Werner aims to grow dedicated after Q4 earnings miss

Werner aims to grow dedicated after Q4 earnings miss

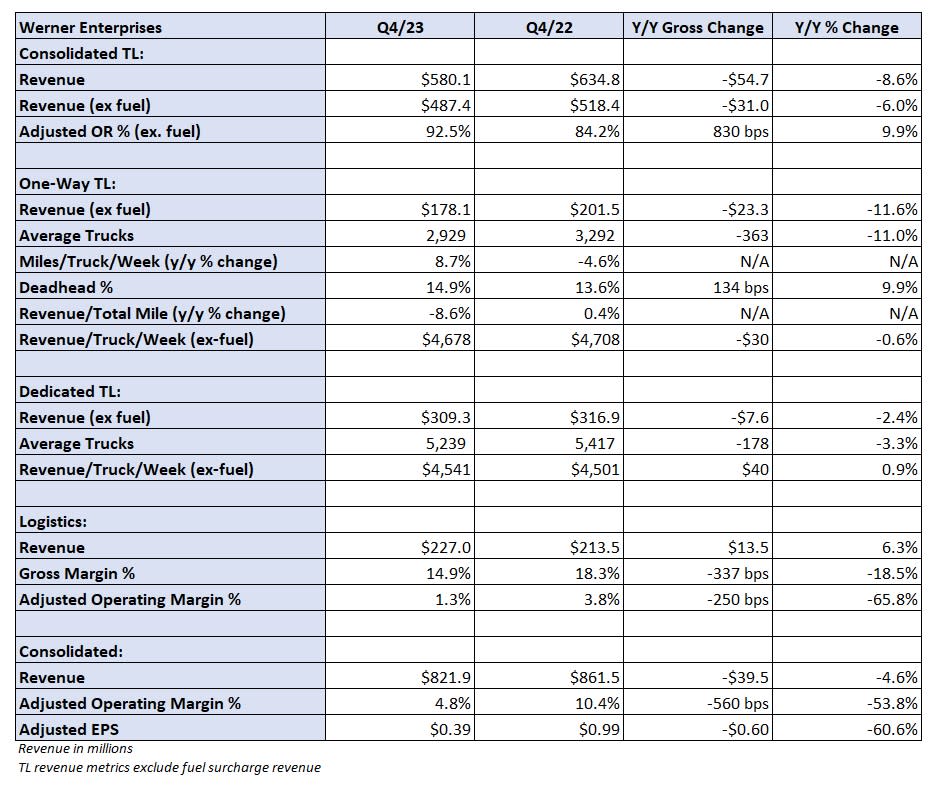

On Tuesday, truckload carrier Werner Enterprises released its Q4 earnings, which saw one-way customers (or OTR) continue one last push for savings on upcoming RFPs but nearing an inflection point due to profitability concerns.

The pricing discipline and willingness to limit the company’s semi-random OTR network while pivoting to dedicated is a proven down-market strategy in which you adjust the mix for less volatile dedicated business and lock in better margins. Stemming losses is the name of the game. Dedicated is more complex than OTR and provides advantages to large carriers that have the assets and people to pull it off.

On Werner’s Q4 earnings call, Chairman and CEO Derek Leathers, said: “Clearly there are customers that are looking to try to take one last bite of the apple. There’s clear pressure, especially on the one-way side of the network. But our stance is we’ve got to stay disciplined. … So they’re going to be frictional. They’re going to be difficult. We’ve already indicated that we’re willing to shrink the fleet size if need be and we’ve shown that through 2023. The good news is we also have a lot of stability in the dedicated portion of the portfolio”

We should see in the coming quarters enterprise fleets maintain or reduce their over-the-road exposure until rates improve. If an inflection begins in H2 2024, we may see early signs of fleets attempting to increase head count and take advantage of higher rates but at a measured pace due to higher equipment- and driver-related costs.

