WEC Energy (WEC) Q4 Earnings Match Estimates, Sales Lag

WEC Energy Group WEC reported fourth-quarter 2023 earnings of $1.10 per share, on par with the Zacks Consensus Estimate. The bottom line improved by 37.5% from the year-ago quarter’s figure of 80 cents.

WEC reported earnings of $4.63 for 2023 compared with $4.45 per share in 2022, which reflects a year-over-year increase of 4%.

Revenues

Operating revenues of $2.21 billion missed the Zacks Consensus Estimate of $2.66 billion by 16.9%. The top line also declined by 13.33% from $2.55 billion recorded in the year-ago quarter.

WEC reported total revenues of $8.9 billion for 2023 compared with $9.6 billion in 2022, which reflects a year-over-year decline of 7.29%.

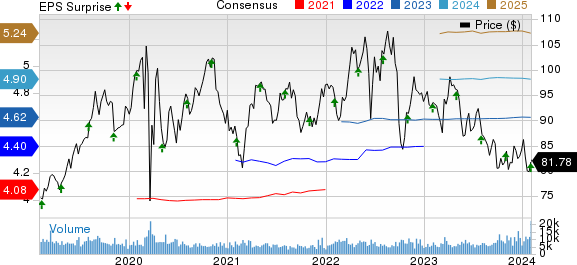

WEC Energy Group, Inc. Price, Consensus and EPS Surprise

WEC Energy Group, Inc. price-consensus-eps-surprise-chart | WEC Energy Group, Inc. Quote

Highlights of the Release

Electricity consumption by small commercial and industrial customers was 1.1% lower during 2023. Electricity use by large commercial and industrial customers, excluding the iron ore mine, declined by 3.2% on a year-over-year basis.

On a weather-normal basis, retail deliveries of electricity during 2023, excluding the iron ore mine, were down by 1% during the same time frame.

Total electric sales volumes for the quarter were 10,524 thousand megawatt-hours, up 7% year over year.

Total operating expenses were $1.87 billion, down 13.8% from the year-ago quarter’s level of $2.17 billion due to the lower cost of sales.

Operating income totaled $341.4 million, down 10.25% from the year-ago quarter’s recorded number of $380.4 million.

The company incurred an interest expense of $193.5 million, up 28.8% from the prior-year quarter’s level of $150.2 million.

Financial Position

As of Dec 31, 2023, WEC had cash and cash equivalents of $42.9 million compared with $28.9 million as of Dec 31, 2022.

As of Dec 31, 2023, the company had a long-term debt of $15.5 billion compared with $14.76 billion as of Dec 31, 2022.

Cash flow from operating activities in 2023 was $3.01 billion compared with $2.06 billion in 2022.

Guidance

WEC Energy Group expects to increase the capital plan by $300 million in the 2024-2028 time frame to further strengthen its energy infrastructure and electric delivery. The company now expects to invest $23.7 billion in the aforesaid time period.

Zacks Rank

WEC Energy currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

PNM Resources PNM will report fourth-quarter results on Feb 6 before market open. The Zacks Consensus Estimate for earnings is pegged at 15 cents per share.

The Zacks Consensus Estimate for PNM’s 2024 earnings is pegged at $2.75 per share, implying a year-over-year decline of 1.43%.

Alliant LNT will report fourth-quarter results on Feb 15 after market close. The Zacks Consensus Estimate for earnings is pegged at 55 cents per share, calling for a year-over-year increase of 19.57%.

The Zacks Consensus Estimate for LNT’s 2024 earnings is pegged at $3.08 per share, implying year-over-year growth of 7.14%.

FirstEnergy FE to report fourth-quarter results on Feb 8 after market close. The Zacks Consensus Estimate for earnings is pegged at 60 cents per share, suggesting a year-over-year rise of 20%.

The Zacks Consensus Estimate for FE’s 2024 earnings is pegged at $2.66 per share, implying a year-over-year increase of 4.25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

PNM Resources, Inc. (PNM) : Free Stock Analysis Report