Welltower (WELL): A Fairly Valued Asset in the Healthcare Sector?

Welltower Inc (NYSE:WELL) has recently been in the spotlight with a daily gain of 1.94% and a 3-month gain of 5.15%. Its Earnings Per Share (EPS) stands at 0.23. This article seeks to answer the burning question: is Welltower fairly valued? We delve into the company's valuation analysis to provide a comprehensive understanding of its intrinsic value.

Company Introduction

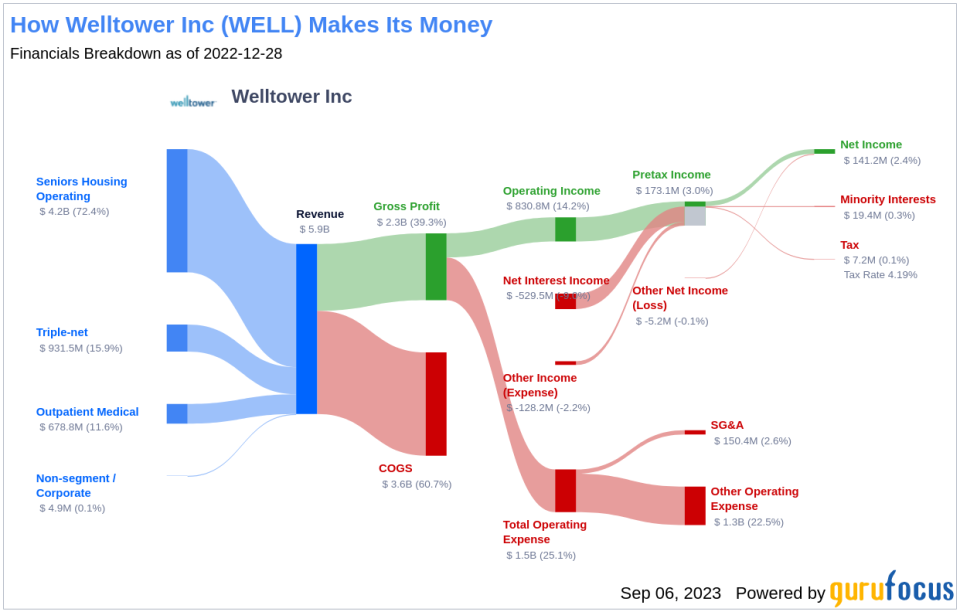

Welltower Inc (NYSE:WELL) owns a diversified healthcare portfolio of over 1,900 properties spread across senior housing, medical office, and skilled nursing/post-acute care sectors. With over 100 properties in both Canada and the United Kingdom, the company is always on the lookout for additional investment opportunities in countries with mature healthcare systems similar to the United States.

As of September 06, 2023, Welltower's stock price stands at $82.43 with a market cap of $42.80 billion. Comparatively, its GF Value, an estimation of fair value, is $82.01. This comparison sets the stage for a deeper exploration of the company's value, ingeniously integrating financial assessment with essential company details.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on three factors:

Historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow) that the stock has traded at.

GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business performance.

We believe the GF Value Line is the fair value that the stock should be traded at. The stock price will most likely fluctuate around the GF Value Line. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

For Welltower (NYSE:WELL), the stock is estimated to be fairly valued, according to GuruFocus Value calculation. This estimation suggests that the long-term return of its stock is likely to be close to the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

This article first appeared on GuruFocus.