Wesbanco Inc (WSBC) Reports Mixed Results Amidst Economic Headwinds

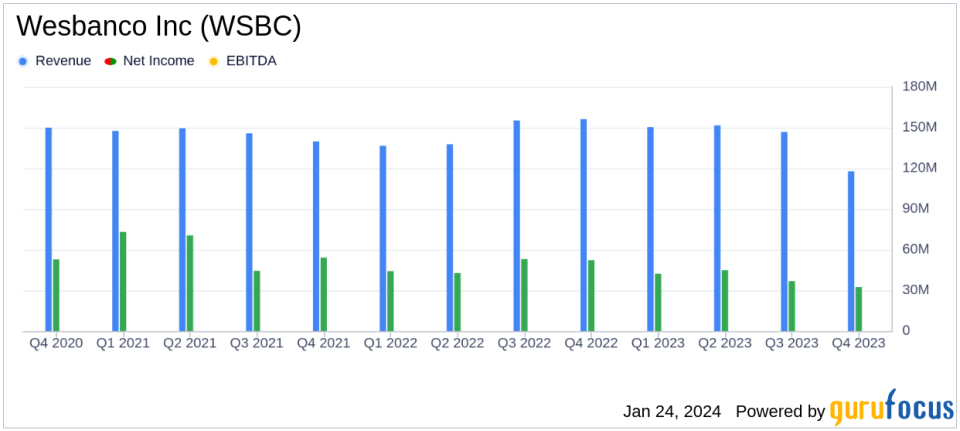

Net Income: Q4 net income available to common shareholders was $32.4 million, a decrease from $49.7 million in Q4 2022.

Diluted Earnings Per Share (EPS): Q4 diluted EPS stood at $0.55, down from $0.84 in the same quarter the previous year.

Loan Growth: Total loan growth reported at 8.7% year-over-year, with significant contributions from new loan production offices.

Deposits: Total deposits increased slightly to $13.2 billion, with a stable non-interest bearing component.

Net Interest Margin: Remained stable at 3.02% for Q4 2023, despite a challenging interest rate environment.

Non-Interest Income: Increased by 8.0% year-over-year, bolstered by new commercial loan swap and wealth management fees.

Capital Ratios: Wesbanco maintains strong regulatory capital ratios, well above well-capitalized standards.

On January 23, 2024, Wesbanco Inc (NASDAQ:WSBC) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The bank holding company, known for its full range of financial services and community banking approach, reported mixed results amidst a challenging economic landscape characterized by record interest rate hikes by the Federal Reserve.

Company Overview

Wesbanco Inc operates through its subsidiary, Wesbanco Bank, across six states, offering services such as retail and corporate banking, trust services, brokerage, mortgage banking, and insurance. The company has been growing through a combination of organic growth and strategic acquisitions, with commercial real estate making up a significant portion of its loan portfolio.

Financial Performance

The company reported a decrease in net income available to common shareholders for the fourth quarter of 2023, which stood at $32.4 million, compared to $49.7 million for the same period in 2022. This decline was also reflected in the diluted earnings per share, which decreased from $0.84 to $0.55. Despite these challenges, Wesbanco achieved year-over-year loan growth of 8.7%, with deposits also showing a modest increase.

Jeff Jackson, President and CEO of Wesbanco, commented on the results:

"Record interest rate escalation by the Federal Reserve had a significant impact on all banks, including Wesbanco. Despite that headwind, Wesbanco performed well during 2023 through our continued focus on customer service and sustainable growth strategies. We achieved sustained loan, deposit, and fee income growth, while maintaining strong capital levels and credit quality."

Balance Sheet and Income Statement Highlights

Wesbanco's balance sheet showed total portfolio loans of $11.6 billion, an 8.7% increase from the previous year, driven by strong commercial and residential lending. Deposits stood at $13.2 billion, with a year-over-year increase of 0.3%. The net interest margin remained stable at 3.02% for the fourth quarter, despite the challenging rate environment.

Non-interest income saw an 8.0% increase year-over-year, supported by new commercial loan swap fees totaling $9.0 million for the year. However, net interest income for the fourth quarter decreased by 9.3% year-over-year, primarily due to rising funding costs.

Looking Forward

Wesbanco remains well-capitalized with solid liquidity and a strong balance sheet, positioning the company to continue its growth trajectory and generate value for stakeholders. The bank's focus on diversifying revenue streams and maintaining strong credit quality metrics suggests a strategic approach to navigating the current economic climate.

Investors and interested parties can access further details on the company's performance and strategies during the conference call scheduled for January 24, 2024.

For a more detailed breakdown of Wesbanco Inc's financial results and operational highlights, please visit the full 8-K filing.

Wesbanco's commitment to customer-centric service and its strategic growth initiatives continue to underpin its operations, even as it navigates the complexities of an evolving financial landscape.

Explore the complete 8-K earnings release (here) from Wesbanco Inc for further details.

This article first appeared on GuruFocus.