Western Alliance Bancorp's Meteoric Rise: Unpacking the 26% Surge in Just 3 Months

Western Alliance Bancorp (NYSE:WAL) has been making waves in the stock market with its impressive performance. The company's stock price has seen a significant gain of 2.53% over the past week and a remarkable 26.43% surge over the past three months. Currently, the stock is trading at $46.66 with a market cap of $5.11 billion. According to GuruFocus.com's GF Value, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, WAL is significantly undervalued. The GF Value stands at $96.11, up from $90.92 three months ago, indicating a potential for further growth.

Company Overview: Western Alliance Bancorp

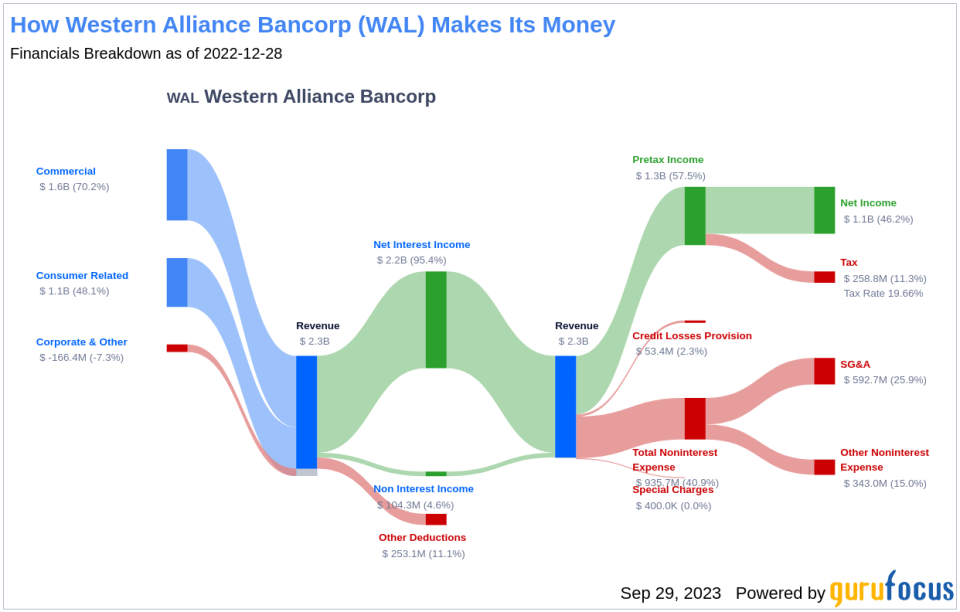

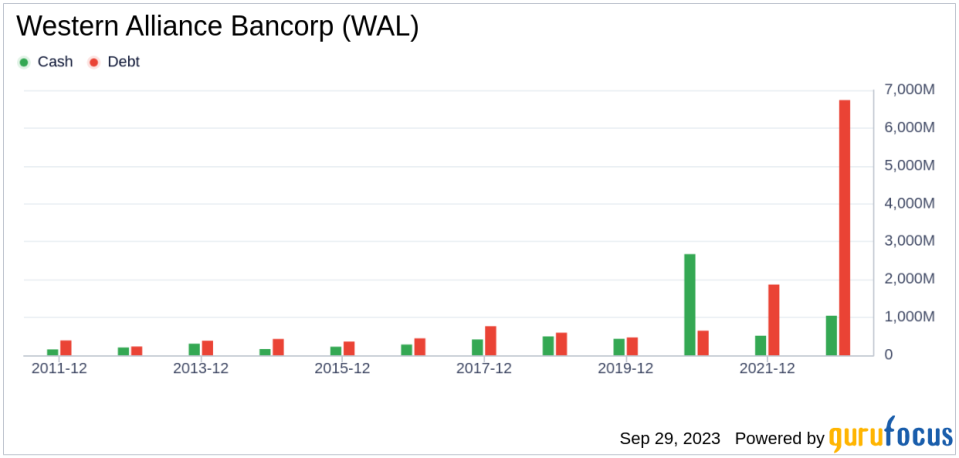

Western Alliance Bancorp is a Las Vegas-based holding company with regional banks operating in Nevada, Arizona, and California. The bank offers retail banking services and focuses on mortgages for retail customers and commercial loans, mainly for real estate. The bank also has an investment advisory business that manages investment portfolios for Western clients and clients of other banks. The company operates in the banking industry, which is known for its competitive nature and regulatory complexities.

