Western Digital (NASDAQ:WDC) Reports Q2 In Line With Expectations, Next Quarter Sales Guidance Is Optimistic

Leading data storage manufacturer Western Digital (NASDAQ: WDC) reported results in line with analysts' expectations in Q2 FY2024, with revenue down 2.4% year on year to $3.03 billion. The company expects next quarter's revenue to be around $3.3 billion, coming in 3.6% above analysts' estimates. It made a non-GAAP loss of $0.69 per share, down from its loss of $0.42 per share in the same quarter last year.

Is now the time to buy Western Digital? Find out by accessing our full research report, it's free.

Western Digital (WDC) Q2 FY2024 Highlights:

Market Capitalization: $18.82 billion

Revenue: $3.03 billion vs analyst estimates of $3.01 billion (small beat)

EPS (non-GAAP): -$0.69 vs analyst estimates of -$1.10

Revenue Guidance for Q3 2024 is $3.3 billion at the midpoint, above analyst estimates of $3.18 billion

EPS (non-GAAP) Guidance for Q3 2024 is $0.05 billion at the midpoint, above analyst estimates of ($0.29)

Free Cash Flow was -$176 million compared to -$557 million in the previous quarter

Inventory Days Outstanding: 115, down from 120 in the previous quarter

Gross Margin (GAAP): 16.2%, down from 17% in the same quarter last year

“Western Digital’s second quarter results demonstrate that the structural changes we have put in place over the last few years and the strategy we have been executing are producing significant outperformance across our flash and HDD businesses,” said David Goeckeler, Western Digital CEO.

Founded in 1970 by a Motorola employee, Western Digital (NASDAQ: WDC) is a leading producer of hard disk drives, SSDs and flash memory.

Memory Semiconductors

The rapid growth in data generation and the need to support increases in processing power for everything from consumer devices to data center servers are driving the demand for memory chips. From the content delivery networks and edge computing to the cloud, data storage is a key component underpinning the global technology architecture. On top of that, secular growth drivers like machine learning and the boom in media-rich digital content are further accelerating the need for storage. Like all semiconductor segments, memory makers are highly cyclical, driven by supply and demand imbalances and exposure to consumer product cycles.

Sales Growth

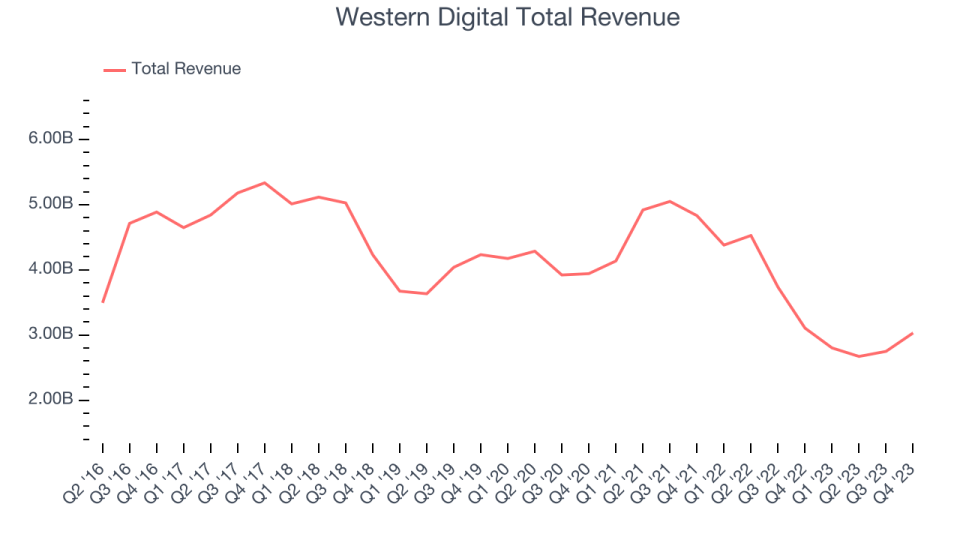

Western Digital's revenue has been declining over the last three years, dropping by 8.7% on average per year. This quarter, its revenue declined from $3.11 billion in the same quarter last year to $3.03 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

This was a slow quarter for the company as its revenue dropped 2.4% year on year, in line with analysts' estimates. This could mean that the current downcycle is deepening.

Western Digital looks like it's on the cusp of a rebound, as it's guiding to 17.7% year-on-year revenue growth for the next quarter. Analysts seem to agree as consesus estimates call for 30.6% growth over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

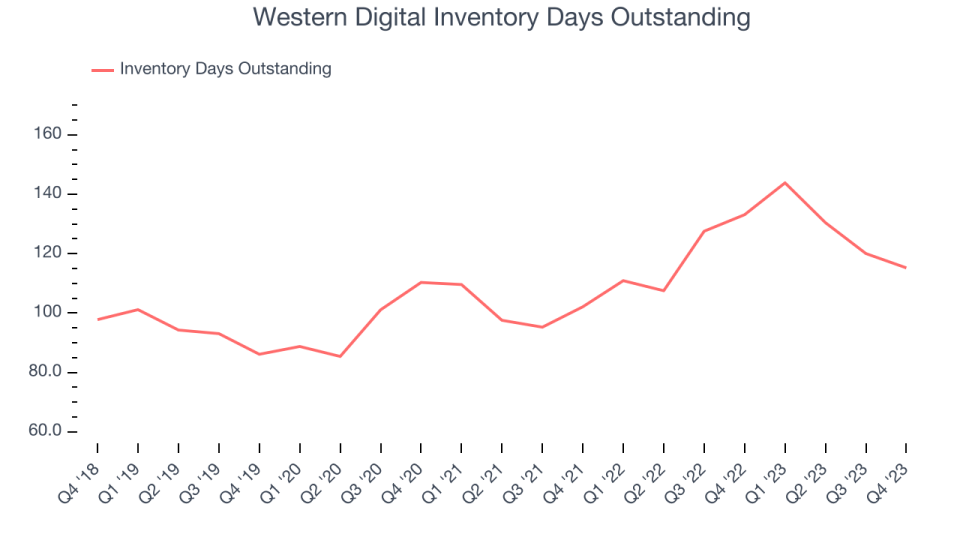

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Western Digital's DIO came in at 115, which is 8 days above its five-year average. These numbers suggest that despite the recent decrease, the company's inventory levels are higher than what we've seen in the past.

Key Takeaways from Western Digital's Q2 Results

We were impressed by Western Digital's EPS beat this quarter compared to analysts' expectations. We were also glad its operating margin improved. Adding to the positives was that the company's revenue and non-GAAP EPS guidance for next quarter exceeded Wall Street analysts' estimates. Many semis stocks have been strong as of late due to a spate of factors, though, and the market was likely expecting more. The stock is down 5.2% after reporting, trading at $57.22 per share.

Western Digital may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.