WEC Energy (WEC) Q2 Earnings Beat Estimates, Revenues Lag

WEC Energy Group WEC reported second-quarter 2023 earnings of 92 cents per share, which beat the Zacks Consensus Estimate of 85 cents by 8.24%. The bottom line also increased 1.1% from the year-ago quarter’s figure of 91 cents.

Revenues

Operating revenues of $1,830 million missed the Zacks Consensus Estimate of $2,166 million by around 15.5%. The top line also declined 14% from $2,127.9 million recorded in the year-ago quarter.

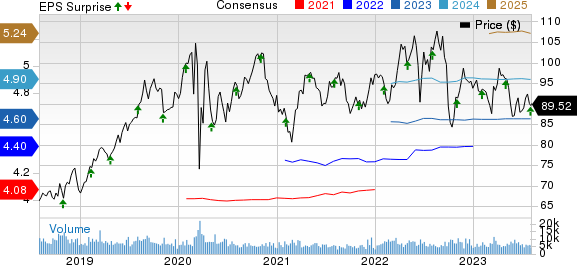

WEC Energy Group, Inc. Price, Consensus and EPS Surprise

WEC Energy Group, Inc. price-consensus-eps-surprise-chart | WEC Energy Group, Inc. Quote

Highlights of the Release

Electricity consumption by small commercial and industrial customers increased 0.1% year over year. The same for large commercial and industrial customers, excluding the iron ore mine, decreased 3.2% on a year-over-year basis.

On a weather-normal basis, retail deliveries of electricity, excluding the iron ore mine, declined 0.6%.

Total electric retail sales volume for the quarter was 8,620.8 thousand megawatt-hour (MWh), down 1.8% year over year. The Zacks Consensus Estimate for the same was pegged at 8,931 thousand MWh.

Total electric sales volume for the quarter was 10,029.6 thousand MWh, down 2.4% year over year. Our model projected total electric sales volume of 10,847.7 thousand MWh for the quarter.

Total operating expenses were $1,404.7 million, down 18.3% from the year-ago quarter’s level of $1,719.7 million. This was due to lower cost of sales.

Operating income totaled $425.3 million, up 4.2% from the year-ago quarter’s recorded number of $408.2 million.

The company incurred an interest expense of $178.7 million, up 49.2% from the prior-year quarter’s level of $119.8 million. Our model projected interest expense of $170.8 million for the reported quarter.

Financial Position

As of Jun 30, 2023, WEC had cash and cash equivalents of $54.7 million compared with $28.9 million as of Dec 31, 2022.

As of Jun 30, 2023, the company had long-term debt of $15,608.3 million compared with $14,766.2 million as of Dec 31, 2022.

Net cash provided by operating activities during the first six months of 2023 was $1,754.3 million compared with $1,762.6 million in the year-ago period.

Guidance

WEC reaffirmed its 2023 earnings guidance in the range of $4.58-$4.62 per share. The midpoint of the range, $4.60 per share, is on par with the Zacks Consensus Estimate.

Zacks Rank

WEC Energy currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Dominion Energy D is slated to report second-quarter results on Aug 4, before market open. The Zacks Consensus Estimate for earnings is pegged at 48 cents per share.

D’s long-term (three to five years) earnings growth rate is 20%. It delivered an average earnings surprise of 1.7% in the last four quarters.

PPL Corporation PPL is slated to report second-quarter results on Aug 4, before market open. The Zacks Consensus Estimate for earnings is pegged at 32 cents per share, indicating a year-over-year increase of 6.7%.

PPL’s long-term earnings growth rate is 7.42%. It delivered an average earnings surprise of 3.14% in the last four quarters.

Duke Energy DUK is scheduled to report second-quarter results on Aug 8, before market open. The Zacks Consensus Estimate for earnings is pinned at 98 cents per share.

DUK’s long-term earnings growth rate is 6.12%. The consensus mark for 2023 EPS is pinned at $5.61, implying a year-over-year improvement of 6.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPL Corporation (PPL) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report