Weekly CEO Buys Highlight

According to GuruFocus Insider Data, these were the largest CEO buys during the past week.

Darden Restaurants

Darden Restaurants Inc. (NYSE:DRI) President and CEO Eugene I. Lee Jr. bought 25,641 shares on April 23 at a price of $58.50. The price of the stock has increased by 17.64% since then.

Darden is one of the largest players in the $185 billion U.S. casual dining industry. Olive Garden (870 units), LongHorn (522) and Cheddar's Scratch Kitchen (169 company-owned units) are its core brands, while the smaller, faster-growing specialty restaurant group is made up of Yard House (81), The Capital Grille (60), Seasons 52 (45), Bahama Breeze (42) and Eddie V's (23).

The company has a market cap of $8.32 billion. Its shares traded at $68.82 with a price-earnings ratio of 13.43 as of April 24.

Third quarter net earnings for fiscal 2020 were $232.3 million compared to $223.6 million for the prior-year period.

Senior Vice President and Chief Financial Officer Ricardo Cardenas bought 2,991 shares on April 23 at a price of $58.50. Since then, the price of the stock has increased by 17.64%.

President of LongHorn Steakhouse Todd Burrowes bought 2,564 shares on April 23 at a price of $58.50. The price of the stock has increased by 17.64% since then.

Director Cynthia T. Jamison bought 3,418 shares on April 23 at a price of $58.50. Since then, the price of the stock has increased by 17.64%.

Executive Vice President and Chief Operating Officer David C. George bought 4,273 shares on April 23 at a price of $58.50. The price of the stock has increased by 17.64% since then.

Director James P. Fogarty bought 4,273 shares on April 23 at a price of $58.50. Since then, the price of the stock has increased by 17.64%.

Director Charles M. Sonsteby bought 12,820 shares on April 23 at a price of $58.50. The price of the stock has increased by 17.64% since then.

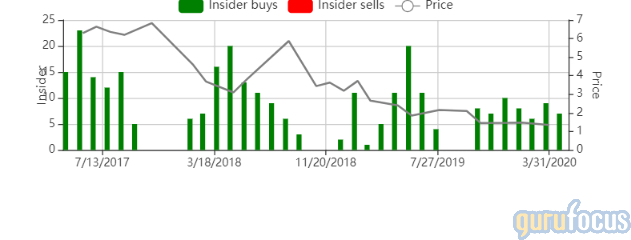

OPKO Health

OPKO Health Inc. (NASDAQ:OPK) CEO, Chairman and 10% Owner Phillip Frost bought 325,000 shares on April 17 at a price of $1.66. Since then, the price of the stock has increased by 24.1%.

OPKO Health is a diversified biotechnology company that operates pharmaceutical and diagnostic development programs. It has a development and commercial supply pharmaceutical company, a global supply-chain operation and holding company and a specialty active pharmaceutical ingredients manufacturer in Israel.

The company has a market cap of $1.38 billion. Its shares traded at $2.06 as of April 24. Net loss for the fourth quarter of 2019 was $112.4 million compared with a net loss of $76.1 million for the comparable period of 2018.

Frost bought 50,000 shares on April 3 at a price of $1.15; 400,000 shares on April 7 at a price of $1.28; 200,000 shares on April 15 at a price of $1.55; and 25,000 shares on April 16 at a price of $1.63. The price of the stock has increased by 26.38% since then.

For the complete list of stocks bought by their company CEOs, go to: CEO Buys.

Disclosure: I do not own stock in any of the companies mentioned in the article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.