West Pharmaceutical (WST) Beats on Q3 Earnings, HVP Drives Sales

West Pharmaceutical Services, Inc. WST reported third-quarter 2023 adjusted earnings per share (EPS) of $2.16, up 6.4% year over year. The figure beat the Zacks Consensus Estimate by 16.1%.

The adjustments include expenses related to the amortization of acquisition-related intangible assets.

GAAP EPS for the quarter was $2.14, up 34.6% year over year.

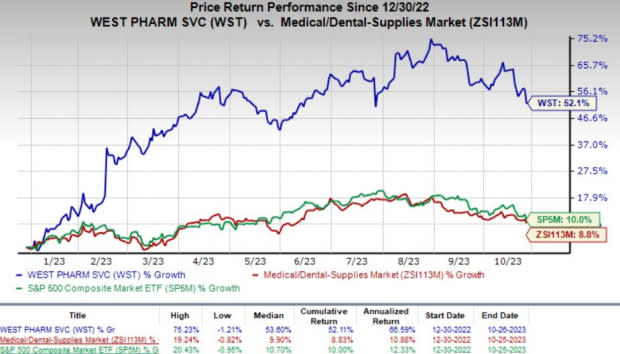

The company’s shares have risen 52.1% year to date compared with the industry’s growth of 8.8%. The broader S&P 500 Index has increased 10% in the same time frame.

Image Source: Zacks Investment Research

Revenues in Detail

West Pharmaceutical registered net sales of $747.4 million in the third quarter, up 8.8% year over year. The figure beat the Zacks Consensus Estimate by 0.1%.

The company recorded organic net sales growth of 5.7% in the reported quarter.

Per management, the top-line growth was driven by Proprietary Products' high-value product (HVP) and strong Contract Manufacturing component sales. However, WST’s revenues reflect a slowdown in restocking trends by large Pharma and Generic customers.

Segmental Details

West Pharmaceutical operates under two segments — Proprietary Products and Contract-Manufactured Products.

Net sales in the Proprietary Products segment were $602.5 million, indicating year-over-year growth of 6.3% reportedly and 3.2% organically. HVP net sales accounted for more than 75% of the segment’s net sales, with a strong demand for FluroTec, Daikyo, Envision and HVP devices like self-injection and administration systems.

Generics and Pharma market units of the Proprietary Products segment reflected robust organic growth in the third quarter. However, declining sales related to COVID-19 vaccines led to a double-digit percentage-point decrease in organic net sales for the Biologics market unit. Excluding COVID-19-related sales, all market units had double-digit organic net sales growth.

Net sales at the Contract-Manufactured Products segment increased 20.8% year over year to $144.9 million. Currency translation was a tailwind, boosting sales growth by 340 basis points. The segment saw a 17.4% improvement in organic net sales.

Margins

In the quarter under review, West Pharmaceutical’s gross profit increased 7.6% to $288.3 million. The gross margin contracted nearly 40 basis points (bps) to 38.6%.

Selling, general and administrative expenses rose 34.2% to $89 million. Research and development expenses went up 20.6% year over year to $16.4 million.

Adjusted operating profit totaled $180.8 million, indicating a decline of 3% from the prior-year quarter’s level. The adjusted operating margin contracted 290 bps to 24.2%.

Financial Position

West Pharmaceutical exited third-quarter 2023 with cash and cash equivalents of $898.6 million compared with $796.3 million at the end of the second quarter. Total debt at the end of the reported quarter was $207.3 million compared with $207.8 million at the end of the previous quarter.

Cumulative net cash flow from operating activities was $537.4 million compared with $493.2 million in the year-ago period.

2023 Guidance

WST raised its 2023 outlook for earnings but lowered the same for revenues.

It currently projects adjusted EPS of $7.95-$8.00, up from the previously anticipated range of $7.65-$7.80. The Zacks Consensus Estimate for the same is pegged at $7.86. Higher expectation for EPS also reflects a favorable currency impact of 7 cents, 2 cents higher than the earlier estimate.

Net sales are projected between $2.95 billion and $2.96 billion, down from the previously guided range of $2.97-$2.995 billion. The Zacks Consensus Estimate for the same is pegged at $2.98 billion. The company expects currency translation to have a positive impact of $20 million on revenues. Lower revenue outlook reflects a lower COVID-19-related sales guidance and an $8- million reduction in sales resulting from the divestiture of a European facility.

The organic sales growth estimate was 2-3%, lower than the earlier anticipated range of 3-4%.

West Pharmaceutical Services, Inc. Price, Consensus and EPS Surprise

West Pharmaceutical Services, Inc. price-consensus-eps-surprise-chart | West Pharmaceutical Services, Inc. Quote

Our Take

West Pharmaceutical exited the third quarter of 2023 with better-than-expected results. The recovery in organic growth is encouraging. The company’s revenue outlook beat market estimates. However, contractions in the gross and operating margins do not bode well.

On a positive note, demand for West Pharmaceutical’s HVP products continued to be strong. Double-digit organic net sales growth in the Pharma and Generic market units is another quarterly highlight. CONMED expects the double-digit base, non-COVID-19-related organic sales growth to continue in the fourth quarter, driven by strong HVP component demand.

Zacks Rank and Other Stocks to Consider

Currently, West Pharmaceutical carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader medical space that have announced quarterly results are Abbott Laboratories ABT, Elevance Health, Inc. ELV and Edwards Lifesciences EW.

Abbott, carrying a Zacks Rank of 2 at present, reported third-quarter 2023 adjusted EPS of $1.14, which beat the Zacks Consensus Estimate by 3.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Revenues of $10.14 billion outpaced the consensus mark by 3.6%.

Abbott has a long-term estimated growth rate of 5.1%. ABT’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 6.76%.

Elevance Health reported third-quarter 2023 adjusted EPS of $8.99, which beat the Zacks Consensus Estimate by 6.4%. Revenues of $42.5 billion were in line with the Zacks Consensus Estimate. The company currently carries a Zacks Rank #2.

ELV has a long-term estimated growth rate of 12.1%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 2.91%.

Edwards Lifesciences reported third-quarter 2023 adjusted EPS of 59 cents and revenues of $1.48 billion, both in line with their respective Zacks Consensus Estimate. It currently carries a Zacks Rank #2.

EW has a long-term estimated growth rate of 8%. Its earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 1.62%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report