LMI’s January index sees expansion in every metric

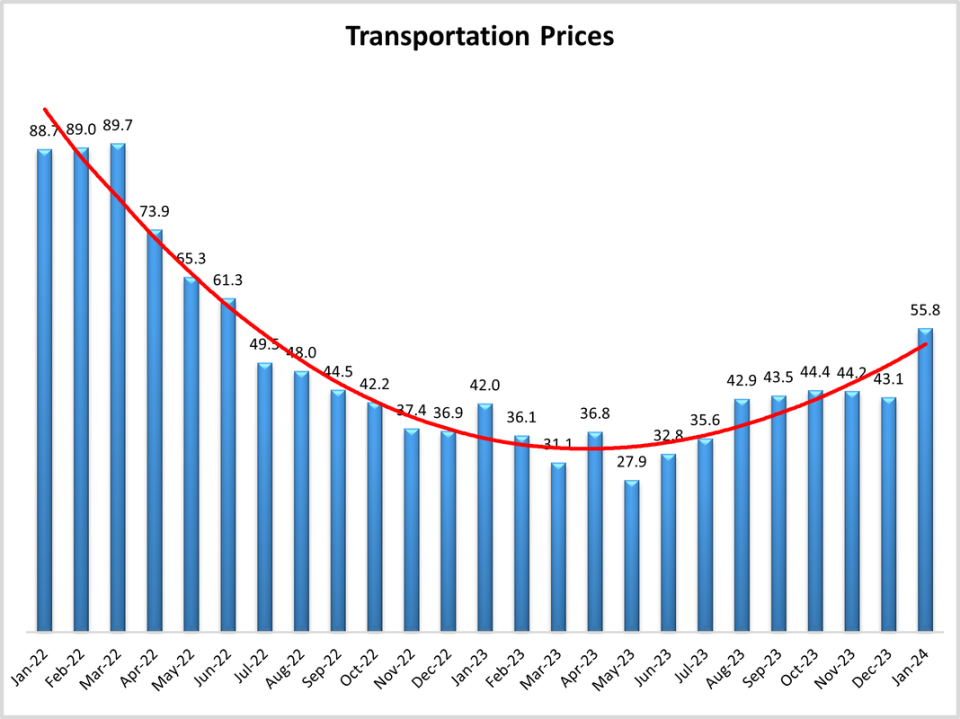

The Logistics Managers’ Index recently released its January index data, which saw all metrics read in expansion territory, the first time since September 2019. An index reading below 50 indicates a contraction while a reading above 50 is an expansion. The overall LMI rose 5 points to 55.6 in January compared to a December reading of 50.6.

One positive sign for truckload carriers is the expansion of transportation prices by 12.7 points month over month to 55.8. This is the first time in more than two years that the report saw prices in expansion territory. The report adds, “It is worth noting that Transportation Prices and Transportation Capacity inverted this month, with the former now growing slightly faster than the latter. Every time there has been an inversion between these two metrics over the 7.5 years of this index it has signaled a shift in the market.”

Potential interest rate cuts are also worth watching. FreightWaves’ Todd Maiden writes, “Another positive catalyst for the transportation industry could come in the form of interest rate cuts as some analysts are predicting. Lower rates would likely result in more activity at upstream firms, like manufacturers and wholesalers, resulting in more ‘larger, bulkier shipments,’ the report said.”

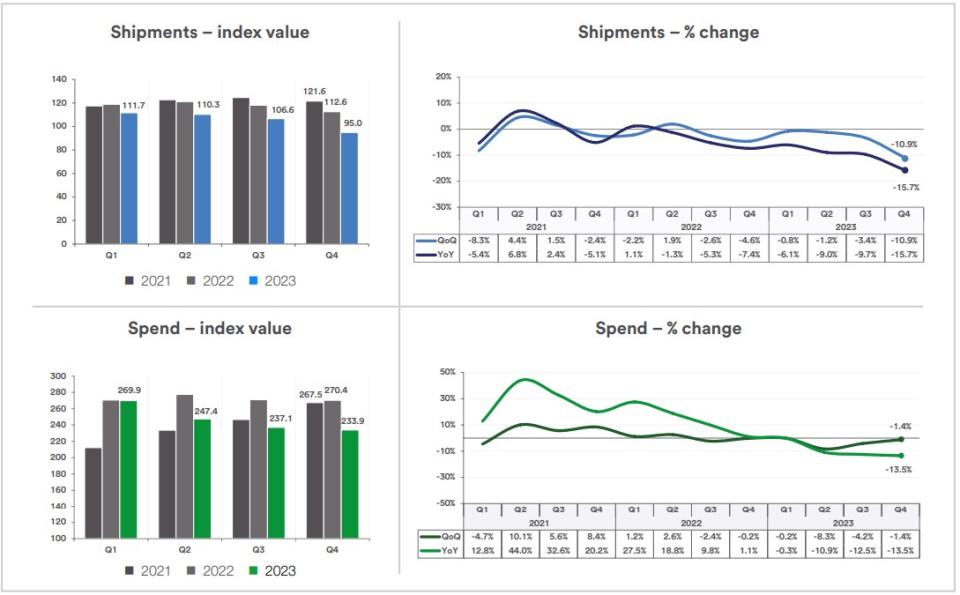

Market update: U.S. Bank Q4 Index see continued declines

Freight audit and payment provider U.S. Bank recently released its Q4 2023 Freight Payment Index, which saw both national shipments and spend index decline for the fourth consecutive quarter. While year-over-year declines remained high, quarter-to-quarter declines moderated. The Shipments index fell from 106.6 points in Q3 2023 to 95 points in Q4 while the Spend index declined from 237.1 points in Q3 to 233.9 points in Q4.

