (12.2% of total net revenues). The figure exhibited a decline of 18.2% on a constant currency basis. It also missed the consensus mark of $405 million.

Active customers were down 7.6% year over year to 21.8 million, which missed the consensus mark of 21.9 million.

LTM’s net revenues per active customer increased 1.5% year over year to $545, which came ahead of the Zacks Consensus Estimate of $532. The average order value was down 7% year over year at $307, lower than the consensus mark of $309.

The total number of orders delivered in the reported quarter was 10.3 million, which increased 3% year over year. The figure came ahead of the Zacks Consensus Estimate of 10.04 million.

Orders per customer for the quarter were 1.82, down 1.6% from the year-ago period. The figure came ahead of the Zacks Consensus Estimate of 1.80.

Repeat customers placed 8.3 million orders (accounting for 80.1% of total orders) in the second quarter, up 6.4% year over year.

Additionally, 61.6% of total orders delivered were placed through mobile devices in the reported quarter compared with 59% in the year-ago period.

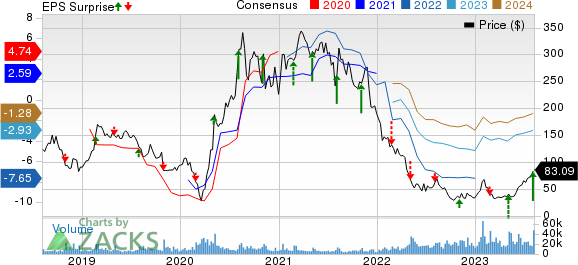

Wayfair Inc. Price, Consensus and EPS Surprise

Wayfair Inc. price-consensus-eps-surprise-chart | Wayfair Inc. Quote

Operating Results

Wayfair’s second-quarter gross margin was 31.1%, expanding 380 basis points on a year-over-year basis.

Adjusted EBITDA was $128 million versus $108 million in the year-ago quarter.

Customer service and merchant fees decreased 11.1% year over year to $144 million.

Advertising expenses fell 6.7% from the prior-year quarter’s level to $352 million. Selling, operations, technology and general and administrative expenses decreased 8.4% year over year to $630 million.

Wayfair incurred an operating loss of $142 million in the reported quarter compared with an operating loss of $372 million in the year-ago quarter.

Balance Sheet & Cash Flow

As of Jun 30, 2023, cash, cash equivalents and short-term investments were $1.25 billion, up from $1.05 billion reported on Mar 31, 2023.

Long-term debt, as of Jun 30, 2023, was $3.205 billion compared with $3.138 billion on Mar 31, 2023.

In the second quarter, cash generated from operations amounted to $217 million against $147 million used in operations in the first quarter.

Wayfair generated a free cash flow of $128 million in the reported quarter.

Zacks Rank & Stocks to Consider

Currently, Wayfair has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the retail-wholesale sector are BJ’s Restaurants BJRI, Domino’s Pizza DPZ and Lithia Motors LAD. While BJ’s Restaurants and Domino’s Pizza sport a Zacks Rank #1 (Strong Buy), Lithia Motors carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

BJ’s Restaurants has gained 37.3% on a year-to-date basis. The long-term earnings growth rate for BJRI is currently projected at 15%.

Domino’s Pizza has gained 15.9% on a year-to-date basis. The long-term earnings growth rate for DPZ is currently projected at 12.97%.

Lithia Motors has gained 47.6% on a year-to-date basis. The long-term earnings growth rate for LAD is currently projected at 3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Wayfair Inc. (W) : Free Stock Analysis Report