West Bancorp Inc (WTBA) Reports Decline in Annual Net Income Amid Margin Challenges

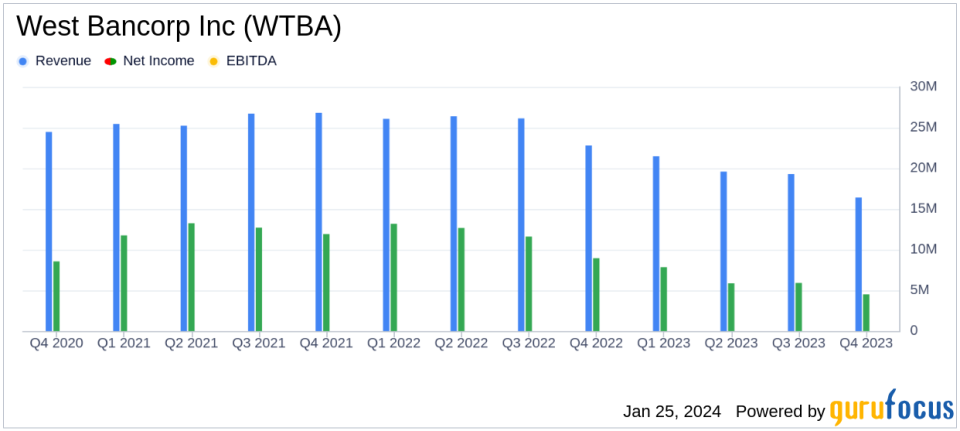

Net Income: Reported $24.1 million for 2023, a decrease from $46.4 million in 2022.

Earnings Per Share: Diluted EPS fell to $1.44 in 2023 from $2.76 in the previous year.

Net Interest Margin: Declined to 1.87% in Q4 2023 from 2.49% in Q4 2022.

Efficiency Ratio: Increased to 64.66% in Q4 2023, indicating higher costs relative to revenue.

Dividend: A quarterly dividend of $0.25 per common share was declared, payable on February 21, 2024.

Credit Quality: Remains strong with no loans greater than 30 days past due as of December 31, 2023.

Loan Growth: Loans increased by $77.8 million in Q4 2023, contributing to a 6.7% annual growth.

On January 25, 2024, West Bancorp Inc (NASDAQ:WTBA) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, a provider of comprehensive banking services including deposit and treasury management services, faced significant margin challenges throughout the year, which impacted its financial performance.

West Bancorp Inc (NASDAQ:WTBA), a community bank known for its focus on lending, deposit services, and trust services for small- to medium-sized businesses and consumers, reported a net income of $24.1 million for the year 2023, a notable decrease from the $46.4 million recorded in 2022. The diluted earnings per share (EPS) similarly declined to $1.44, compared to $2.76 in the previous year. The fourth quarter of 2023 saw a net income of $4.5 million, or $0.27 per diluted common share, a decrease from the $5.9 million, or $0.35 per diluted common share, reported in the third quarter of 2023, and significantly lower than the $8.9 million, or $0.53 per diluted common share, in the fourth quarter of 2022.

President and CEO David Nelson cited the challenging interest rate environment, including dramatic increases in short-term rates, an ongoing inverted yield curve, and aggressive deposit competition as key factors impacting the company's cost of funds and net interest margin. Despite these challenges, Nelson highlighted the company's pristine credit quality, with no loans greater than 30 days past due and only one classified loan at the end of 2023.

"We have a clear understanding of what is driving our challenges, along with a clear understanding of our path forward to more normalized margins," Nelson stated, emphasizing the company's strategic focus.

The company's net interest margin, a critical measure of banking profitability, declined to 1.87% in the fourth quarter of 2023 from 2.49% in the same quarter of the previous year. The efficiency ratio, which measures non-interest expenses as a percentage of revenue, worsened to 64.66% in the fourth quarter of 2023, up from 50.42% in the fourth quarter of 2022, indicating higher costs relative to revenue.

Loan growth was a positive note, with a 10.9% annualized increase in the fourth quarter of 2023. However, the company recorded a credit loss expense of $500 thousand in the fourth quarter due to loan growth and an increase in the allowance for unfunded commitments. Deposits also increased by $218.2 million, or 7.9%, in the fourth quarter, with brokered deposits making up a significant portion of this increase.

West Bancorp Inc (NASDAQ:WTBA) plans to file its report on Form 10-K with the Securities and Exchange Commission by February 22, 2024, which will provide a more in-depth discussion of the company's financial results. Investors and stakeholders are encouraged to review this document for a comprehensive analysis of the company's performance.

The company's financial stability is further underscored by its declaration of a regular quarterly dividend of $0.25 per common share, payable on February 21, 2024, to stockholders of record as of February 7, 2024. This consistent return to shareholders reflects the company's commitment to delivering value despite the economic headwinds faced over the past year.

In conclusion, West Bancorp Inc (NASDAQ:WTBA) navigated a challenging fiscal environment in 2023, marked by margin pressures and a competitive deposit landscape. While net income and EPS saw declines, the company's strong credit quality and loan growth provide a foundation for future stability and growth. The company's strategic focus on overcoming margin challenges and its commitment to shareholder returns position it to potentially benefit from a more normalized interest rate environment in the future.

Explore the complete 8-K earnings release (here) from West Bancorp Inc for further details.

This article first appeared on GuruFocus.