FreightWaves’ John Kingston wrote: “In what might be considered the most accurate summation of the current market, the U.S. Bank commentary said: ‘As shipments volumes contract, it results in too many trucks chasing too little freight.’ But the bank also noted that given that the Shipments index was down 10.9% and the Spend index dropped just 1.4% relative to the third quarter, that variance is ‘suggesting that the market may be moving closer to balance between supply and demand.’”

Inventory levels and customer restocking remained an important theme. The report notes, “One of the reasons why freight volumes were so soft during the final quarter was that retailer inventory reduction was significant during the final three months of 2023. As businesses worked to reduce inventories, they required fewer truck shipments. Furthermore, shelf destocking reduces total economic activity; the reduction in inventory, once completed, will no longer be a headwind on the freight supply chain.”

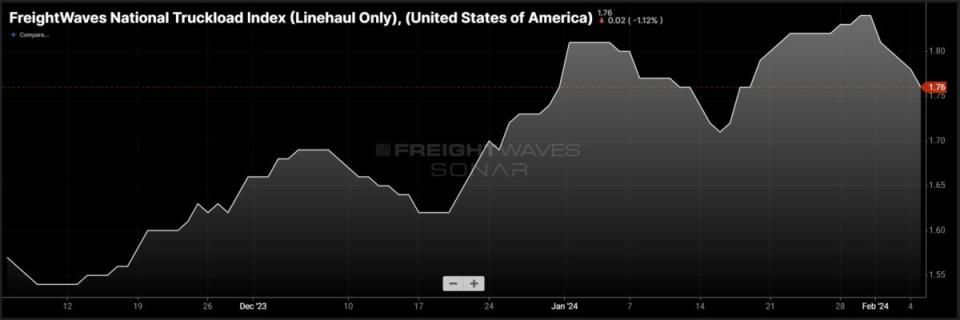

FreightWaves SONAR spotlight: Spot linehaul rates lose steam

Summary: The prognostications of Punxsutawney Phil, resident groundhog and weather expert who on Friday predicted an early spring, have not swayed spot market linehaul rates in the past week. The FreightWaves National Truckload Index (Linehaul Only) fell 7 cents per mile week over week from $1.83 on Jan. 29 to $1.76. It remains premature to predict an end to the gradual improvement in spot market rates based on one week’s worth of change. However, for groundhogs as a substitute for a real freight analyst, early spot market activity for February suggests that rodents may not make informed market decisions.

Dry van all-in spot market rates also saw declines in the past week, with the NTI falling only 3 cents per mile w/w from $2.40 on Jan. 29 to $2.37. Reefer spot rates (RTI) continue to outperform dry van rates, rising 4 cents per mile w/w from $2.75 on Jan. 29 to $2.79. The flatbed segment also saw improvements, increasing 6 cents per mile all-in from $2.77 on Jan. 29 to $2.83.

Looking ahead over the next 28 days, spot market rates suggest signs of stabilization but at elevated levels compared to the past three months. The NTI 28-Day outlook forecasts all-in spot market rates declining 6 cents per mile then stabilizing at $2.35 per mile by March 3 from its current level of $2.41. For adherents of groundhog-based freight analysis, this outlook provides some signs of optimism, as the freight cycle slowly transitions from a down cycle to a cautious upswing and truckload capacity moves closer to truckload demand equilibrium.

The Routing Guide: Links from around the web

FMCSA calls out sham towing fees charged to truckers (FreightWaves)

Imports of avocados, beer from Mexico score big on Super Bowl Sunday (FreightWaves)

Extreme weather in January obscures carriers’ Q1 outlooks (Trucking Dive)

Bankrupt Yellow repays principal, interest on COVID loan (FreightWaves)

FreightWaves opens 2024 Shipper of Choice award nominations (FreightWaves)

‘Take Our Border Back’ convoy ends with rallies in 3 states (FreightWaves)

The post Werner aims to grow dedicated after Q4 earnings miss appeared first on FreightWaves.