Werner Enterprises Inc (WERN) Faces Headwinds: Q4 and Full-Year 2023 Earnings Analysis

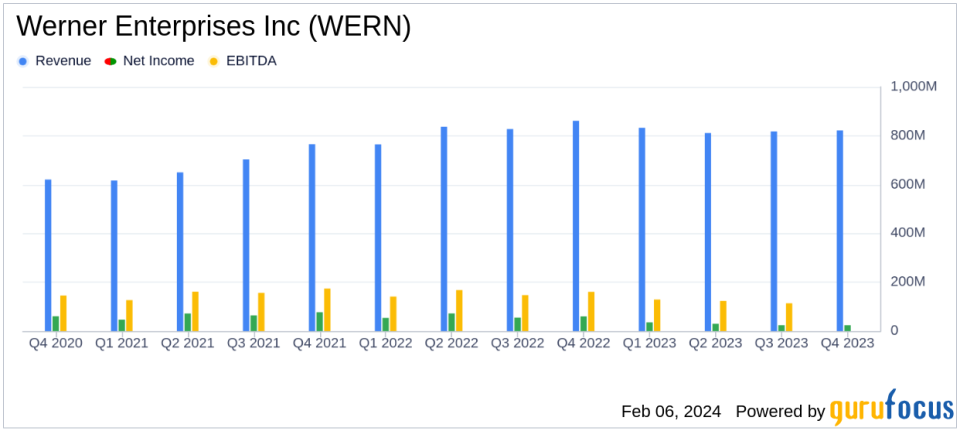

Total Revenues: Q4 down 5% to $821.9 million; Full-year stable at $3.28 billion.

Operating Income: Q4 down 57% to $37.9 million; Full-year down 45% to $176.4 million.

Diluted EPS: Q4 decreased 61% to $0.37; Full-year down 53% to $1.76.

Operating Margin: Q4 down 570 basis points to 4.6%; Full-year down 440 basis points to 5.4%.

Logistics Segment Growth: Q4 revenues up 6% to $227 million; Full-year up 15% to $910.4 million.

Debt Reduction: Over $40 million in debt paid down during the quarter.

Capital Expenditure: Net capital expenditures in Q4 decreased 46% to $34.5 million.

On February 6, 2024, Werner Enterprises Inc (NASDAQ:WERN) released its 8-K filing, detailing the financial outcomes for both the fourth quarter and the full year of 2023. The report revealed a mixed performance underpinned by resilience in total annual revenues, which remained relatively flat at $3.28 billion, but a notable decline in profitability metrics such as operating income and diluted earnings per share (EPS).

Werner Enterprises Inc, a top full-truckload carrier with a fleet exceeding 7,800 tractors, operates two primary segments: Truckload Transportation Services (TTS) and Werner Logistics. The company generates approximately 80% of its revenue from full-truckload shipping services, with the remaining 20% coming from non-asset-based logistics operations, including truck brokerage.

Performance and Challenges

The fourth quarter saw total revenues decrease by 5% to $821.9 million, driven by a $54.7 million drop in TTS revenues, partially offset by a 6% increase in Logistics revenues. Operating income plummeted by 57% to $37.9 million, with operating margin contracting by 570 basis points to 4.6%. Diluted EPS also fell sharply by 61% to $0.37. These declines reflect the challenging freight conditions and ongoing pricing pressure faced by the company.

Despite these headwinds, Werner's Dedicated business segment demonstrated resilience, achieving double-digit margins and growing revenue per truck for the ninth year in the last decade. The One-Way Trucking business improved its miles per truck by nearly 9% year over year, outperforming industry benchmarks despite a rate per mile decline. Logistics volume remained strong, marking 13 consecutive quarters of growth.

Financial Achievements and Industry Relevance

Werner's ability to maintain stable annual revenues amidst a challenging market is a testament to its operational strength and strategic focus. The company's cost-saving initiatives, which realized over $40 million in savings for 2023, helped mitigate some of the negative impacts from market dynamics. Strong operating cash flow enabled the company to reinvest in the business, reduce debt, and return value to shareholders, positioning Werner to capitalize on market recovery.

Financial Metrics and Importance

Key financial metrics from the income statement and balance sheet highlight the company's financial health and operational efficiency. The operating cash flow margin improved to 14% of operating revenues, and net capital expenditures were reduced significantly. These metrics are crucial for Werner as they reflect the company's ability to generate cash, reinvest in its fleet, and manage debt effectivelyessential aspects for sustaining operations and growth in the transportation industry.

"We continue to execute on structural cost changes, realizing over $40 million of savings in 2023, helping to partially offset market dynamics and conditions out of our control, such as rate pressure, cost inflation and declining resale values of equipment," said Derek J. Leathers, Chairman and CEO of Werner Enterprises.

Analysis of Company's Performance

Werner's performance in the fourth quarter and full year of 2023 reflects the broader challenges in the transportation sector, including rate pressure and cost inflation. However, the company's strategic initiatives and disciplined capital management have allowed it to navigate these challenges effectively. The focus on cost savings and operational excellence, combined with a robust logistics segment, provides a foundation for Werner to improve its financial performance as market conditions stabilize.

For a comprehensive understanding of Werner Enterprises Inc's financial position and strategic direction, investors and stakeholders are encouraged to review the full 8-K filing.

Stay informed on the latest financial news and analysis by visiting GuruFocus.com for more expert insights and in-depth reports.

Explore the complete 8-K earnings release (here) from Werner Enterprises Inc for further details.

This article first appeared on GuruFocus.