Werner misses Q2 expectations

Werner Enterprises missed second-quarter expectations Thursday and said the third quarter presents a challenge as pricing on another 25% of its contracts will be renewed, most with lower rates.

On a call with analysts, management said there was slight improvement in the middle of June and the level was held through July. It is hopeful for a seasonally normal fourth quarter, noting most customers have indicated their inventories have already been corrected.

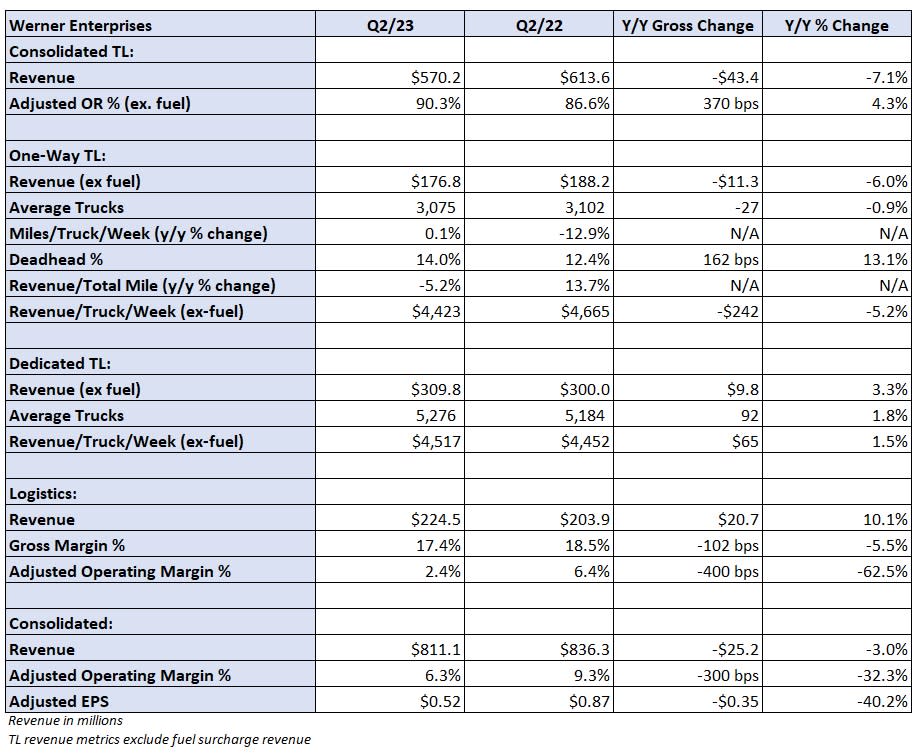

Werner (NASDAQ: WERN) reported second-quarter adjusted earnings per share of 52 cents, which was 7 cents light of the consensus estimate and 35 cents lower year over year (y/y).

The result excluded 5 cents net in one-offs like acquisition-related expenses, costs from an insurance claim that has been appealed and a loss in an equity investment.

Lower gains on sale were a 10-cent headwind as equipment values have dropped. The carrier sold twice as many tractors and three times as many trailers in the period as it did in the year-ago quarter.

Higher interest expense was a 6-cent drag as the debt balance was higher due to past acquisitions and interest rates increased.

Management has now identified more than $40 million in cost saving opportunities, 40% of which have been realized.

Total truckload revenue fell 7% y/y to $570 million. Revenue per truck per week in the dedicated fleet was up 2% excluding fuel in the quarter. The new guidance calls for the metric to be flat to up 3% y/y for the full year, implying a flattish result in the back half. (It was up 3% y/y in the first half.)

Revenue per total mile and revenue per truck were down 5% y/y in the one-way segment during the quarter. The outlook calls for a 4% to 7% y/y decline in the third quarter.

The TL segment posted a 90.3% operating ratio, which was 370 basis points worse y/y.

Werner’s logistics segment recorded revenue of $225 million, a 10% y/y increase. Loads were higher due to the ReedTMS acquisition. The segment logged a 100-bp decline in gross margin to 17.4%. The adjusted operating margin was 2.4%, 400 bps worse y/y.

Management’s guidance assumes spot rates will improve sequentially in the back half of the year and cost inflation will ease. Declining used equipment prices will continue to be a headwind to the gains it books on the sale of tractors and trailers. Full-year gains on sale are expected to range between $40 million and $50 million compared to nearly $90 million last year.

“The company did book $12 million in gains, and those are expected to moderate in 2H, so it’ll be tough to improve margins in 2H without meaningful improvement in volumes/pricing,” said Amit Mehrotra, an equities analyst at Deutsche Bank (NYSE: DB), in a Thursday note to clients.

More FreightWaves articles by Todd Maiden

The post Werner misses Q2 expectations appeared first on FreightWaves.