Western Alliance Bancorp (WAL) Reports Mixed Financial Results for Q4 and Full Year 2023

Net Income: $147.9 million for Q4, down from $216.6 million in the previous quarter.

Earnings Per Share: $1.33 for Q4, a decrease from $1.97 in Q3.

Net Interest Margin: Decreased to 3.65% in Q4 from 3.67% in Q3.

Loan Growth: HFI loans increased by $850 million, or 1.7%, in Q4.

Deposit Growth: Total deposits rose by $1.0 billion, or 1.9%, in Q4.

Asset Quality: Nonperforming assets to total assets ratio increased to 0.40% in Q4.

Capital Ratios: CET1 ratio improved to 10.8%, up from 10.6% in Q3.

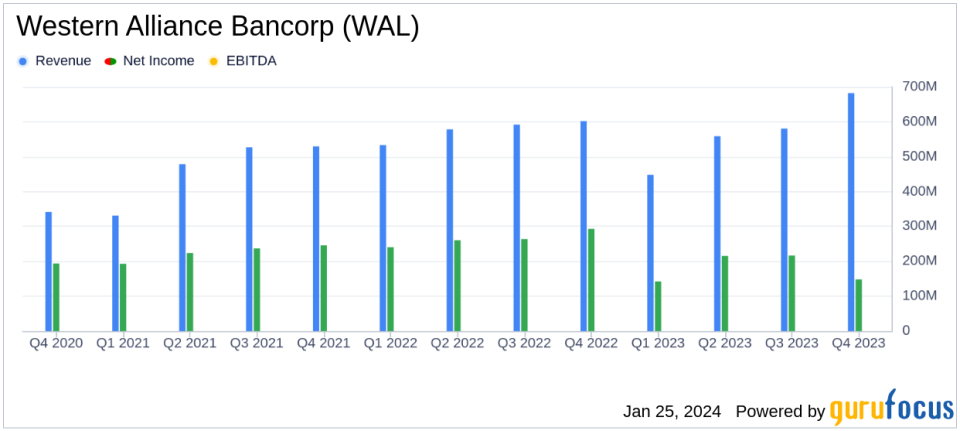

On January 25, 2024, Western Alliance Bancorp (NYSE:WAL) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The Las Vegas-based holding company, operating regional banks in Nevada, Arizona, and California, reported a net income of $147.9 million for the fourth quarter, a decrease from the $216.6 million reported in the previous quarter. Earnings per share (EPS) also saw a decline, coming in at $1.33 compared to $1.97 in the third quarter. Despite these challenges, the bank experienced solid loan and deposit growth, which could position it for improved profitability in 2024.

Financial Performance and Challenges

Western Alliance Bancorp's net interest margin decreased slightly to 3.65% in the fourth quarter from 3.67% in the third quarter. The bank's net revenue saw a decrease of 4.7% quarter-over-quarter, while non-interest expenses rose by 8.4%. The adjusted efficiency ratio worsened to 59.1% in Q4 from 50.0% in Q3, indicating higher costs relative to revenue. The bank's effective tax rate increased to 29.9% in Q4, up from 22.1% in the previous quarter.

For the full year, net income and EPS were down 31.7% and 32.6%, respectively, from the previous year. However, net revenue increased by 3.1% compared to the prior year, and the CET1 capital ratio improved to 10.8% from 10.6%. The tangible book value per share, excluding goodwill and intangibles, rose by 16% year-over-year to $46.72.

Income Statement and Balance Sheet Highlights

The income statement revealed that net interest income for Q4 increased marginally by 0.8% from Q3 but decreased by 7.5% compared to Q4 of the previous year. The provision for credit losses was $9.3 million, showing a decrease from the third quarter but an increase from the same period last year. Non-interest income decreased significantly from the previous quarter, primarily due to a decrease in fair value gain adjustments and a loss on sale of securities.

On the balance sheet, HFI loans increased by $850 million during the quarter, while total deposits grew by $1.0 billion. Stockholders' equity also saw an increase, reaching $6.1 billion at the end of the year. Asset quality showed some signs of concern, with nonperforming assets to total assets ratio increasing to 0.40%.

"Western Alliance's diversified, national commercial business strategy continued to drive strong momentum in the fourth quarter as we generated earnings per share of $1.91, excluding $0.58 of notable items. We view this quarter's solid loan and deposit momentum, continued net interest income growth, and sustained stable asset quality as positioning us to deliver leading profitability in 2024," said Kenneth A. Vecchione, President and Chief Executive Officer.

Analysis and Outlook

While Western Alliance Bancorp faced headwinds in the fourth quarter, with a decrease in net income and EPS, the bank's loan and deposit growth, along with a stable asset quality, suggest a strong foundation for future profitability. The bank's strategy of diversification and national commercial business focus appears to be paying off, as indicated by the increase in tangible book value per share. However, the rising efficiency ratio and nonperforming assets ratio could be areas of concern that the bank needs to monitor closely in the coming year.

Value investors and potential GuruFocus.com members may find Western Alliance Bancorp's solid balance sheet and capital ratios appealing, despite the mixed financial results. The bank's ability to navigate the challenges of 2023 and its strategic positioning for 2024 could make it an interesting prospect for those looking for banking sector opportunities.

For a more detailed analysis and to stay updated on Western Alliance Bancorp's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Western Alliance Bancorp for further details.

This article first appeared on GuruFocus.