WEC Energy Group Inc's Dividend Analysis

Assessing the Upcoming Dividend and Historical Performance of WEC Energy Group Inc

WEC Energy Group Inc (NYSE:WEC) recently announced a dividend of $0.84 per share, payable on 2024-03-01, with the ex-dividend date set for 2024-02-13. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into WEC Energy Group Inc's dividend performance and assess its sustainability.

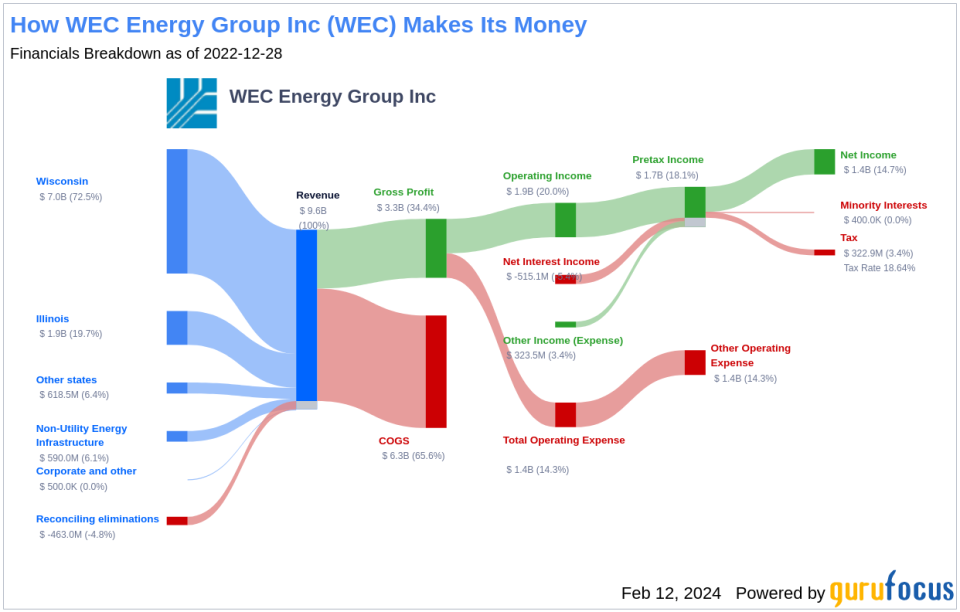

What Does WEC Energy Group Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

WEC Energy Group Inc operates in the utilities sector, providing essential electric and gas services to customers across several Midwest states. Its diversified portfolio includes electric generation and distribution, gas distribution, electric transmission, and a segment of unregulated renewable energy. The company's strategic investments in these areas ensure a balanced asset mix, catering to a broad customer base and contributing to its financial stability.

A Glimpse at WEC Energy Group Inc's Dividend History

With a track record of consistent dividend payments since 1987, WEC Energy Group Inc stands as a testament to reliability in shareholder returns. Notably, the company has not only maintained these payments but has increased its dividend annually since 2004, earning the title of a dividend achiever. This status is a significant indicator of the company's commitment to returning value to its shareholders.

Below is a chart showing annual Dividends Per Share for tracking historical trends.

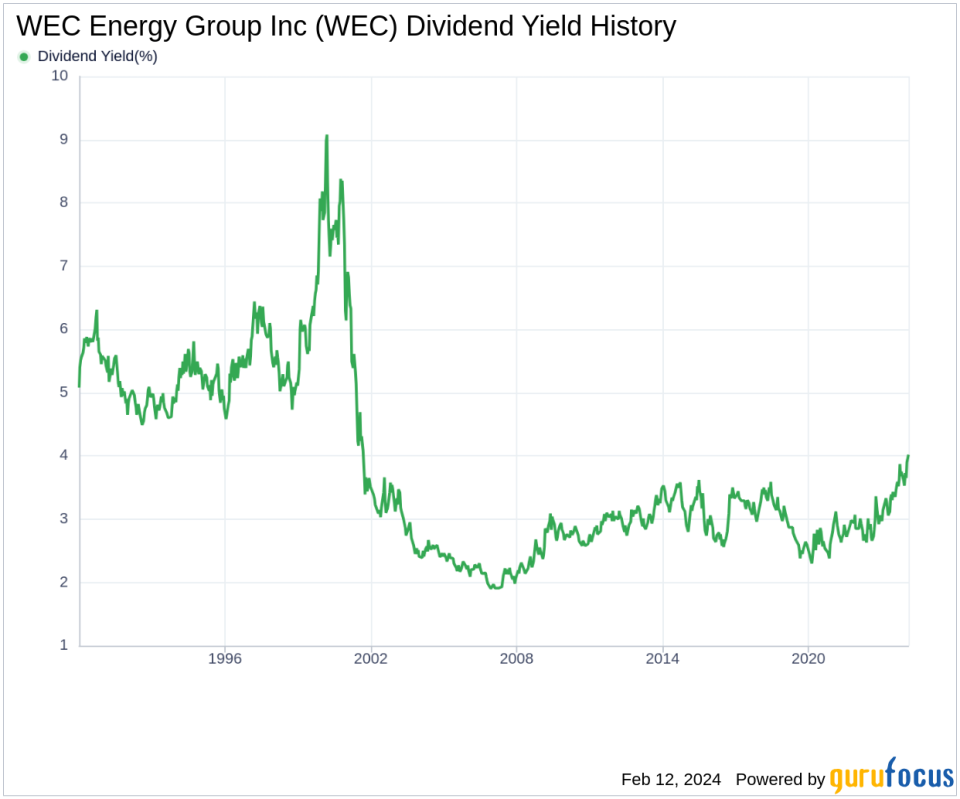

Breaking Down WEC Energy Group Inc's Dividend Yield and Growth

WEC Energy Group Inc's trailing dividend yield of 4.02% and forward dividend yield of 4.31% reflect investor expectations of increasing dividend payments. These yields position WEC Energy Group Inc favorably within the Utilities - Regulated industry, providing an attractive proposition for income investors seeking steady and growing returns.

Over various time frames, WEC Energy Group Inc's dividend growth rates have been impressive, with an annual increase of 7.20% over the past three years and a consistent 8.20% over the past decade. The company's 5-year yield on cost stands at approximately 5.69%, showcasing the potential long-term benefits for shareholders.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio, currently at 0.67, indicates that WEC Energy Group Inc retains a substantial portion of its earnings, which supports both future growth and dividend sustainability. This is complemented by the company's strong profitability rank of 8 out of 10, reflecting its ability to generate consistent earnings, a cornerstone for maintaining and growing dividends.

Growth Metrics: The Future Outlook

WEC Energy Group Inc's robust growth rank of 8 out of 10 suggests a favorable growth trajectory when compared to its competitors. However, the company's growth rates in revenue, earnings per share (EPS), and EBITDA have shown mixed performance relative to global peers. These indicators provide insights into the company's potential to sustain its dividend payments and finance further expansion.

Next Steps

Considering WEC Energy Group Inc's consistent dividend payments, noteworthy growth in dividend rates, a prudent payout ratio, and solid profitability, the company appears to be a compelling choice for value investors focused on income generation. The growth metrics, while varied, still support a positive outlook for the company's ability to sustain its dividends. As the utility sector often provides a stable investment ground, WEC Energy Group Inc may continue to be a reliable source of dividends for shareholders.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.