Western Digital Corp (WDC) Navigates Market Challenges with Mixed Fiscal Q2 2024 Results

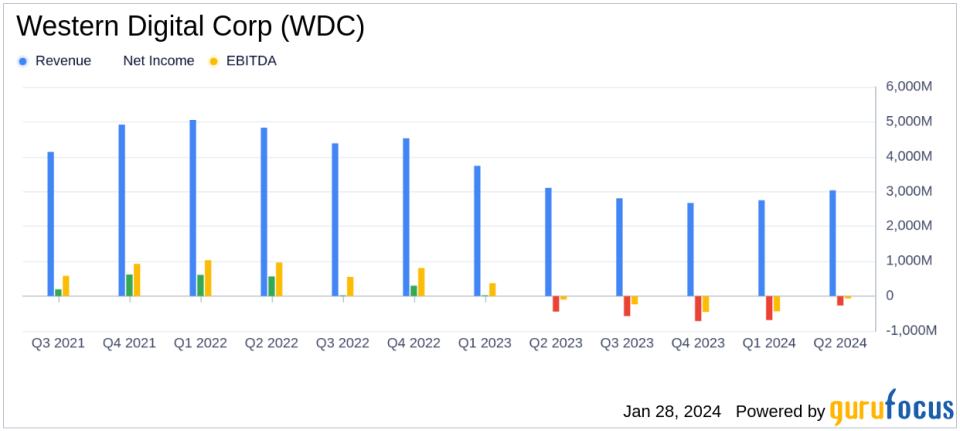

Revenue: Reported a 10% sequential increase to $3.03 billion, though a slight 2% decline year-over-year.

GAAP EPS: Posted a GAAP loss per share of $(0.87), with Non-GAAP loss per share of $(0.69).

Gross Margin: Improved sequentially to 16.2% but decreased from the previous year's 17.0%.

Operating Expenses: Managed a reduction in operating expenses by 17% year-over-year.

Cloud Segment: Demonstrated robust growth with a 23% sequential increase in revenue.

Balance Sheet: Ended the quarter with $2.48 billion in cash and cash equivalents.

Future Outlook: Anticipates Q3 2024 revenue between $3.20 billion and $3.40 billion with Non-GAAP EPS ranging from $(0.10) to $0.20.

On January 25, 2024, Western Digital Corp (NASDAQ:WDC) released its 8-K filing, detailing the financial outcomes for the fiscal second quarter of 2024. As a leading supplier of data storage solutions, Western Digital operates in a competitive and rapidly evolving industry, marked by its significant presence in both the hard disk drive (HDD) and solid-state drive (SSD) markets.

The company reported a revenue of $3.03 billion, a 10% increase from the previous quarter, driven by strong performance in its Cloud segment, which saw a 23% sequential increase. However, the Client segment experienced a 2% decrease, and the Consumer segment enjoyed a 15% increase from the previous quarter. Despite the sequential growth, revenue was slightly down by 2% compared to the same quarter last year.

Western Digital's GAAP earnings per share (EPS) stood at $(0.87), with Non-GAAP EPS at $(0.69), reflecting underutilization-related charges in both Flash and HDD segments. The company's gross margin improved sequentially by 12.6 percentage points to 16.2% but showed a year-over-year decrease of 0.8 percentage points. Operating expenses were reduced by 17% compared to the same quarter in the previous year, indicating effective cost management.

CEO David Goeckeler commented on the results:

"Western Digitals second quarter results demonstrate that the structural changes we have put in place over the last few years and the strategy we have been executing are producing significant outperformance across our flash and HDD businesses."

He further expressed confidence in the company's strategy to manage inventory proactively, offer a broad range of products, and control product costs through focused R&D and manufacturing, aiming to improve profitability and dampen business cycles.

Looking ahead, Western Digital expects fiscal third quarter 2024 revenue to be in the range of $3.20 billion to $3.40 billion, with Non-GAAP EPS ranging from $(0.10) to $0.20, which includes underutilization-related charges in HDD.

Western Digital's balance sheet ended the quarter with a solid $2.48 billion in cash and cash equivalents, despite an operating cash outflow of $92 million. The company's strategic focus on inventory management and cost control, along with its diversified product portfolio, positions it to navigate the challenging market dynamics and capitalize on future growth opportunities.

Investors and stakeholders will be closely monitoring Western Digital's progress as it continues to execute its strategic initiatives and adapt to the evolving demands of the data storage market.

Explore the complete 8-K earnings release (here) from Western Digital Corp for further details.

This article first appeared on GuruFocus.