The Wendy's Co (WEN) Reports Solid Growth Amidst Inflationary Challenges

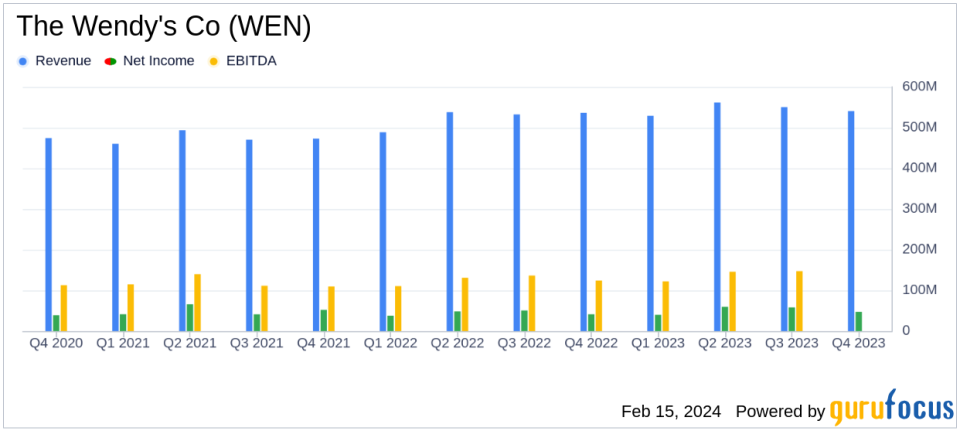

Revenue Growth: Total revenues increased by 4.1% year-over-year to $2.18 billion in 2023.

Net Income Surge: Net income rose by 15.2% to $204.4 million for the full year.

U.S. Company-Operated Restaurant Margin: Improved by 1.0% to 15.3% in 2023, despite cost pressures.

Adjusted EBITDA: Grew by 7.7% to $535.9 million, reflecting operational efficiency.

Free Cash Flow: Increased significantly by 28.7% to $274.3 million.

Dividend: Quarterly cash dividend declared at 25 cents per share, payable on March 15, 2024.

Share Repurchases: 2.4 million shares repurchased in Q4 2023 for $45.7 million.

The Wendy's Co (NASDAQ:WEN) released its 8-K filing on February 15, 2024, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, known for its square hamburgers and fresh, never frozen beef, has demonstrated resilience and strategic growth amidst challenging economic conditions.

The Wendy's Company, a leader in the quick-service restaurant (QSR) industry, has reported a robust set of financial results for the fourth quarter and full year of 2023. The company's focus on strategic growth pillars and alignment with franchisees has led to its 13th consecutive year of global same-restaurant sales growth. Wendy's has also made significant strides in digital sales, opened nearly 250 new restaurants globally, and expanded its U.S. Company-operated restaurant margin to pre-COVID levels.

Performance and Challenges

Despite facing extreme inflationary headwinds, Wendy's has managed to grow its systemwide sales and maintain a positive trajectory in same-restaurant sales growth. The U.S. segment saw a 5.1% increase in systemwide sales, while the international segment experienced a notable 14.1% growth. However, the company-operated restaurant margin in the U.S. saw a slight decrease in the fourth quarter, primarily due to higher commodity costs, customer count declines, and increased labor costs.

Financial Achievements

Wendy's financial achievements are particularly important in the competitive QSR industry. The company's ability to grow its revenue and net income in a challenging economic environment demonstrates the strength of its brand and operational efficiency. The increase in free cash flow by 28.7% to $274.3 million is a testament to the company's solid financial management and positions it well for future investments and shareholder returns.

Key Financial Metrics

Wendy's reported total revenues of $540.7 million for the fourth quarter, a slight increase from the previous year. The full-year revenues reached $2.18 billion, marking a 4.1% increase. The U.S. Company-operated restaurant margin improved by 1.0% for the full year, reflecting the company's ability to manage costs effectively. General and administrative expenses decreased by 2.0%, contributing to an 8.1% increase in operating profit for the year. Net income for the full year increased by 15.2% to $204.4 million, while adjusted EBITDA grew by 7.7% to $535.9 million.

"The Wendys system delivered strong sales, profit, and cash flow growth in 2023, all supported by progress on our strategic growth pillars," said President and Chief Executive Officer Kirk Tanner.

Adjusted earnings per share for the full year increased by 12.8% to $0.97. The company also declared a regular quarterly cash dividend of 25 cents per share, demonstrating its commitment to returning value to shareholders.

Analysis of Company's Performance

Wendy's has shown a commendable ability to navigate through inflationary pressures and maintain growth in key financial areas. The company's strategic investments and focus on digital sales have paid off, contributing to its overall positive performance. The expansion of the company-operated restaurant margin to pre-COVID levels is particularly noteworthy, as it indicates a recovery from the pandemic's impact and a return to operational stability.

The company's plans for 2024 include investments aimed at accelerating global growth, delivering significant restaurant margin expansion, and driving long-term shareholder value. With a strong financial foundation and clear strategic direction, Wendy's is well-positioned for continued success in the QSR industry.

For more detailed information and financial tables, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from The Wendy's Co for further details.

This article first appeared on GuruFocus.