Is Weakness In Steven Madden, Ltd. (NASDAQ:SHOO) Stock A Sign That The Market Could be Wrong Given Its Strong Financial Prospects?

It is hard to get excited after looking at Steven Madden's (NASDAQ:SHOO) recent performance, when its stock has declined 11% over the past three months. But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Particularly, we will be paying attention to Steven Madden's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Steven Madden

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Steven Madden is:

21% = US$179m ÷ US$838m (Based on the trailing twelve months to March 2023).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.21 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Steven Madden's Earnings Growth And 21% ROE

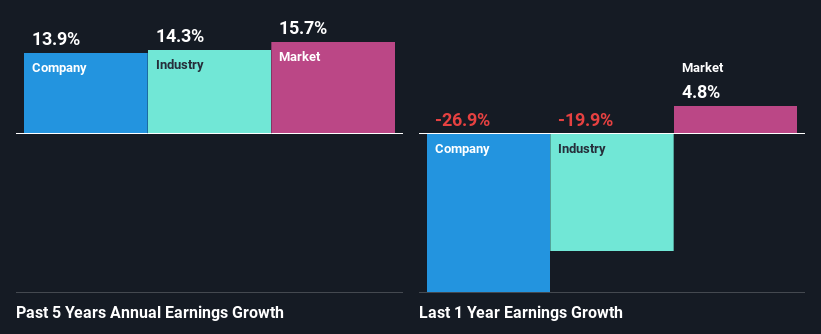

To start with, Steven Madden's ROE looks acceptable. Especially when compared to the industry average of 18% the company's ROE looks pretty impressive. This certainly adds some context to Steven Madden's decent 14% net income growth seen over the past five years.

We then performed a comparison between Steven Madden's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 14% in the same 5-year period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Steven Madden is trading on a high P/E or a low P/E, relative to its industry.

Is Steven Madden Using Its Retained Earnings Effectively?

In Steven Madden's case, its respectable earnings growth can probably be explained by its low three-year median payout ratio of 25% (or a retention ratio of 75%), which suggests that the company is investing most of its profits to grow its business.

Besides, Steven Madden has been paying dividends over a period of five years. This shows that the company is committed to sharing profits with its shareholders. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to rise to 31% over the next three years. Despite the higher expected payout ratio, the company's ROE is not expected to change by much.

Summary

Overall, we are quite pleased with Steven Madden's performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. The latest industry analyst forecasts show that the company is expected to maintain its current growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here