Profitability Analysis

Western Alliance Bancorp's profitability is commendable. The company's Profitability Rank stands at 7 out of 10, indicating a strong profitability compared to other companies in the industry. The company's Return on Equity (ROE) is 17.23%, which is better than 83.65% of the companies in the Banks industry. The Return on Assets (ROA) is 1.34%, outperforming 71.85% of the companies in the industry. Furthermore, the company has maintained profitability for the past 10 years, which is better than 99.93% of the companies in the industry.

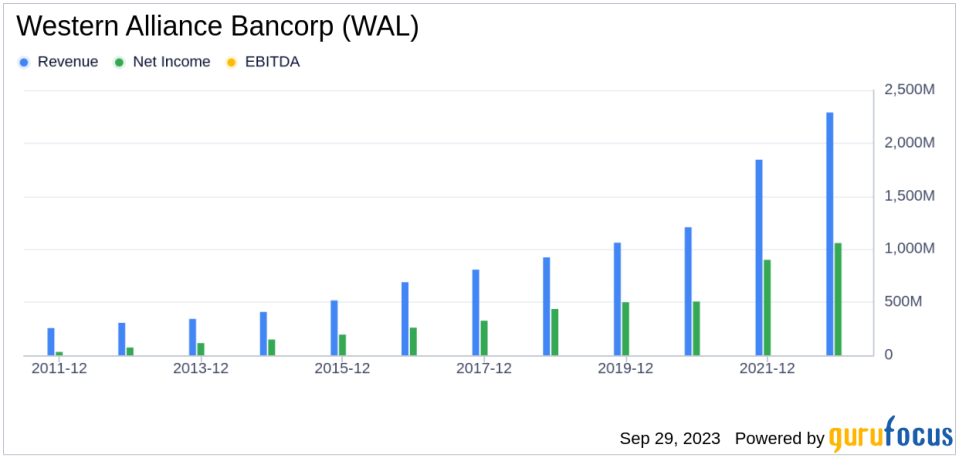

Growth Prospects

Western Alliance Bancorp's growth prospects are promising. The company's Growth Rank is 10 out of 10, indicating a strong growth potential. The 3-Year Revenue Growth Rate per Share is 27.30%, better than 95.01% of the companies in the industry. The 5-Year Revenue Growth Rate per Share is 23.50%, outperforming 94.89% of the companies in the industry. The company's future total revenue growth rate estimate is 11.82%, which is better than 86.9% of the companies in the industry. The 3-Year EPS without NRI Growth Rate is 26.10%, and the 5-Year EPS without NRI Growth Rate is 25.50%, both outperforming a majority of the companies in the industry.

Major Holders

Steven Cohen (Trades, Portfolio) is the top holder of Western Alliance Bancorp's stock, holding 1,207,306 shares, which accounts for 1.1% of the company's shares. Jim Simons (Trades, Portfolio) holds the second-largest number of shares, with 508,104 shares, accounting for 0.46% of the company's shares. Chuck Royce (Trades, Portfolio) holds 443,578 shares, accounting for 0.41% of the company's shares.

Competitive Landscape

Western Alliance Bancorp operates in a competitive industry with companies like Pinnacle Financial Partners Inc(NASDAQ:PNFP) with a stock market cap of $5.16 billion, Prosperity Bancshares Inc(NYSE:PB) with a stock market cap of $5.15 billion, and Zions Bancorp NA(NASDAQ:ZION) with a stock market cap of $5.25 billion.

Conclusion

In conclusion, Western Alliance Bancorp's stock performance, profitability, and growth prospects are impressive. The company's stock has seen a significant surge over the past three months, and its GF Value indicates that it is significantly undervalued. The company's profitability and growth ranks are high, indicating a strong profitability and growth potential. The company's major holders and competitive landscape also indicate a positive outlook for the company. Therefore, Western Alliance Bancorp's current position and future prospects are promising.

This article first appeared on GuruFocus.