Western Digital (WDC) Q1 Earnings Beat, Revenues Fall Y/Y

Western Digital Corporation WDC reported first-quarter fiscal 2024 non-GAAP loss of $1.76 per share, narrower than the Zacks Consensus Estimate of a loss of $1.88. The company had reported earnings per share (EPS) of 20 cents in the prior-year quarter.

Revenues of $2.750 billion beat the Zacks Consensus Estimate by 3.1%. However, the top line decreased 26% year over year owing to weak performance across Cloud and Client end markets. On a sequential basis, revenues increased 3%.

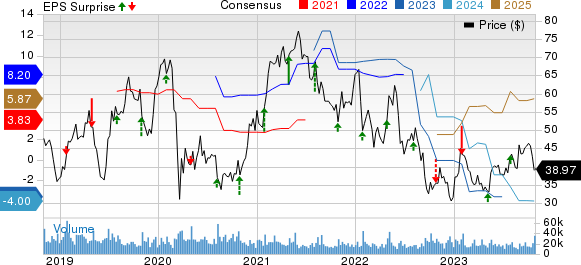

Western Digital Corporation Price, Consensus and EPS Surprise

Western Digital Corporation price-consensus-eps-surprise-chart | Western Digital Corporation Quote

Quarter in Detail

At the beginning of first-quarter fiscal 2022, Western Digital started reporting revenues under three refined end markets — Cloud (includes products for public or private cloud), Client (includes products sold directly to OEMs or through distribution) and Consumer (includes retail and other end-user products).

Revenues from the Cloud end market (31.7% of total revenues) fell 52% year over year to $872 million owing to lower shipments of both hard drive and flash products. On a sequential basis, cloud revenues were down 12%.

Revenues from the Client end market (41.7% of total revenues) were down 7% year over year to $1,147 million. The downtick was caused by lower flash pricing on a year-over-year basis. Client revenues increased 11% sequentially.

Revenues from the Consumer end market (26.6% of total revenues) were up 8% year over year to $731 million. Revenues increased 14% on a sequential basis. Sequential performance benefited from higher content per unit and unit shipments in flash.

Considering revenues by product group, Flash revenues (56.6% of total revenues) declined 9.7% from the year-ago quarter’s figure to $1.556 billion. Sequentially, flash revenues rose 13%.

Hard disk drive (HDD) revenues (43.4% of total revenues) decreased 40.7% year over year to $1.194 billion. Revenues decreased 7.8% quarter over quarter.

The company announced that it plans to separate its HDD and Flash businesses and create two independent and public companies. The separation is likely to be structured in a tax-free manner and is scheduled for the second half of 2024.

Key Metrics

The company shipped 10.4 million HDDs at an average selling price (ASP) of $112. The reported shipments declined 29.3% from the prior-year quarter’s levels.

On a quarter-over-quarter basis, HDD Exabytes sales decreased 5%. Flash exabytes sales were up 26%. Total exabytes sales (excluding non-memory products) increased 2% sequentially.

ASP/Gigabytes (excluding licensing, royalties, and non-memory products) were down 10% sequentially.

Margins

Non-GAAP gross margin was 4.1% compared with 26.7% reported in the year-ago quarter.

HDD’s gross margin contracted 560 bps year over year to 22.9%. Flash gross margin was a negative 10.3% against 24.5% reported in the prior-year quarter.

Non-GAAP operating expenses declined 19.5% from the year-ago quarter’s level to $555 million.

Non-GAAP operating loss totaled $443 million against the non-GAAP operating income of $307 million in the prior-year quarter.

Balance Sheet & Cash Flow

As of Sep 29, 2023, cash and cash equivalents were $2.03 billion compared with $2.02 billion reported as of Jun 30, 2023.

The long-term debt (including the current portion) was $5.822 billion as of Sep 29.

Western Digital used $626 million in cash from operations against $6 million of cash generated from operations in the previous-year quarter.

Free cash outflow amounted to $544 million in the quarter under review compared with the free cash outflow of $215 million reported in the prior-year quarter.

Fiscal Q2 Guidance

For second-quarter fiscal 2024, the company expects non-GAAP revenues in the range of $2.85-$3.05 billion. The Zacks Consensus Estimate is currently pegged at $2.93 billion.

Management projects a non-GAAP loss per share between $1.05 and $1.35. The Zacks Consensus Estimate is currently pegged at a loss of $1.53 per share.

WDC expects non-GAAP gross margin in the range of 10-12%. Non-GAAP operating expenses are expected to be between $560 million and $580 million.

Zacks Rank & Stocks to Consider

Currently, Western Digital carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space are Asure Software ASUR, Synopsys SNPS and Wix.com WIX. Asure Software and Wix.com presently sport a Zacks Rank #1 (Strong Buy), whereas Synopsys carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 EPS has increased 5.9% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 676.4%. Shares of ASUR have surged 55.9% in the past year.

The Zacks Consensus Estimate for Synopsys’ 2023 EPS has gained 2.5% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.4%. Shares of SNPS have surged 62.7% in the past year.

The Zacks Consensus Estimate for Wix’s 2023 EPS has remained unchanged in the past 60 days to $3.35.

Wix’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 319.3%. Shares of WIX have rallied 5.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Western Digital Corporation (WDC) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report