Webster Financial (WBS) Dips 2.3% Despite In-Line Q4 Earnings

Webster Financials’ WBS fourth-quarter 2023 adjusted earnings per share of $1.46 were in line with Zacks Consensus Estimate. This compares favorably with earnings of $1.38 per share a year ago.

Results benefited from lower provisions and solid loans and deposit balances. However, a fall in both net interest income (NII) and non-interest income, along with elevated expenses, was the major headwind. Due to these concerns, investors turned bearish on the stock, which fell 2.3% following the earnings release.

The results excluded the charges related to the FDIC special assessment and merger with Sterling Bancorp on Jan 31, 2022. After considering these charges, net income applicable to common shareholders was $181.2 million, down 24.7% from the prior-year quarter.

In 2023, adjusted earnings per share were $5.99, surpassing the Zacks Consensus Estimate of $5.89. Net income applicable to common shareholders (GAAP) was $851.2 million, up 35.5% year over year.

Revenues & Expenses Increase

WBS’ total revenues in the quarter dropped 9.9% year over year to $634.8 million. The top line lagged the Zacks Consensus Estimate of $674.8 million.

In 2023, total revenues were $2.7 billion, up 7.1% year over year. The top line matched the Zacks Consensus Estimate.

NII decreased 5.2% year over year to $571 million. The net interest margin was 3.42%, down 32 basis points (bps).

Non-interest income was $63.8 million, down 37.5% year over year. It included a loss from the sale of investment securities. Excluding this, non-interest income was down 24.5% from the previous year’s quarter to $80.6 million. The fall was primarily due to lower deposit fees, reduced loan syndication, prepayment and other transaction fees.

Non-interest expenses were $377.2 million, up 8.3% from the year-ago quarter. The reported figure included a charge of $47.2 million related to FDIC Special assessment and $30.7 million expense related to the merger. Excluding these charges, non-interest expenses would have been $345.3 million, down marginally year over year. The fall was affected by lower consulting, project and loan expenses, partially offset by an increase in compensation and benefits, along with deposit insurance expense.

The efficiency ratio was 43.04% compared with 40.27% in the prior-year quarter. A rise in the efficiency ratio indicates a deterioration in profitability.

As of Dec 31, 2023, total loans and leases increased 1.3% sequentially to $50.7 billion. This was driven by an increase in commercial real estate loans and commercial loans and leases.

Also, total deposits increased marginally from the previous quarter to $60.8 billion.

Credit Quality: A Mixed Bag

Total non-performing assets were $218.6 million, as of Dec 31, 2023, up 6% from the year-ago quarter. Allowance for loan losses was 1.25% of the total loans, which increased from 1.20% in the fourth quarter of 2022.

The ratio of net charge-offs to annualized average loans was 0.27%, up 10 bps year over year.

The provision for credit losses was $36 million, down 16.3% year over year.

Capital Ratios Improve

As of Dec 31, 2023, the Tier 1 risk-based capital ratio was 11.63%, which rose from 11.23% as of Dec 31, 2022. The total risk-based capital ratio was 13.72%, rising from the prior-year quarter’s 13.25%.

Profitability Ratios Worsen

Return on average assets was 1.01%, which declined from 1.40% in the prior-year quarter. At the end of the fourth quarter, the return on average common stockholders' equity was 9.03%, which declined from 12.54% in the prior-year quarter.

Our Viewpoint

Webster Financial finds support in solid loan and deposit balances accompanied by reduced provisions for credit losses. Further, the company’s inorganic expansion efforts continue to support financials. However, lower NII, non-interest income and elevated expenses remain major concerns.

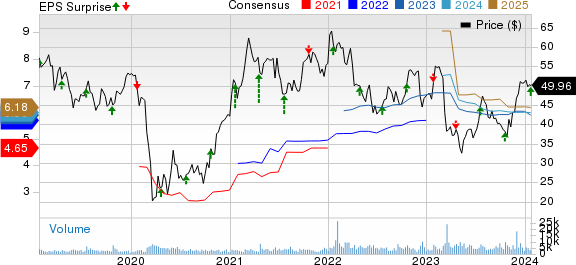

Webster Financial Corporation Price, Consensus and EPS Surprise

Webster Financial Corporation price-consensus-eps-surprise-chart | Webster Financial Corporation Quote

Webster Financial currently carries a Zacks Rank #3 (hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Hancock Whitney Corp.’s HWC fourth-quarter 2023 adjusted earnings per share of $1.26 beat the Zacks Consensus Estimate of $1.08. Adjusted earnings per share, however, compared unfavorably with $1.65 earned in the year-ago quarter.

HWC’s results were impacted by a decline in both NII and non-interest income. Further, a slight decrease in loan balances and an increase in expenses and provisions acted as spoilsports.

WaFd, Inc.’s WAFD first-quarter fiscal 2024 (ended Dec 31) earnings of 85 cents per share surpassed the Zacks Consensus Estimate of 72 cents. However, the bottom line declined 26.7% year over year.

WAFD’s results primarily benefited from the rise in other income and steady loan balance. In the reported quarter, the company did not record any provision for credit losses. However, a fall in NII and an increase in other expenses acted as spoilsports.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

WaFd, Inc. (WAFD) : Free Stock Analysis Report

Webster Financial Corporation (WBS) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report