Wendy's (WEN) Banks on Digitization Efforts, Hurt by High Costs

The Wendy's Company WEN is poised to benefit from digitization, unit expansion and Breakfast daypart offerings. Also, the emphasis on menu innovation initiatives bodes well. However, high commodity and labor costs are a concern.

Let us discuss the factors highlighting why investors should retain the stock for the time being.

Growth Catalysts

Wendy’s is focused on digitalization to drive growth. During third-quarter fiscal 2023, the company had nearly 12% of its sales generated through digital channels in the United States and approximately 18% in international markets. The company reported benefits from strength across digital channels, third-party delivery partnerships and an uptick in loyalty programs.

Buoyed by the strong embrace of digital channels and an increase in active users monthly, Wendy’s is optimistic about maintaining this momentum in the foreseeable future. Their emphasis lies in expanding both delivery options and mobile ordering accessibility while optimizing user experiences. They're developing a personalized marketing initiative to enhance their digital business and drive further growth. Wendy’s projects digital sales to hit roughly $1.8 billion in 2023.

Wendy’s maintains a steadfast commitment to its global expansion. In the US and Canada, there's been a significant rise in commitments across various development initiatives, including fresh participation in incentive programs like Pacesetter and Groundbreaker. Meanwhile, in the UK, a new franchisee has joined, while existing ones have demonstrated increased confidence in the brand's future by expanding their development agreements. Similarly, in Japan, a franchisee expedited their agreement as operations rebounded post-pandemic, resulting in improved sales.

Mexico — acknowledged as a critical growth market — witnessed the signing of an additional development agreement, signaling sustained sales growth and heightened interest from potential franchisees. The company boasts a robust pipeline and remains on target to achieve approximately 2% net unit growth in 2023. Looking ahead to the fiscal 2024 and 2025, Wendy’s anticipates a yearly global net unit growth in the range of 2-3% and 3-4%, respectively.

Wendy’s focuses on Breakfast daypart Offerings to drive incremental sales. During third-quarter fiscal 2023, the company reported strong breakfast performance courtesy of its menu innovation and promotions. The company reported sequential sales improvement, backed by its value offering (2 for 3 breakfast Biggie Bag bundles). It also expanded its menu offerings with the additions of Loaded Nacho Cheeseburger, Kcell fries, Frosty Cream Cold Brew and English Muffin. The company intends to focus on enhancing its breakfast and late-night options offerings to support the restaurant's economic model and drive sales.

Concerns

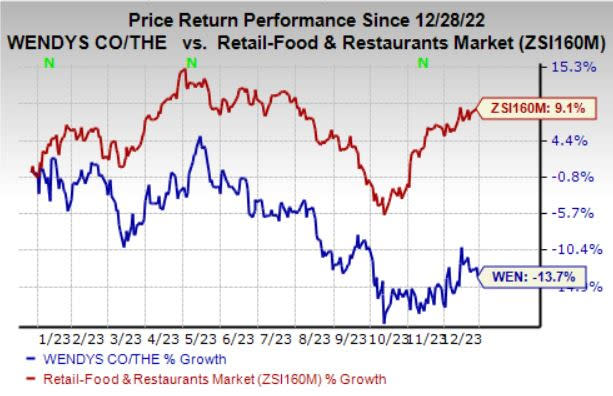

Image Source: Zacks Investment Research

Wendy’s shares have declined 13.7% in the past year against the industry’s growth of 9.1%. A challenging macro environment mainly caused the downside.

Wendy’s has been shouldering increased expenses that have been detrimental to margins. In the third quarter of fiscal 2023, the company’s total cost of sales came in at $199.5 million compared with $196.2 million reported in the prior-year quarter. The downside was primarily due to higher commodity and labor costs, a decline in customer counts and increased investments (to support the entry into the U.K. market. Also, inflationary pressures in the U.K. market added to the negatives. In 2023, WEN anticipates commodity and labor inflation to be in the mid-single digits.

Zacks Rank & Key Picks

Wendy’s currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Retail-Wholesale sector include:

Arcos Dorados Holdings Inc. ARCO sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 28.3% on average. Shares of ARCO have surged 55.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ARCO’s 2024 sales and earnings per share (EPS) indicates 10.6% and 15.5% growth, respectively, from the year-ago period’s levels.

Brinker International, Inc. EAT sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 223.6%, on average. Shares of EAT have increased 38.9% in the past year.

The Zacks Consensus Estimate for EAT’s 2024 sales and EPS indicates 5.1% and 26.2% growth, respectively, from the year-ago period’s levels.

Wingstop Inc. WING sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 28.9%, on average. The stock has gained 83.6% in the past year.

The Zacks Consensus Estimate for Wingstop’s 2024 sales and EPS suggests rises of 15.8% and 18.2%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

The Wendy's Company (WEN) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report