Is Weibo (WB) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

Value investors are perpetually on the lookout for stocks priced below their intrinsic value. Weibo Corp (NASDAQ:WB), a China-based social media advertising company, merits attention in this regard. The stock, priced at $12.3, recently recorded a gain of 4.28% in a single day and a 3-month decrease of 7.31%. According to its GF Value, the fair valuation of the stock stands at $23.78.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock, derived from an exclusive method. This method considers historical multiples, the GuruFocus adjustment factor based on the company's past returns and growth, and future business performance estimates. The GF Value Line on the summary page provides an overview of the stock's fair value. If the stock price significantly deviates from the GF Value Line, it indicates overvaluation or undervaluation, affecting future returns.

However, investors must conduct an in-depth analysis before making an investment decision. Despite Weibo's seemingly attractive valuation, certain risk factors should not be overlooked. These risks are primarily reflected through its low Altman Z-score of 1.43, suggesting that Weibo, despite its apparent undervaluation, might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making.

Demystifying the Altman Z-Score

The Altman Z-score, developed by New York University Professor Edward I. Altman in 1968, is a financial model that predicts the probability of a company entering bankruptcy within two years. It combines five different financial ratios, each weighted to create a final score. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

Company Overview

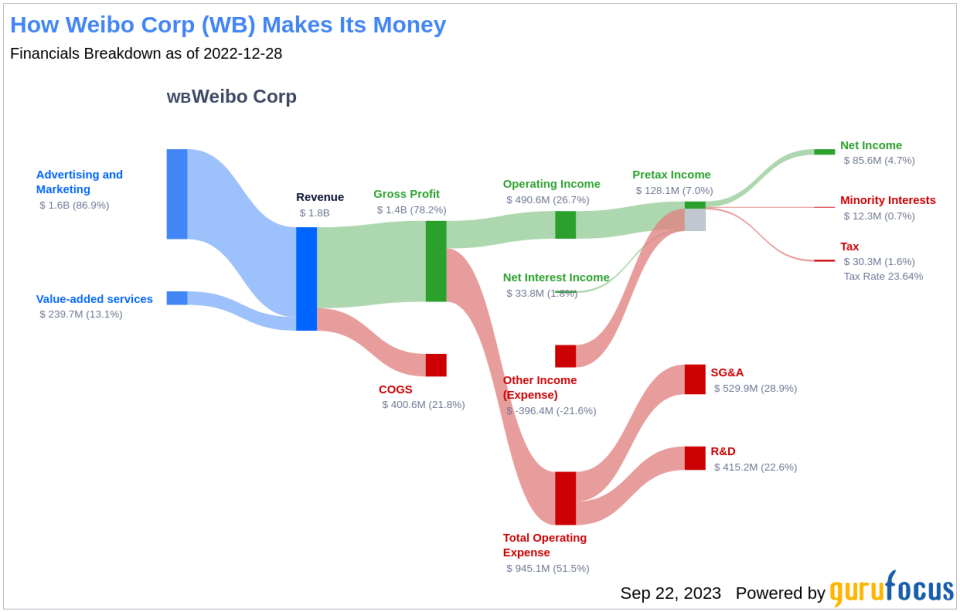

Weibo Corp (NASDAQ:WB) is primarily engaged in the social media advertising business, providing a range of advertising customization and marketing solutions. In addition, it offers value-added services such as membership services on social platforms, online games, live broadcasts, social e-commerce, and more. Despite its promising business model and operations, Weibo's stock price significantly deviates from its GF Value, indicating a potential value trap.

Decoding Weibo's Low Altman Z-Score

A breakdown of Weibo's Altman Z-score reveals potential financial distress. The Retained Earnings to Total Assets ratio, which provides insights into a company's ability to reinvest its profits or manage debt, has shown a decline in recent years for Weibo. Similarly, the EBIT to Total Assets ratio, a crucial measure of a company's operational effectiveness, also exhibits a descending trend. Furthermore, Weibo's decreasing asset turnover ratio suggests reduced operational efficiency, potentially due to the underutilization of assets or decreased market demand for the company's products or services.

Conclusion: A Potential Value Trap

Despite its seemingly attractive valuation, Weibo Corp (NASDAQ:WB) exhibits potential signs of a value trap. Its low Altman Z-Score and declining ratios indicate potential financial distress and operational inefficiencies. Therefore, it is crucial for investors to conduct thorough due diligence before investing in Weibo.

GuruFocus Premium members can find stocks with high Altman Z-Score using the Walter Schloss Screen .

This article first appeared on GuruFocus.