WEC Energy Group Reports Mixed 2023 Financial Results Amid Regulatory Challenges

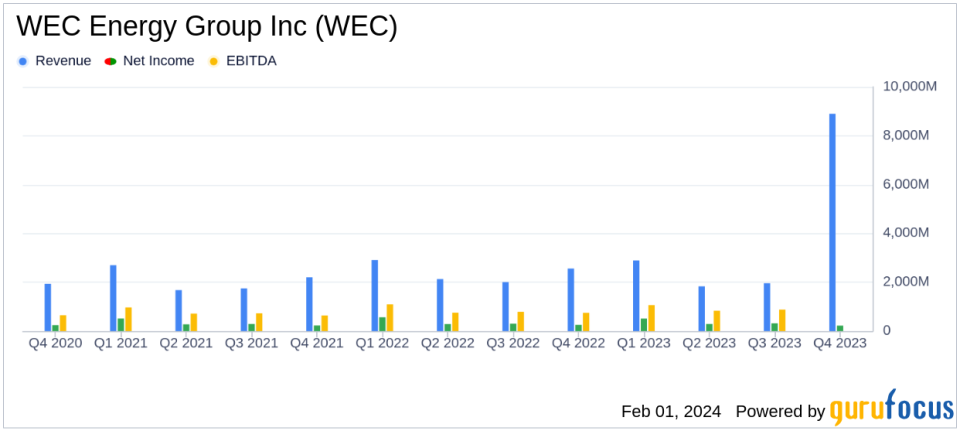

Net Income: Reported GAAP net income of $1.3 billion for 2023, down from $1.4 billion in 2022.

Adjusted Earnings Per Share: Adjusted EPS increased by 4% to $4.63, excluding a non-cash charge related to capital investments disallowed by the Illinois Commerce Commission.

Revenue: Consolidated revenues decreased to $8.9 billion, a $704.4 million drop from 2022.

Dividend: Quarterly cash dividend increased by 7% to 83.5 cents per share, marking the 21st consecutive year of dividend growth.

Electricity and Gas Deliveries: Retail deliveries of electricity and natural gas saw a decline in 2023, with weather-normalized electricity deliveries down by 1.0%.

Capital Investments: Faced a non-cash impairment charge due to disallowed capital costs by the Illinois Commerce Commission.

On February 1, 2024, WEC Energy Group Inc (NYSE:WEC) released its 8-K filing, detailing the company's financial performance for the year ended December 31, 2023. WEC Energy Group, a prominent energy company serving millions of customers across several U.S. states, reported a decrease in GAAP net income to $1.3 billion, or $4.22 per share, compared to $1.4 billion, or $4.45 per share, in the previous year. The company's adjusted earnings per share, however, rose by 4 percent to $4.63 when excluding a significant non-cash charge.

Financial Performance and Challenges

The company's financial results reflect a mix of achievements and setbacks. The adjusted earnings per share increase is a positive indicator of WEC Energy Group's underlying financial health and its ability to grow earnings despite challenges. However, the decline in GAAP net income and consolidated revenues points to external pressures and regulatory hurdles, particularly the non-cash charge related to capital investments disallowed by the Illinois Commerce Commission.

Executive Chairman Gale Klappa commented on the year's performance, stating:

"We delivered another year of strong results in 2023, despite an historically warm start to the year and a disappointing regulatory decision in Illinois. We have significant growth opportunities ahead. And we will continue to compound value with our focus on the fundamentals reliability, customer satisfaction, financial discipline, and environmental stewardship."

Key Financial Metrics

WEC Energy Group's financial achievements, such as the 21st consecutive year of dividend growth, underscore the company's commitment to shareholder returns. The utility industry is known for its stable dividends, and WEC's consistent dividend growth is a testament to its financial discipline and operational efficiency.

Key details from the financial statements include:

Financial Metrics | 2023 Full Year | 2023 Q4 |

|---|---|---|

GAAP Net Income (in millions) | $1,331.7 | $218.5 |

Adjusted Net Income (in millions) | $1,461.5 | $348.3 |

GAAP Earnings Per Share | $4.22 | $0.69 |

Adjusted Earnings Per Share | $4.63 | $1.10 |

These metrics are crucial as they provide insights into the company's profitability and operational efficiency. The adjusted figures, in particular, offer a clearer view of the company's performance by excluding the one-time regulatory setback.

Analysis of Company's Performance

WEC Energy Group's performance in 2023 reflects resilience in the face of regulatory and environmental challenges. The company's ability to increase its adjusted earnings per share despite a revenue decline and a non-cash charge is indicative of strong management and operational effectiveness. The decrease in electricity and gas deliveries could be a concern for future revenue growth, but the company's focus on customer satisfaction and environmental stewardship, as highlighted by Klappa, may help mitigate these impacts.

Overall, WEC Energy Group's 2023 financial results present a picture of a company navigating a complex regulatory environment while maintaining a commitment to shareholder value and operational excellence. Investors and potential GuruFocus.com members interested in the utilities sector may find WEC's disciplined approach and growth opportunities compelling despite the challenges faced.

Explore the complete 8-K earnings release (here) from WEC Energy Group Inc for further details.

This article first appeared on GuruFocus.